From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market: Strong Auto Sales Drive Optimism Despite EV Transition, Tariffs

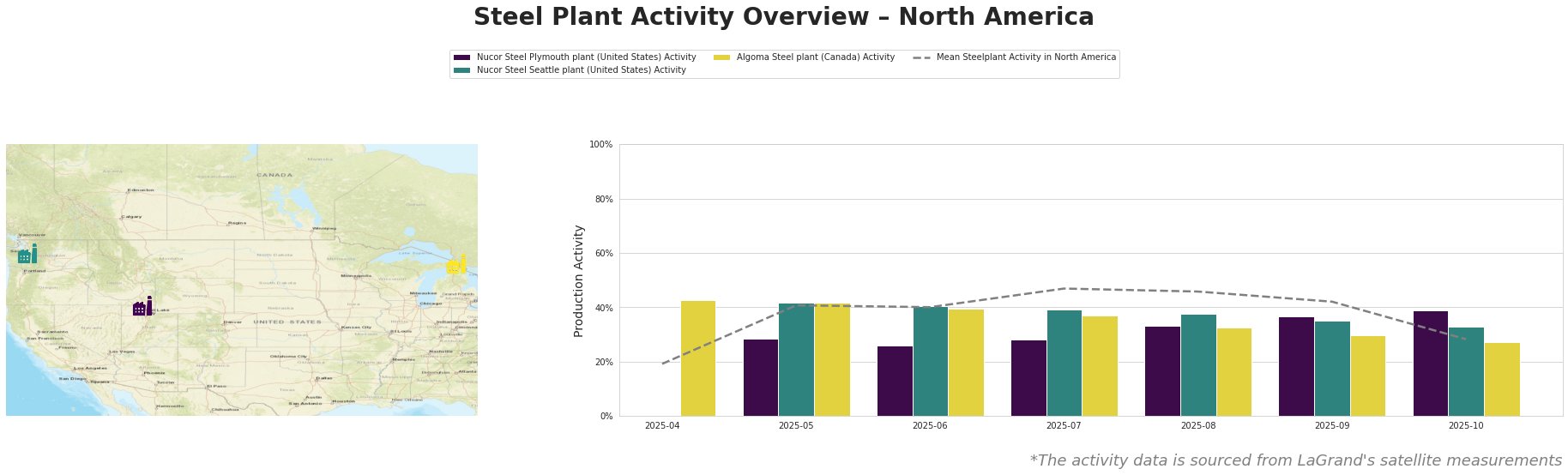

In North America, the steel market is experiencing positive momentum driven by robust U.S. car sales, as highlighted in “General Motors lifts forecast as tariff outlook improves, shares surge 8%” and “General Motors lifts forecast as tariff outlook improves, shares surge 10%“. While the article “GM takes $1.6 billion hit on eletric vehicle rollout as U.S. automakers rethink future” indicates a potential slowdown in the EV transition, its impact on overall steel demand appears to be offset by strong sales in traditional vehicle segments. The satellite data reflects this complexity, with plant activity varying across the region.

Here’s a summary of observed monthly activity trends:

The mean steel plant activity in North America peaked in July at 47.0% before declining to 28.0% in October.

Nucor Steel Plymouth plant, an EAF-based producer in Utah serving the automotive sector, showed a gradual increase in activity from 26.0% in June to 39.0% in October. This increase aligns with the reports of strong U.S. car sales in the GM articles, potentially indicating higher demand from automotive clients.

Nucor Steel Seattle plant, another EAF-based bar producer, saw activity fluctuate between 33.0% and 42.0%. However, activity decreased to 33.0% in October. As with the Plymouth plant, its products support automotive, building, and infrastructure sectors. The October dip does not have a direct and explicit connection to the named news articles.

Algoma Steel plant, a Canadian integrated steel producer with both BF and BOF operations, exhibited higher activity levels compared to the Nucor plants in the earlier months, reaching 43.0% in April and 42.0% in May, but experienced a decline to 27.0% in October. This decline does not have a direct and explicit connection to the named news articles. Algoma Steel’s product portfolio, including plate and sheet, caters to a wider range of industries, including automotive and energy.

Despite the news regarding the EV transition, the General Motors lifts forecast as tariff outlook improves, shares surge 8% and “General Motors lifts forecast as tariff outlook improves, shares surge 10%” articles demonstrate that the North American steel market is currently driven by conventional auto sales, and it appears the effects of any potential EV transition have not yet impacted supply, or are balanced out by conventional vehicle demand.

The activity decreases observed towards the end of the period could be attributed to various factors not explicitly covered in the provided news, such as seasonal slowdowns, maintenance shutdowns, or shifts in demand across different steel product categories.

Given the current market dynamics:

- Steel buyers focused on the automotive sector: Should proactively secure supply from EAF-based steel producers like Nucor, particularly for bar products. The articles “General Motors lifts forecast as tariff outlook improves, shares surge 8%” and “General Motors lifts forecast as tariff outlook improves, shares surge 10%” signal continued strength in conventional auto sales, potentially increasing demand for steel.

- Market analysts: Should monitor inventory levels and lead times from Nucor’s Plymouth plant, as this plant shows the most direct correlation with reported increased demand, and inventory can be a leading indicator of pricing changes.

- All Steel Buyers: should take into consideration that the Algoma Steel Plant is reporting lower activity and this may impact inventories, delivery times, or product availability.