From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Shows Resilience Amidst Tariff and Rate Cut Expectations

The North American steel market demonstrates underlying strength despite economic uncertainties. While “Trump setzt höhere Zölle auf China-Importe weiter aus,” potentially easing pressure on import competition, observed changes in steel plant activity do not directly correlate with this news. A possible exception is the gold market as “Medienbericht USA verhängen offenbar Zölle auf Gold-Importe” and “Stock market today: Dow, S&P 500, Nasdaq futures steady with Wall Street looking for more records” indicate the metal market’s volatility due to tariff and rate cut expectations, which may indirectly impact steel demand, as steel companies stocks are linked with the development of the other metal markets. It is currently uncertain whether “S&P Futures Gain as Fed Rate-Cut Bets Firm” will stimulate economic activity enough to compensate for any tariff-related market fluctuations.

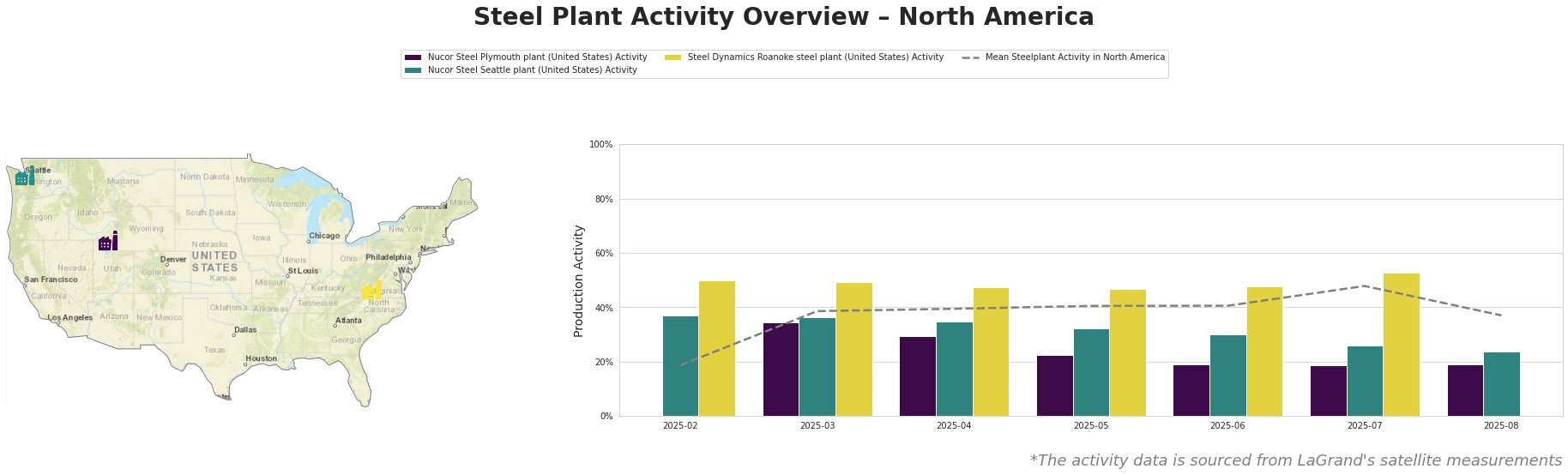

The mean steel plant activity in North America shows fluctuating, but overall positive trends, rising from 19% in February to 48% in July, before declining to 37% in August. Nucor Steel Plymouth plant consistently operated well below the average, remaining stable at 19% since June, after experiencing a significant drop from 34% in March. Nucor Steel Seattle plant showed a gradual decline from 37% in February to 24% in August. Steel Dynamics Roanoke steel plant exhibited strong performance compared to the other two, maintaining above-average activity levels, peaking at 53% in July. No direct connection between the news articles and the activity levels of specific plants could be established.

Nucor Steel Plymouth, located in Utah, operates two EAFs with a crude steel capacity of 908 ttpa. The plant focuses on finished rolled bar products for the automotive, building & infrastructure, energy, steel packaging, tools & machinery, and transport sectors. The consistent low activity levels at this plant, with no improvement in the last three months, may indicate localized operational issues or shifts in regional demand. It is not directly related to the recent news.

Nucor Steel Seattle, located in Washington, operates a single EAF with a crude steel capacity of 855 ttpa, producing finished rolled bar products. Similar to the Plymouth plant, its end-user sectors include automotive, building & infrastructure, energy, steel packaging, tools & machinery and transport. The observed decline in activity from 37% to 24% between February and August, without a clear link to market events from the news articles, warrants closer monitoring.

Steel Dynamics Roanoke, situated in Virginia, has a crude steel capacity of 660 ttpa using a single EAF. It produces merchant bars. The plant’s consistent high activity, peaking in July, suggests robust regional demand or operational efficiency, but the lack of August data prevent final judgement. No clear connection to the provided news events could be established.

The extension of tariff suspensions on Chinese imports, as reported in “Trump setzt höhere Zölle auf China-Importe weiter aus,” should, in theory, alleviate immediate price pressures. However, the fluctuations in plant activity, particularly the decline in the mean activity in August and the consistent low activity at Nucor Steel Plymouth, signal potential localized supply constraints.

Recommendations:

- Steel Buyers: Given the stable low activity levels at the Nucor Steel Plymouth plant since June, buyers reliant on bar products from this region should proactively secure alternative supply sources. Diversification will mitigate risks associated with potential disruptions.

- Market Analysts: Closely monitor the activity levels of Steel Dynamics Roanoke plant. A complete activity time series is needed for August, as this data is currently missing, to confirm its continued above-average output. Any significant drop could indicate broader market shifts. A focus on local news could prove beneficial.