From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Resilient Amid Rate Cuts and Steady Plant Activity

North America’s steel market shows resilience despite economic adjustments. Interest rate cuts by the Bank of Canada, as indicated in “Bank of Canada signals likely end to rate cuts, but keeps options open” and “Bank of Canada trims key interest rate, hints at end to cuts“, aim to buffer the economy against U.S. trade policy impacts. U.S. inflation, detailed in “U.S. inflation Rose to 3% in September, less than expected“, remains slightly below expectations, potentially easing pressure on steel prices. No direct links between these macroeconomic adjustments and recent satellite-observed plant activity levels are immediately apparent.

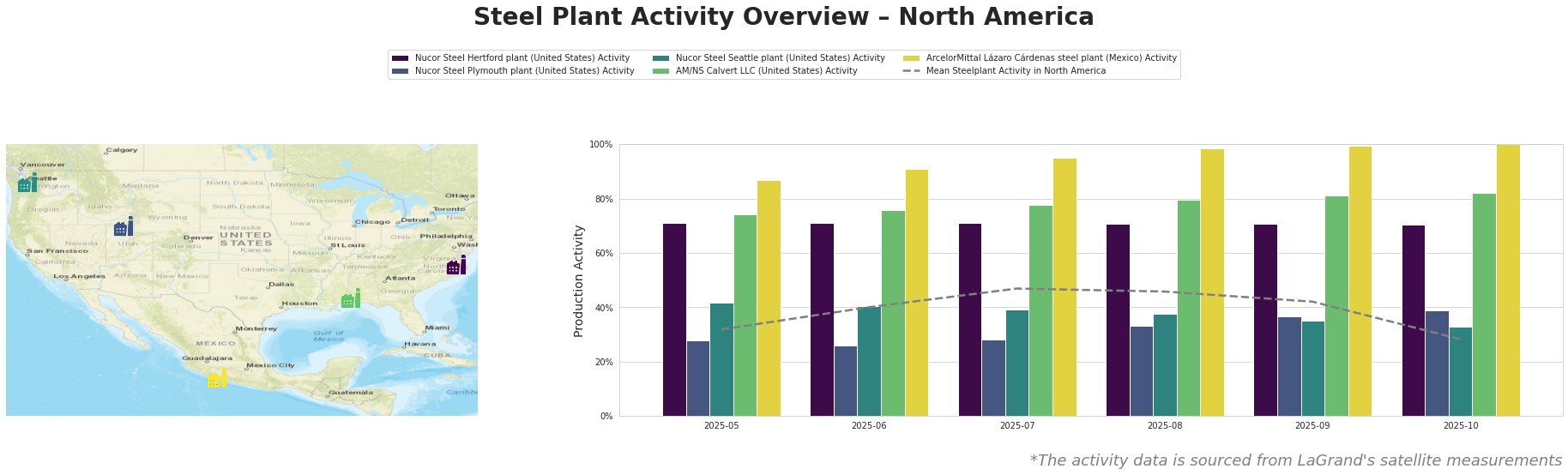

The mean steel plant activity in North America shows a peak in July 2025 (47%) followed by a decrease to 28% in October 2025. Nucor Steel Hertford plant maintained stable activity at 71%. Nucor Steel Plymouth plant showed fluctuating activity, rising to 39% in October 2025. Nucor Steel Seattle plant showed a decrease over time to 33% in October 2025. AM/NS Calvert LLC exhibited consistent growth in activity, reaching 82% in October 2025. ArcelorMittal Lázaro Cárdenas steel plant activity consistently increased, reaching its peak at 100% in October 2025.

Nucor Steel Hertford, a North Carolina-based EAF plate producer with a capacity of 1542 ttpa, maintained a stable activity level of 71% throughout the observed period. This stable production suggests consistent demand for its semi-finished products across sectors like automotive and infrastructure. The stability is observed independently of the fluctuations of the national average, nor is a connection to the provided articles established.

Nucor Steel Plymouth, an EAF-based bar producer in Utah with a capacity of 908 ttpa, experienced fluctuations in activity, increasing from 28% in May 2025 to 39% in October 2025. This suggests a gradual increase in production, potentially driven by regional demand for finished rolled products in sectors like building and infrastructure. The increase occurred independently of the fluctuations of the national average, nor is a connection to the provided articles established.

Nucor Steel Seattle, an EAF-based bar producer in Washington with a capacity of 855 ttpa, saw its activity decline from 42% in May 2025 to 33% in October 2025. This downward trend may indicate decreased demand for its finished rolled products, or possibly planned maintenance. This decline occurred independently of the fluctuations of the national average, nor is a connection to the provided articles established.

AM/NS Calvert, located in Alabama with a capacity of 1500 ttpa, produces hot-rolled, cold-rolled sheet, and advanced coated products via EAF. The plant’s activity steadily increased from 74% in May 2025 to 82% in October 2025. This growth suggests robust demand for its finished rolled products, potentially driven by the automotive sector. The increase occurred independently of the fluctuations of the national average, nor is a connection to the provided articles established.

ArcelorMittal Lázaro Cárdenas, a major integrated steel plant in Mexico with a capacity of 5700 ttpa utilizing both BF/BOF and DRI/EAF technologies, shows a consistent increase in activity, peaking at 100% in October 2025. This indicates high production rates for its semi-finished and finished rolled products (rod, wire rod, billet, slab), possibly to meet both domestic and export demands. The rise occurred independently of the fluctuations of the national average, nor is a connection to the provided articles established.

Given the consistent operation of Nucor Steel Hertford and the increasing activity at AM/NS Calvert and ArcelorMittal Lázaro Cárdenas, supply disruptions are not immediately apparent. However, the Bank of Canada’s rate cuts, as highlighted in “Bank of Canada signals likely end to rate cuts, but keeps options open” and “Bank of Canada trims key interest rate, hints at end to cuts“, indicate economic uncertainty.

* Recommendation: Steel buyers should closely monitor economic data releases from both the U.S. and Canada. Despite the current lack of direct impact, the economic uncertainty could affect future steel demand.

* Recommendation: Given the stability of Nucor Steel Hertford’s production, buyers relying on plate should consider securing contracts to mitigate potential future supply chain risks arising from broader economic fluctuations.

* Recommendation: Given the rate cuts and stable inflation, analyze the total cost of ownership, accounting for potential long-term cost benefits associated with rate cuts.