From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Remains Robust Despite Gold Tariff Uncertainty

North American steel production remains generally stable, even as new tariffs on gold imports introduce potential market volatility. While there is no direct relationship between the provided news articles “USA verhängen Zölle auch auf Goldbaren“, “Medienbericht USA verhängen offenbar Zölle auf Gold-Importe“, and “Gold Futures Hit Record High as U.S. Import Tariff Sparks Turmoil” and observed steel plant activity, the resulting economic uncertainty could indirectly influence future steel demand.

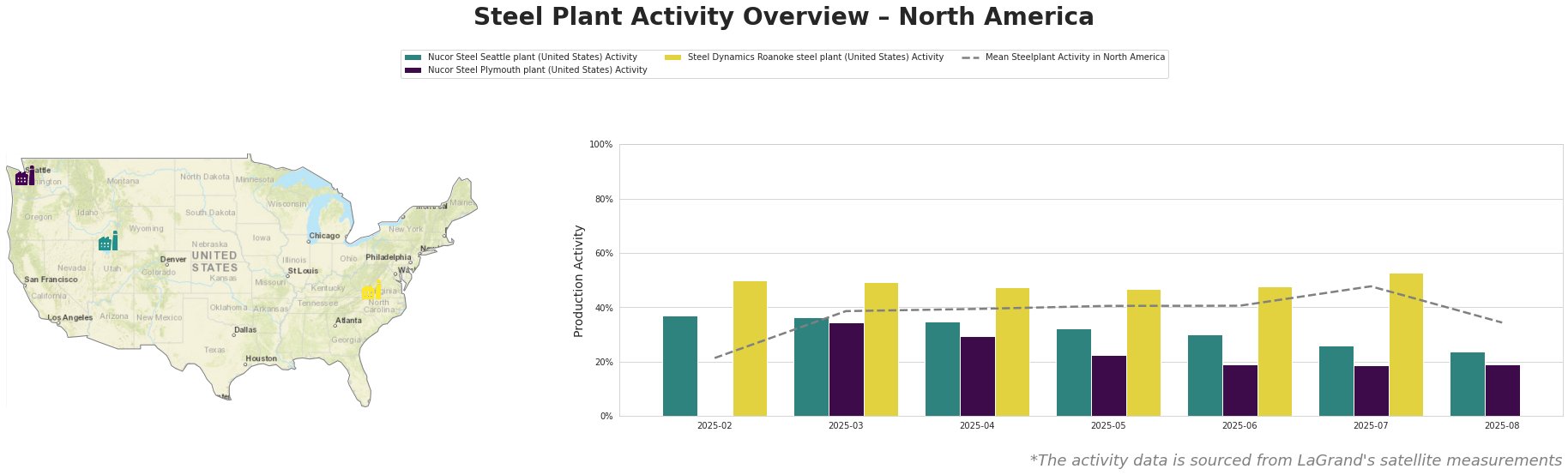

The mean steel plant activity in North America has fluctuated, peaking in July 2025 at 48% and declining to 34% in August 2025.

Nucor Steel Seattle plant, an EAF-based facility in Washington with a crude steel capacity of 855 ttpa, producing finished rolled bar products for various sectors, showed a consistent decrease in activity from February (37%) to August (24%), significantly below the North American average. No direct connection to the gold tariff news can be established.

Nucor Steel Plymouth plant, an EAF-based facility in Utah with a crude steel capacity of 908 ttpa, also producing finished rolled bar products, has exhibited a stable but consistently low activity level, remaining at 19% for the last three months, which is substantially below the North American average. No direct connection to the gold tariff news can be established.

Steel Dynamics Roanoke steel plant, an EAF-based facility in Virginia with a crude steel capacity of 660 ttpa, produces merchant bars. This plant showed a consistent activity of around 48-53% and also was the only one increasing its production in July 2025, standing in contrast to the Nucor Plants activity development. The activity in July 2025 increased to 53%, being the highest value of the three mentioned facilities and dropped to zero in August 2025. No direct connection to the gold tariff news can be established.

Given the observed decline in activity at the Nucor Steel Seattle plant and the low activity at the Nucor Steel Plymouth plant, steel buyers focusing on bar products, particularly in the Western United States, should closely monitor inventory levels and consider diversifying their supplier base to mitigate potential regional supply constraints. Procurement professionals should monitor the situation and prepare for slight delays or potential price increases in Q4, specifically for bar products.