From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Reacts to Potential Tariffs: Activity Surges Amidst Uncertainty

In North America, the steel market is exhibiting a very positive sentiment amidst potential tariff implementations. Activity levels are generally trending upwards. This trend may relate to the news of “The United States plans to impose duties on imports of steel and semiconductor chips” as companies potentially increase production in anticipation of the tariffs taking effect. No direct relationship to increased plant activity could be established with the news of “Report: Trump Plans to Set 50% Copper Tariff” or “Cleveland-Cliffs applauds the DOC adding more derivative steel items to Section 232“.

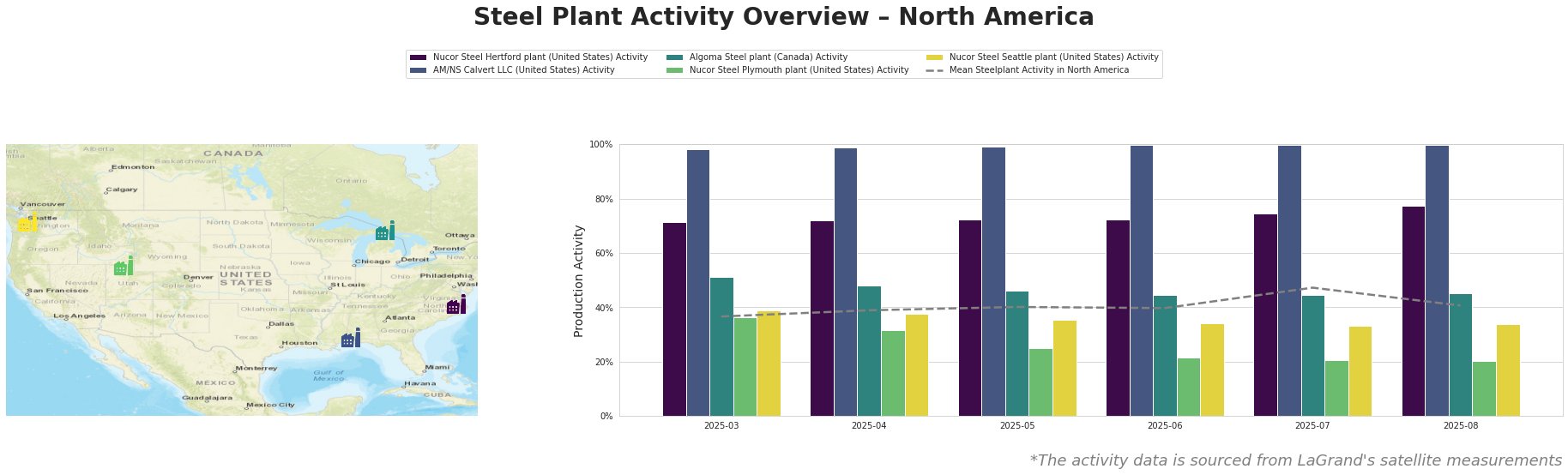

The average steel plant activity in North America has fluctuated, reaching a peak of 47.0% in July before decreasing to 41.0% in August.

Nucor Steel Hertford plant (North Carolina), an EAF-based producer of semi-finished plate steel with a capacity of 1542 ttpa, has shown a consistent upward trend in activity, rising from 71.0% in March to 77.0% in August. No direct connection can be established between this increase and the provided news articles.

AM/NS Calvert LLC (Alabama), a producer of finished rolled steel using EAF technology and boasting a capacity of 1500 ttpa, has consistently operated at very high activity levels, reaching 100% in June, July, and August. This may relate to “The United States plans to impose duties on imports of steel and semiconductor chips“, reflecting increased production in anticipation of tariffs, but no direct evidence confirms this.

Algoma Steel plant (Ontario), an integrated BF-BOF producer with a capacity of 2800 ttpa, has shown a slight decline in activity from 51.0% in March to 45.0% in August. This decline contrasts with the increases seen at Nucor Hertford and AM/NS Calvert. No connection to the news articles could be established.

Nucor Steel Plymouth plant (Utah), an EAF-based producer of finished rolled bar steel with a capacity of 908 ttpa, has seen a steady decrease in activity, dropping from 36.0% in March to 20.0% in August, significantly below the North American average. No direct connection can be established between this decrease and the provided news articles.

Nucor Steel Seattle plant (Washington), an EAF-based producer of finished rolled bar steel with a capacity of 855 ttpa, has shown a relatively stable activity level, fluctuating between 39.0% in March and 34.0% in August. No direct connection can be established between this stable activity and the provided news articles.

Based on the provided information, procurement professionals should be aware of potential supply disruptions, particularly for products supplied by Algoma Steel due to the observed activity decline. Simultaneously, AM/NS Calvert’s very high utilization suggests stable availability of its hot-rolled, cold-rolled, and coated products. Consider diversifying suppliers, securing contracts with AM/NS Calvert for its product range, and carefully monitoring Algoma Steel’s production outlook. The news of “Cleveland-Cliffs applauds the DOC adding more derivative steel items to Section 232” indicates a potential for higher costs for derivative steel products, particularly those from Mexico and Canada. Buyers should assess their reliance on these sources and explore domestic alternatives.