From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Reacts Positively to US-China Tariff Reduction: Plant Activity and Procurement Strategies

In North America, the steel market is showing positive signs following the announced US-China tariff reductions. This observation aligns with news headlines such as “U.S.-China Trade Deal: Doesn’t Cover Steel, Cars, Aluminum” and “Stocks Soar After U.S. and China Tariff Talks. Here’s What Investors Need to Know Now.” while the first news article clearly states that the US-China Trade Deal did not cover steel, the market is still reacting positvely. The articles focus more on the wider economic benefits, which is potentially impacting supply chains and therefore steel production indirectly. Direct links between these articles and specific plant activity levels are not definitively established but the overall market sentiment and potentially derived cost optimizations are assessed.

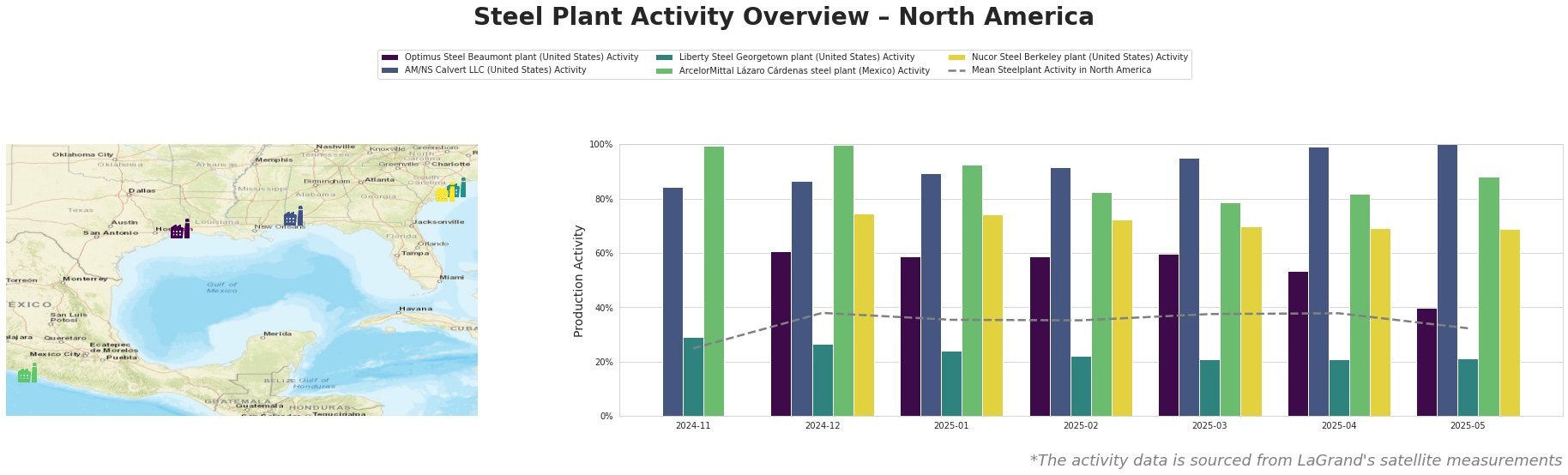

The mean steel plant activity in North America shows an increase from 25.0% in November 2024 to a peak of 38.0% between December 2024 and April 2025, before declining to 32.0% in May 2025. ArcelorMittal Lázaro Cárdenas steel plant in Mexico operated at 100% in November and December 2024 before experiencing a decline to 79% in March 2025, followed by a gradual recovery to 88% in May 2025. AM/NS Calvert LLC shows a consistent increase in activity, reaching 100% in May 2025. The other plants showed reduced or constant activity.

Optimus Steel Beaumont plant, located in Texas, operates one 113-tonne EAF and produces 700 thousand metric tons per annum of crude steel, specializing in wire rods, coiled rebar, and billets. The plant’s activity decreased from 61% in December 2024 to 40% in May 2025. This drop does not have a clear and direct link to the provided news articles on US-China trade, but the reduced transportation rates, as discussed in “Transportation rates likely to surge during tariff pause“, may have shifted demand and affected production volumes.

AM/NS Calvert LLC, situated in Alabama, has a production capacity of 1500 thousand metric tons per annum of crude steel using EAF technology. The plant has shown a steady increase in activity, reaching 100% in May 2025. This suggests a strong demand for its hot-rolled, cold-rolled sheet, and advanced coated products. There is no direct established link to recent news events, but the plant’s focus on finished rolled products for automotive and infrastructure might benefit indirectly from increased market confidence described in “Stocks Soar After U.S. and China Tariff Talks. Here’s What Investors Need to Know Now.“.

Liberty Steel Georgetown plant in South Carolina, with a capacity of 908 thousand metric tons per annum of crude steel produced via EAFs, has shown consistently low activity, remaining stable at 21% in April and May 2025. The plant produces semi-finished and finished rolled products, including billets and wire rods. The persistently low activity level, significantly below the North American average, suggests potential operational or market-specific challenges unrelated to the US-China trade developments discussed in the provided articles.

ArcelorMittal Lázaro Cárdenas steel plant in Mexico, a major integrated steel producer with both BOF and EAF technologies and a capacity of 5700 thousand metric tons per annum, experienced a decrease in activity from 100% in December 2024 to 79% in March 2025, before recovering to 88% in May 2025. This fluctuation could be influenced by factors unrelated to the US-China trade dynamics, as the plant serves a broader range of markets.

Nucor Steel Berkeley plant in South Carolina, utilizing EAF technology with a capacity of 2956 thousand metric tons per annum of crude steel, has seen a slight decline in activity from 75% in December 2024 to 69% in April and May 2025. This minor decrease does not appear directly related to the recent tariff discussions.

The increase in transportation rates, as reported in “Transportation rates likely to surge during tariff pause“, combined with the stable demand, could create localized supply pressures. The ongoing negotiations, as indicated by “Trump’s trade war wins so far: More talk, uncertainty and deadlines“, still suggest considerable uncertainty. The tariff reductions not including steel, as per “U.S.-China Trade Deal: Doesn’t Cover Steel, Cars, Aluminum“, means that steel pricing is influenced by other market mechanisms.

Evaluated Market Implications:

– Optimus Steel Beaumont plant in Texas is showing significantly reduced activity levels, indicating a potential risk of supply disruptions for wire rods, coiled rebar and billets, which might impact sectors like automotive, building and infrastructure, and energy.

– Recommended procurement action: Steel buyers should prioritize securing supply contracts with AM/NS Calvert LLC, whose production is at 100% for hot- and cold-rolled sheet products. Consider diversifying suppliers to mitigate risks associated with potential disruptions from plants showing reduced output, like Optimus Steel. Closely monitor transportation rates to the south, from Alabama, as they might continue to surge and add additional cost.