From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market: Activity Up Despite Economic Uncertainty; Focus on Mexican Supply Chains

The North American steel market shows increasing activity despite economic headwinds. The observed increase cannot be directly linked to the news articles, as they focus on financial markets: “Morning Bid: Senate’s vote-a-rama continues“, “Futures dip after record run as investors focus on Trump’s tax bill“, and “S&P Futures Tick Higher Ahead of U.S. ADP Jobs Report“. These articles highlight concerns about rising U.S. debt and potential trade deal uncertainties, which may impact future steel demand, but no connection to the observed activity changes is apparent.

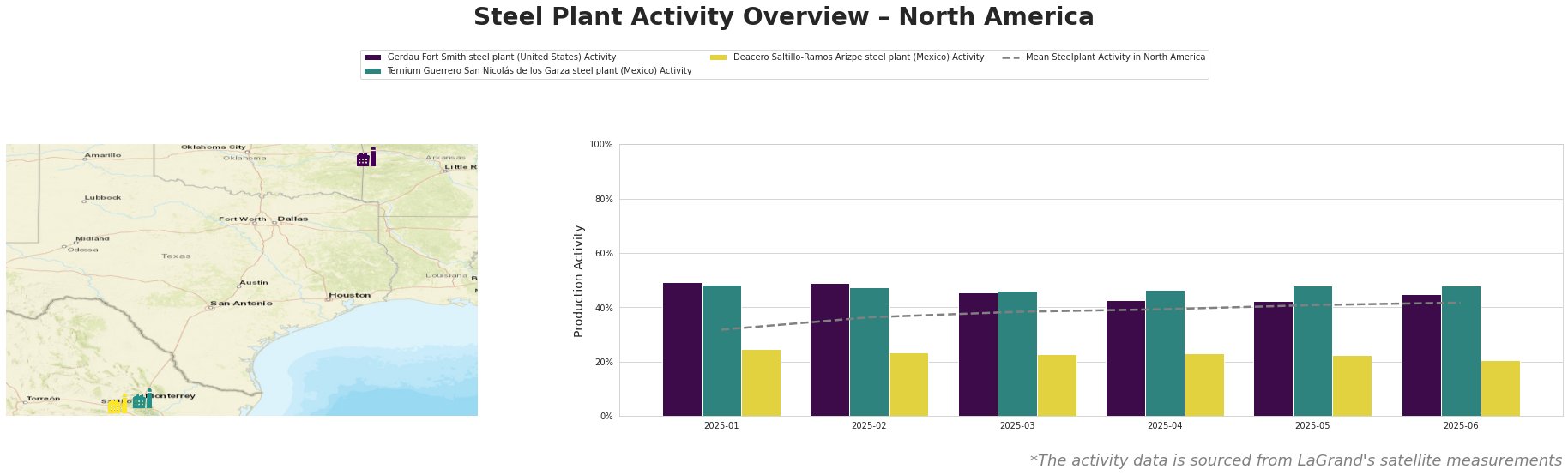

Across North America, mean steel plant activity steadily increased from 32.0% in January 2025 to 42.0% in June 2025. Gerdau Fort Smith’s activity began relatively high at 49.0% in January and February, then experienced a decline to 42.0% by May before increasing to 45.0% in June. The Ternium Guerrero plant maintained consistently high activity, hovering around 46.0% to 48.0% throughout the period. Deacero Saltillo-Ramos Arizpe consistently operated below the average, showing a further drop from 25.0% in January to 20.0% in June.

The Gerdau Fort Smith steel plant in Arkansas, a 550 ttpa EAF-based producer of semi-finished and finished rolled products for building and infrastructure, steel packaging, and transport, showed a slight decline in activity from 49% in January/February to 42% in May, followed by a slight increase to 45% in June. Given its ResponsibleSteel Certification, the plant aligns with environmentally conscious supply chains. However, no explicit link between its activity levels and the news articles can be established.

Ternium’s Guerrero plant in San Nicolás de los Garza, Mexico, an integrated DRI-EAF producer with a 2400 ttpa crude steel capacity and a ResponsibleSteel Certification, maintained relatively high activity levels between 46% and 48% throughout the monitored period. This plant, producing hot- and cold-rolled coils, profiles, and tubes, benefits from its DRI capabilities and internal iron ore sourcing. Again, no connection to any financial news is evident.

The Deacero Saltillo-Ramos Arizpe plant in Coahuila, Mexico, an EAF-based producer with a 700 ttpa crude steel capacity and also having a ResponsibleSteel Certification, experienced a steady decline in activity, decreasing from 25% in January to 20% in June. This plant manufactures steel profiles for building and infrastructure, and tools and machinery. The observed decline suggests potential production constraints, and as no news event can explain this, it points to internal reasons (e.g. maintenance).

The increased mean activity level suggests a generally positive trend in North American steel production. However, the specific decrease in activity at the Deacero Saltillo-Ramos Arizpe plant in Mexico, combined with its below-average activity throughout the observed period, indicates potential supply chain vulnerabilities specifically for steel profiles sourced from this plant.

Evaluated Market Implications:

- Potential Supply Disruption: The declining activity at Deacero Saltillo-Ramos Arizpe could signal a localized disruption in the supply of steel profiles, particularly affecting the building and infrastructure sectors in North America that rely on this plant.

- Recommended Procurement Actions:

- Steel Buyers: Diversify your steel profile suppliers, particularly if sourcing from Deacero’s Saltillo-Ramos Arizpe plant. Explore alternative suppliers within Mexico or other regions to mitigate potential shortages.

- Market Analysts: Closely monitor Deacero’s production output and inventory levels in the coming months. Track steel profile pricing trends to identify any market imbalances caused by reduced supply.