From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNeutral Sentiment in Asia’s Steel Market Amid Trade Tensions and EV Price Wars

Recent developments in Asia’s steel market reflect a neutral sentiment as various external factors impact plant activity levels. The article Trump dreht an der Zollschraube – Autos und Lkws im Fokus highlights tightening U.S. trade policies affecting automotive-related imports, potentially impacting steel demand in the region. In parallel, Tesla, Hyundai, Nissan offer cheaper electric vehicles, while the price war in China is becoming global signals declining EV demand, further echoing through the steel supply chain. Notably, no direct connection has been established between these articles and specific changes in plant activity.

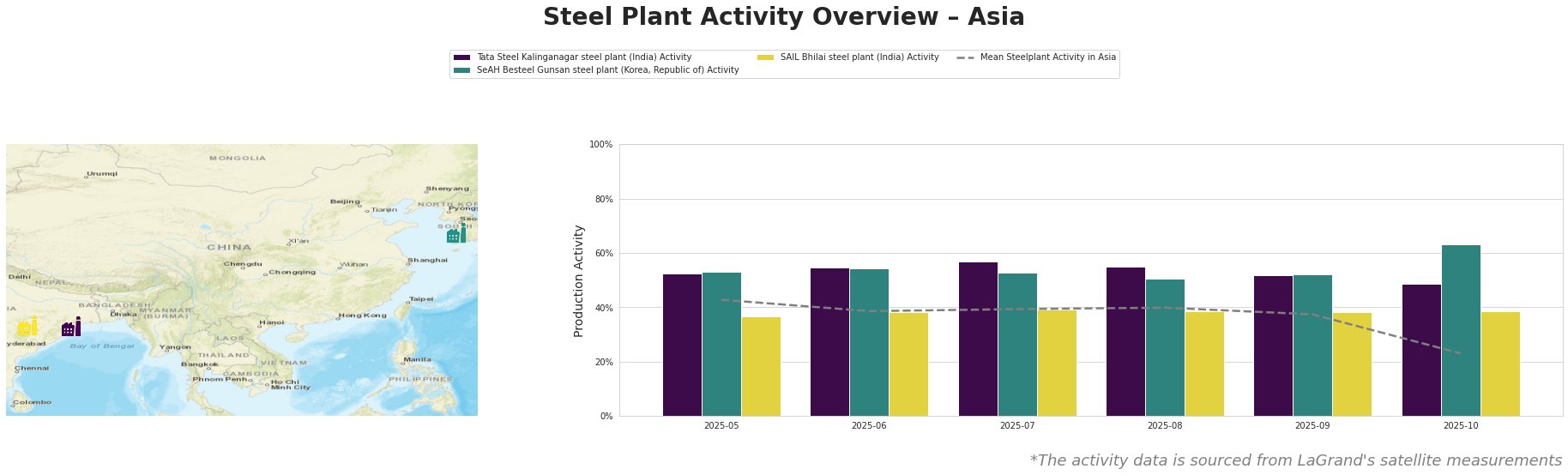

Tata Steel Kalinganagar in Odisha observed a gradual decline from 57.0% in July to 49.0% in October. This activity reduction reflects potential indirect impacts from U.S. tariffs causing shifts in automotive demand, tied to their finished rolled products aimed largely at the automotive sector.

SeAH Besteel Gunsan, located in North Jeolla, experienced a notable increase to 63.0% in October, up from 52.0% in September, suggesting a potential realignment in product focus amid global pricing pressures as highlighted in the EV market competition. This rise is not directly linked to any current news but indicates a demand shift possibly driven by competitive pricing strategies.

Conversely, the SAIL Bhilai steel plant’s stability has been less pronounced, holding at 38.0% in October, indicating ongoing operational consistency, but no link to the aforementioned news was determined.

Evaluated together, the potential supply disruptions may arise from automotive demand fluctuations influenced by both foreign tariffs and shifting EV market dynamics. Steel buyers should consider diversified sourcing arrangements while companies remain attentive to tariff impacts on imported components and raw materials. Therefore, it is recommended that procurement teams closely monitor the activities of Tata Steel Kalinganagar and SeAH Besteel Gunsan for supply reliability and pricing adjustments in the coming months.