From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNeutral Market Sentiment in China’s Steel Industry Amid EU Duty Adjustments

Recent developments in China’s steel market have been notably influenced by the EU’s adjustments to anti-dumping duties on tinplate imports. The articles “EU amends AD on tinplate from China“ and “EU imposes definitive Chinese organic coated steel duties“ indicate a tightening regulatory posture which could potentially impact the export competitiveness of key steel producers.

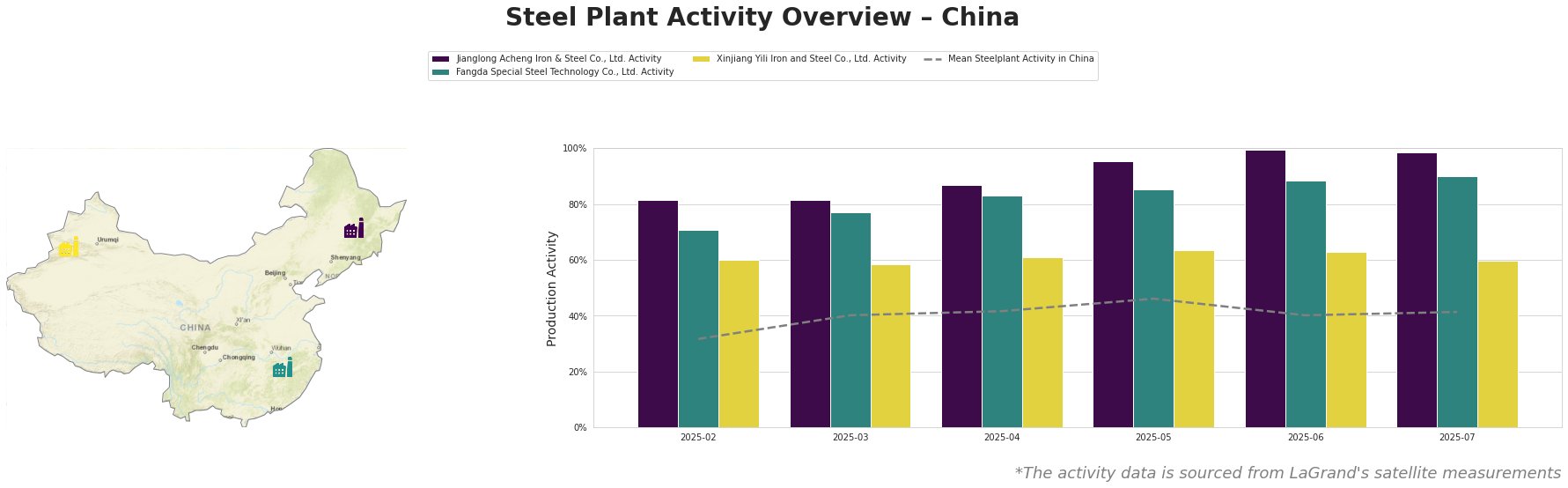

The activity levels at some prominent steel plants reveal varied responses. Jianglong Acheng Iron & Steel Co., Ltd. reported a recent activity peak at 100% in June 2025 but showed a slight drop to 98% in July, indicating stable production capabilities amid these regulatory changes. Fangda Special Steel Technology Co., Ltd. maintained high activity at around 90% during the same period, reflecting resilience against market fluctuations. In contrast, Xinjiang Yili Iron and Steel Co., Ltd. displayed lower stability, decreasing from 64% in May to 60% by July.

The observed changes in plant activity can be related to the EU’s announcements which may affect the pricing and export strategies of these companies. The relatively stable activity in Jianglong and Fangda reflects operational readiness amid these external pressures, offering potential procurement security for buyers. Nonetheless, the decrease at Xinjiang Yili raises caution regarding their market vulnerabilities.

In terms of supply implications, the heightened duties on organic coated steel as noted in “EU imposes final Chinese duties on organically coated steel“, could strain producers heavily reliant on European markets, potentially leading to volatile supply scenarios. Steel procurement professionals should consider diversifying sources and monitoring the situation closely, particularly for products affected by these revisions, ensuring collaborations with resilient suppliers like Jianglong and Fangda. Immediate engagements with these plants could capitalize on their current stability amidst external market fluctuations.