From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNegative Trends in Germany’s Steel Market: Klöckner and Salzgitter Highlight Struggles Amid Falling Activity Levels

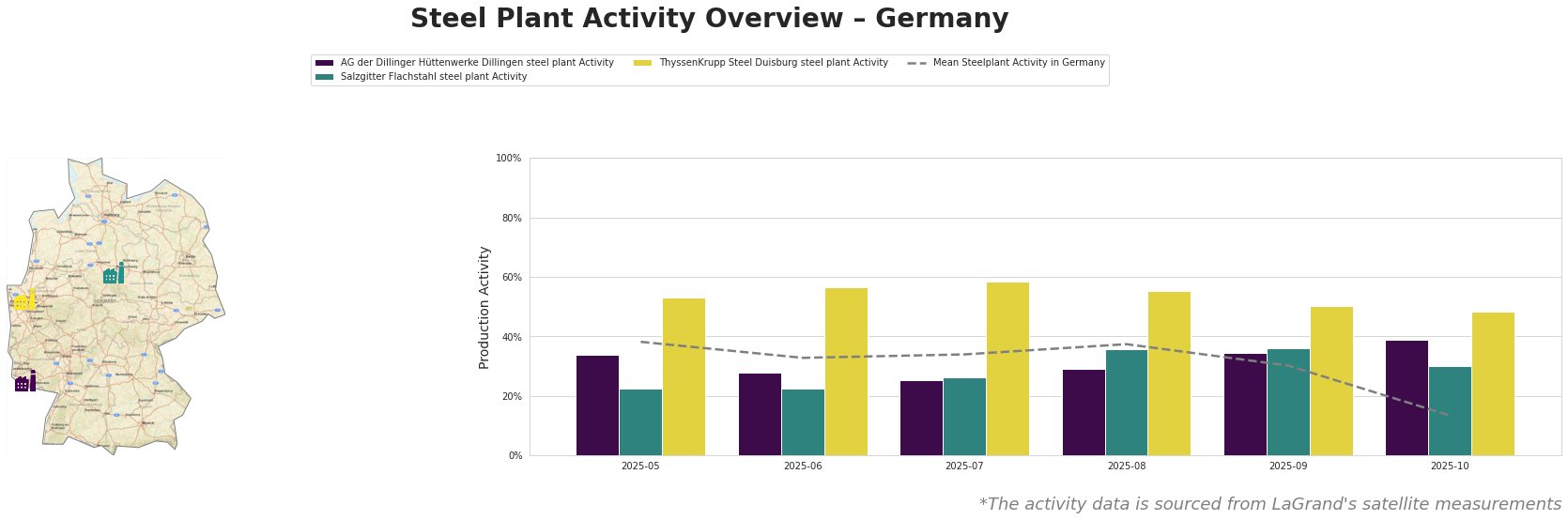

Germany’s steel market is grappling with declining activity levels and financial challenges, as demonstrated in recent reports. Notably, Germany’s Klöckner posts lower net loss for Q3 2025 and Germany’s Salzgitter reports lower net loss for Jan-Sept 2025 reflect reduced sales revenue and production drops. These trends have been corroborated by satellite observations of activity at key steel plants.

The data indicates a significant drop in overall activity, with the mean plant activity plummeting to 13% in October—the lowest recorded. Particularly, Salzgitter Flachstahl’s activity fell to 22% in June, coinciding with its reported 11.4% drop in sales revenues. This confirms a direct connection between declining outputs and sales, as highlighted in the Salzgitter report.

AG der Dillinger Hüttenwerke Dillingen steel plant

Operating in Saarland, the Dillingen facility has a crude steel capacity of 2.76 million tons using a traditional blast furnace (BF) and basic oxygen furnace (BOF). Recently, activity peaked at 39% in October, aligning with Klöckner’s reported improved steel shipments. However, the underlying sentiment remains dampened by the industry-wide price reductions and low consumer demand.

Salzgitter Flachstahl steel plant

Located in Lower Saxony, this steel plant has a production capacity of 5.2 million tons and operates primarily through BFs and BOFs. Despite a net profit of €42.4 million in Q3, the drop in crude steel production by 9.4% indicates challenges in sustaining operations at full capacity. The activity level has fluctuated, reaching 36% in August, yet the sliding sales revenues suggest ongoing difficulties in the market.

ThyssenKrupp Steel Duisburg steel plant

As one of the largest producers with a capacity of 13 million tons, this North Rhine-Westphalia plant recently recorded activity levels around 48% in October, which aligns with lower overall demand from industry sectors. While ThyssenKrupp’s financial position remains relatively stable, CEO forecasts may suggest future constraints based on current trends, especially given the broader economic context.

The negative sentiment surrounding Germany’s steel market is driven by explicit connections between weakened financial performance in the sector, as cited in recent reports, and significant drops in observed activity levels across upper-tier steel producers.

Procurement professionals should be cautious about potential supply disruptions, particularly from Salzgitter and ThyssenKrupp, whose output is becoming increasingly volatile. Buyers may consider negotiating long-term contracts at current lower price levels while inventory levels permit, as the data suggests continued downward pressure on steel prices is likely in the near term.