From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNegative Outlook for European Steel Market Amidst Activity Decline

Recent disruptions in the European steel market have prompted negative market sentiment, driven by activity decreases across key plants. As highlighted in the articles “Australia’s Pilbara shuts LNG, iron ore ports on storm“ and “Australia’s Pilbara Ports reopens WA ports: Update,” adverse weather conditions impacting Australian iron ore exports may indirectly ripple through European supply chains. However, no direct correlation with observed plant activity changes in Europe can be firmly established.

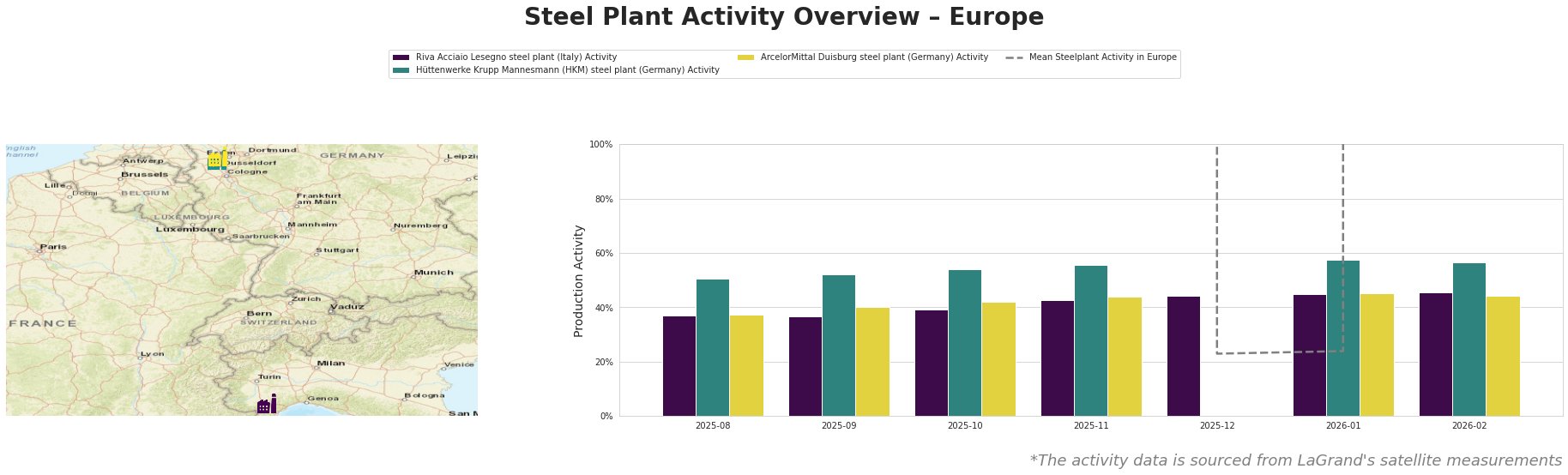

Steel demand and operational efficiency have eroded recently, marked by a downturn in the mean steelplant activity to 19.56% in February 2026, sharply down from 44.02% in September 2025. Notable drops include the Riva Acciaio Lesegno steel plant, which remained stable at 45.0%, while Hüttenwerke Krupp Mannesmann saw a significant increase to 57.0% in January but fell back in February, lacking operational resilience.

The decline in activity is reflected in the strategic positioning of plants: Riva Acciaio Lesegno specializes in electric arc furnace (EAF) technology, producing key semi-finished products for various sectors but exhibits vulnerability during market downturns. Meanwhile, Hüttenwerke Krupp Mannesmann, with its integrated blast furnace and oxygen-based production capabilities, has historically managed fluctuations better but may face threats of lower global demand as conditions worsen.

Supply disruptions may arise particularly from the interconnected nature of global markets and the impact of Australian port closures. Buyers should be vigilant about forecasted production capacity limits at steel plants, especially as adverse weather can lead to increased lead times and logistical challenges.

Steel buyers are advised to reassess procurement strategies to circumvent potential shortages. Specifically, consideration should be given to diversifying supplier bases beyond current European sources, particularly if disruptions in Australian markets influence operations in Europe. Additionally, long-term contracts may mitigate risk against volatility in demand and activity fluctuation.