From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMixed Signals: Steel Production Rises in Southern and Eastern Europe Amidst Austrian Output Decline

Europe’s steel market presents a mixed landscape, with production increases in some regions contrasting with declines elsewhere. As reported in “Spain increased steel production by 6.1% y/y in January-April“, Spain saw a production increase in early 2025. Similarly, “Poland increased steel production by 3.9% y/y in January-April” indicates a positive trend in Poland. Italy also reports increases according to “Steel production in Italy continues to grow“. Conversely, “Austria reduced steel production by 6% y/y in January-April” and “Austria crude steel production decreases” highlight output reductions due to high production costs and decreased competitiveness, although the article provides mixed data with differing decreases (6% vs 8.9%). The satellite data provides insights into individual plant activity but cannot be directly linked to these specific regional production figures.

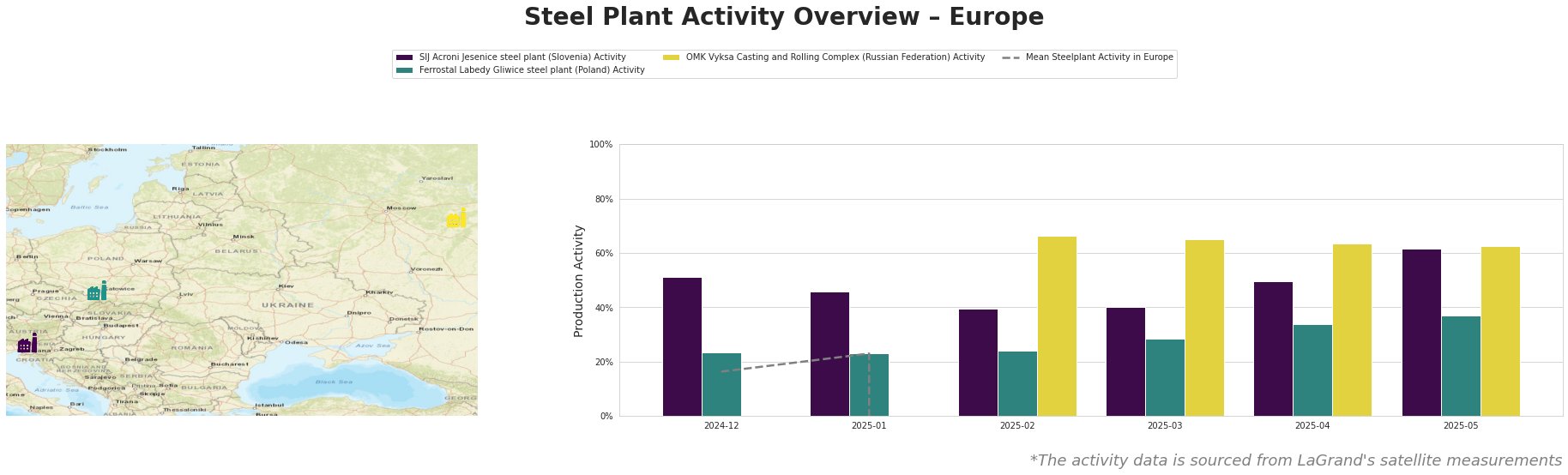

Note: Negative values for ‘Mean Steelplant Activity in Europe’ should be disregarded, as they result from a technical processing error.

Activity Overview:

SIJ Acroni Jesenice steel plant (Slovenia) exhibited a generally increasing activity trend from December 2024 (51%) to May 2025 (62%). Ferrostal Labedy Gliwice steel plant (Poland) also showed an upward trend, increasing from 23% in December 2024 and January 2025 to 37% in May 2025. The OMK Vyksa Casting and Rolling Complex (Russian Federation) showed high and relatively stable activity from February 2025 (66%) to May 2025 (62%). The mean activity across all observed plants is unusable due to corrupt data. No direct connection between these individual plant activities and the named news articles regarding country-level production can be established.

SIJ Acroni Jesenice steel plant: This Slovenian plant, with a 726,000-ton EAF capacity, focuses on flat-rolled products and holds ResponsibleSteel certification. The plant’s observed activity increased steadily, rising from 51% in December 2024 to 62% in May 2025. No direct connection between this activity and the provided news articles could be established.

Ferrostal Labedy Gliwice steel plant: Located in Poland, this EAF-based plant has a 500,000-ton capacity and produces ingots and hot-rolled bars. Its activity increased from 23% in December 2024/January 2025 to 37% in May 2025. While “Poland increased steel production by 3.9% y/y in January-April” reports increased Polish production, no direct causal link between this article and the specific activity of this plant can be established.

OMK Vyksa Casting and Rolling Complex: This Russian plant with 1.25 million tons EAF capacity, produces hot-rolled flat products. Observed activity remained consistently high between February 2025 (66%) and May 2025 (62%). No connection can be established with any of the provided news articles.

Evaluated Market Implications:

Given the reduced steel production in Austria, as reported in “Austria reduced steel production by 6% y/y in January-April“, and the cited reasons of high production costs and decreased competitiveness, steel buyers should:

- Evaluate Alternative Sourcing: Actively explore alternative steel suppliers, especially from Spain, Poland and Italy. The news articles “Spain increased steel production by 6.1% y/y in January-April“, “Poland increased steel production by 3.9% y/y in January-April“, and “Steel production in Italy continues to grow” indicates growing production in those regions and, as a consequence, greater likelihood of reliable supply.

- Evaluate and Track Voestalpine’s Financial Health: Closely monitor Voestalpine AG’s financial performance and government negotiations regarding electricity cost compensation, to anticipate further potential production adjustments. This is vital given that, as reported in “Austria reduced steel production by 6% y/y in January-April“, Voestalpine attributes decreased production to high electricity expenses.

These recommendations are explicitly driven by the reported production decreases in Austria and the identified reasons for this decline, combined with the positive production trends observed in Spain, Poland, and Italy, making diversified sourcing a prudent strategy.