From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMixed Signals: Italian Steel Surges, German Demand Lags Amidst Fluctuating Plant Activity

Europe’s steel market presents a mixed picture as increased steel production in Italy contrasts with lagging demand in Germany, according to “Italy increased steel production by 2.3 times m/m in September” and “Germany lags behind in steel demand among industrialized countries“. The plant activity data shows varying trends across different European steel plants, but clear direct connections to the aforementioned news are difficult to establish. “Germany increased steel production by 15.4% m/m in September“, adds to the complexity by indicating monthly gains alongside long-term annual declines.

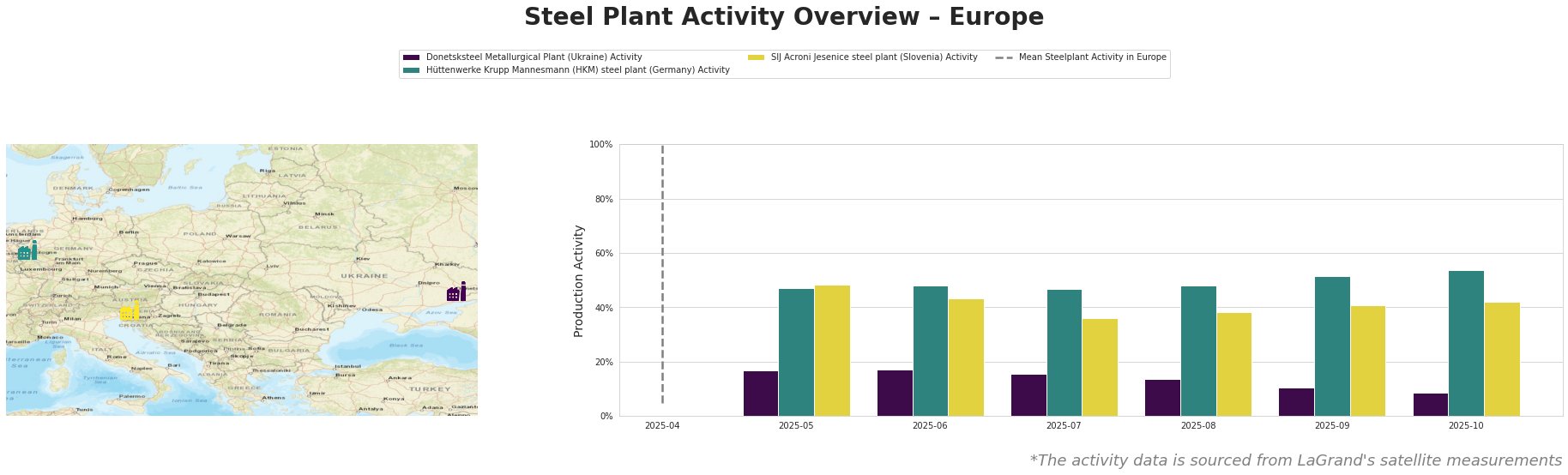

The “Mean Steelplant Activity in Europe” shows volatile aggregate activity that does not readily match the news cycles available, peaking in May and July with high figures before decreasing again in September and October. Donetsksteel Metallurgical Plant shows a consistent decline in activity from May (17%) to October (9%). Hüttenwerke Krupp Mannesmann (HKM) steel plant shows relative stability with a gradual increase in activity from May (47%) to October (54%). SIJ Acroni Jesenice steel plant shows fluctuating activity levels, peaking in May (48%) and gradually decreasing to 42% in October.

Donetsksteel Metallurgical Plant, an integrated BF producer in Donetsk, has a crude steel capacity of 0 tons and iron capacity of 1500 tons, and the satellite data indicates a decrease in activity from 17% in May to 9% in October. This decline does not directly correlate with available news articles.

Hüttenwerke Krupp Mannesmann (HKM) steel plant, an integrated BF producer in North Rhine-Westphalia, Germany, has a crude steel capacity of 6000 tons and an iron capacity of 5200 tons. The plant’s activity has shown a gradual increase from 47% in May to 54% in October. This slight increase could partially reflect the “Germany increased steel production by 15.4% m/m in September,” but the news also highlights a year-over-year decline, suggesting the increase may be temporary. However, the general sentiment regarding German steel demand remains weak according to “Germany lags behind in steel demand among industrialized countries“.

SIJ Acroni Jesenice steel plant, an EAF producer in Jesenice, Slovenia, with a crude steel capacity of 726 tons, has shown fluctuating activity levels. From May to October, activity has ranged from 48% to 36%, settling at 42% in October. This volatility cannot be directly attributed to any of the provided news articles.

Based on the information presented, potential supply disruptions are difficult to assess accurately. The Italian increase in production reported in “Italy increased steel production by 2.3 times m/m in September” should alleviate pressure on flat and long steel supply, but the overall EU outlook outlined in “Germany lags behind in steel demand among industrialized countries” emphasizes the need for protective measures, which, if enacted, may result in price increases.

Therefore, steel buyers should:

- Closely monitor German steel demand: Given the potential for continued weakness described in “Germany lags behind in steel demand among industrialized countries,” buyers should negotiate contracts with German suppliers with caution.

- Diversify sourcing: The increase in Italian steel production provides an opportunity to diversify away from potentially strained German supply chains.

- Stay informed on trade policy: The WVStahl’s call for protective measures in “Germany lags behind in steel demand among industrialized countries” indicates a risk of trade barriers, so buyers should closely follow EU trade policy developments.