From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMixed Signals in European Steel: Italian Surge Contrasts German Decline Amidst Global Headwinds

Europe’s steel market presents a mixed picture. Recent data reveals diverging trends within the region, highlighting the need for careful monitoring. While “Italy increased steel production by 2.3 times m/m in September“, Germany experienced declines as reported in “Germany increased steel production by 15.4% m/m in September” and confirmed by “German crude steel output down 10.7 percent in Jan-Sept 2025“. These regional variations occur against a backdrop of global contraction, as “Global steel production in September decreased by 1.6% y/y“. No direct relationship between these specific news articles and observed satellite activity changes can be established.

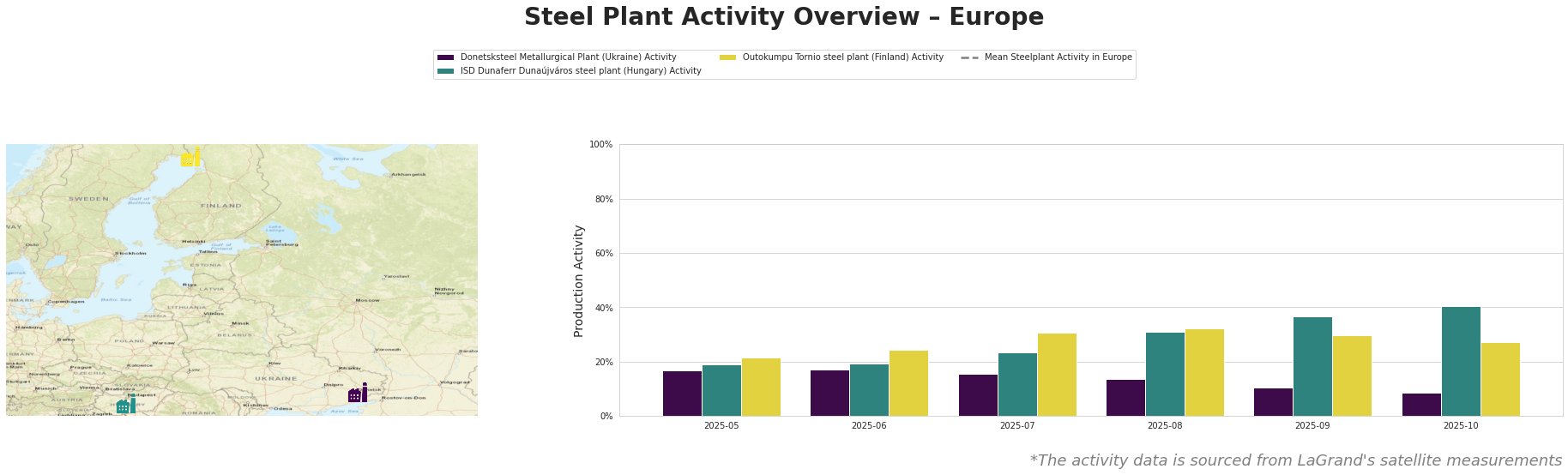

The mean steel plant activity in Europe shows fluctuations, with peaks in July and August 2025, and a significant drop in October 2025. Donetsksteel Metallurgical Plant consistently demonstrates the lowest activity levels of the observed plants, with a continuous decline from May (17%) to October (9%). ISD Dunaferr Dunaújváros steel plant activity exhibits a steady increase, reaching a peak of 40% in October. Outokumpu Tornio steel plant also shows increased activity until August, followed by a decline to 27% in October. No direct connection between the mean activity level and the named news articles can be established.

Donetsksteel Metallurgical Plant, an integrated steel plant in Donetsk, Ukraine, primarily produces pig iron using BF and EAF technologies, and has a BF iron capacity of 1500 ttpa. Satellite data indicates a consistent decline in activity from 17% in May to 9% in October. Given the plant’s location in Ukraine, this decline could indirectly relate to the broader regional downturn reported in “Global steel production in September decreased by 1.6% y/y” which notes a decrease in steel production from the CIS+Ukraine region, however, a direct relationship cannot be established based on the provided information alone.

ISD Dunaferr Dunaújváros steel plant, located in Hungary, is an integrated plant with a crude steel capacity of 1600 ttpa using BOF technology. The plant produces semi-finished and finished rolled products. Satellite data reveals a significant increase in activity, rising steadily from 19% in May to 40% in October. No direct connection between this specific plant’s activity and the provided news articles can be established.

Outokumpu Tornio steel plant in Finland, an electric arc furnace (EAF) facility with a crude steel capacity of 1200 ttpa, produces a range of stainless steel products. Activity levels peaked in August at 32% but declined to 27% in October. No direct connection between this specific plant’s activity and the provided news articles can be established.

Based on the data, potential supply disruptions may arise from regions mirroring the activity patterns of Donetsksteel. Conversely, increased activity at ISD Dunaferr Dunaújváros could indicate a more secure supply from that source.

Recommended Procurement Actions: Steel buyers should diversify their sources, with caution on relying heavily on regions with declining plant activity like those potentially influenced by broader economic trends impacting German or CIS+Ukraine steel production, as noted in “German crude steel output down 10.7 percent in Jan-Sept 2025” and “Global steel production in September decreased by 1.6% y/y“. Specifically, carefully consider current reliance on regions with similar geopolitical and production constraints as the region of Donetsksteel. Actively explore opportunities for sourcing from regions with increasing steel production like those potentially influenced by Italian steel production, as noted in “Italy increased steel production by 2.3 times m/m in September” and Hungary.