From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMixed Signals in European Steel: Austrian Surge Offsets Italian Export Slump; Monitor Sidenor & Voestalpine

Europe’s steel market presents a complex picture. While “Austria increased steel production by 35.8% y/y in October” and “Steel production in Italy continues to grow,” other forces are at play. This contrasts with news such as “Italian merchant bar production hits multi-year low: Federacciai,” highlighting divergent trends. The Italian export slump, as reported in “Italy’s steel exports have dropped to a ten-year low“, may be linked to decreased activity in certain product segments and plants. However, a direct link between the Austrian increase and specific plant-level activity changes could not be conclusively established based on the provided data.

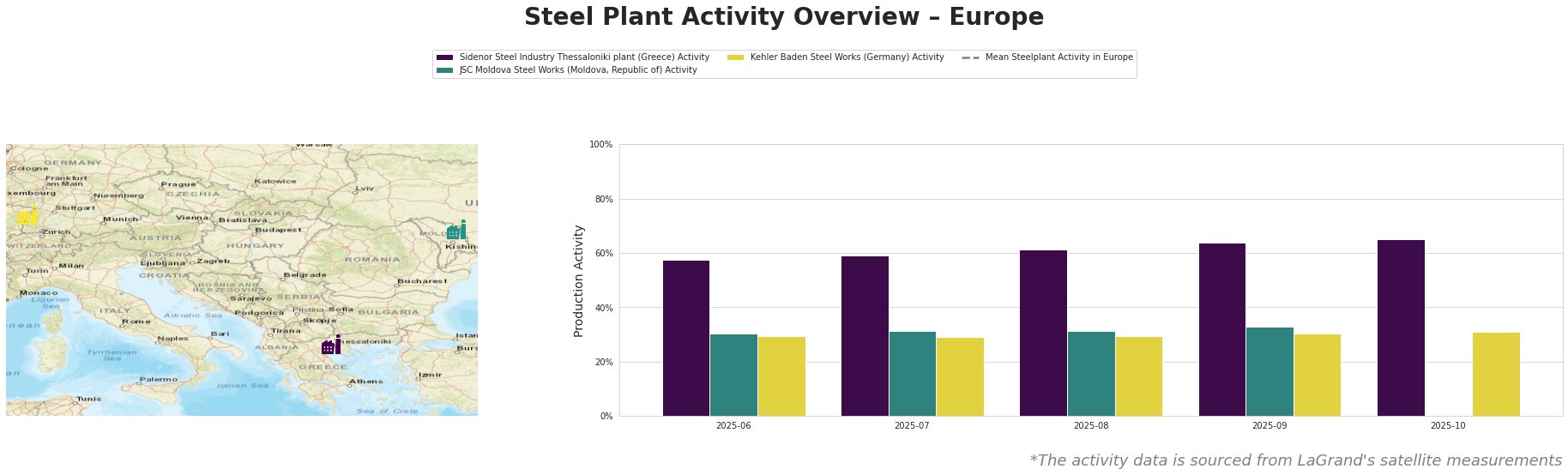

The mean steel plant activity in Europe fluctuated, peaking in July and August, then declining in October.

Sidenor Steel Industry Thessaloniki plant (Greece): Activity at the Sidenor plant, an 800ktpa EAF-based producer of rebar, bars & coil, merchant bars, and wire rod, steadily increased from 58% in June to 65% in October. Given that “Italian merchant bar production hits multi-year low: Federacciai,” and Sidenor produces merchant bars, the increased activity could indicate Sidenor is fulfilling demand elsewhere, potentially replacing some Italian output.

JSC Moldova Steel Works (Moldova, Republic of): This 1000ktpa EAF-based plant producing wire rod, rebar, and billet showed stable activity, ranging from 30% to 33% between June and September. No October activity data is available. No direct link to the provided news articles can be established.

Kehler Baden Steel Works (Germany): Activity at this 2500ktpa EAF-based plant producing wire rod, bar, rebar, and billet showed minimal fluctuation, remaining at 29-31% from June to October. No direct link to the provided news articles can be established.

Evaluated Market Implications:

The decline in “Italy’s steel exports have dropped to a ten-year low” suggests potential supply chain disruptions for steel buyers relying on Italian exports, particularly for hot-rolled flat steel given that “Italian merchant bar production hits multi-year low: Federacciai.” The increase in steel production in Austria, per “Austria increased steel production by 35.8% y/y in October,” might partially offset this disruption, but “Austria increased crude steel production in October” also notes that Voestalpine is considering production cuts.

Recommended Procurement Actions:

- Monitor Voestalpine’s Production Plans: Given Voestalpine’s potential production cuts despite overall Austrian growth, buyers should closely monitor their announcements and consider diversifying supply sources to mitigate potential disruptions. This is critical because voestalpine is reducing production despite overall Austrian growth as noted in “Austria increased crude steel production in October”.

- Secure Sidenor Supply Contracts: With “Italian merchant bar production hits multi-year low: Federacciai,” and Sidenor’s increasing activity, buyers reliant on merchant bar should consider securing contracts with Sidenor to ensure supply continuity. The plant’s rising activity levels may indicate it is filling gaps left by decreased Italian production.

- Diversify Import Sources: As “Italy’s steel exports have dropped to a ten-year low”, buyers should diversify import sources beyond Italy, particularly for products where Italian production is declining. Analyze import/export data for surrounding nations to proactively discover an alternative provider.