From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMixed Signals in European Steel: Austrian Output Rises Amidst Ukrainian Export Surge and Polish Production Dip

Europe’s steel market presents a complex picture. While “Austria increased crude steel production in July,” and “Ukraine increased its exports of long rolled products by 56.7% y/y in January-July,” production in other regions declined, as noted in “Southeast Europe’s July steel output falls on-year” and “Poland reduced steel production by 14.7% m/m in July.” A direct relationship between specific activity levels and these news articles cannot always be established due to the limited scope of observed plants.

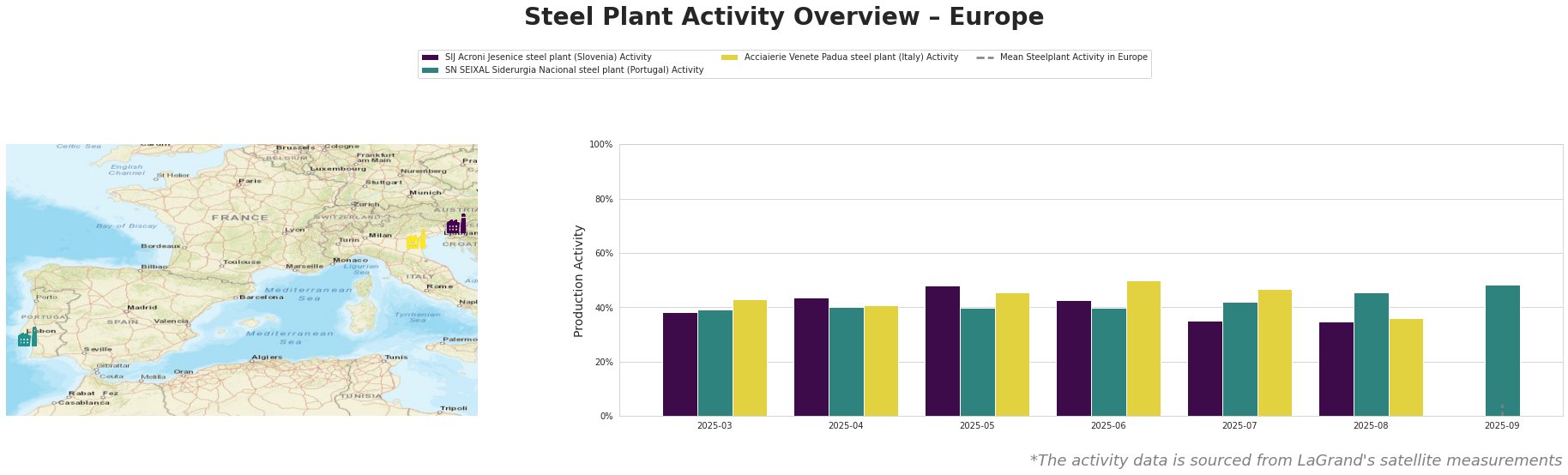

Observed activity at SIJ Acroni Jesenice in Slovenia, an EAF-based producer of flat-rolled products, declined from a high of 48% in May to 35% in both July and August. The SN SEIXAL plant in Portugal, also an EAF producer focusing on mesh, wire, and hot-rolled coils, saw its activity fluctuate slightly, rising to 46% in August, indicating a potentially stronger performance relative to other observed plants. Activity at Acciaierie Venete in Padua, Italy, which focuses on bars and wire rod, peaked at 50% in June, then dropped to 36% in August. It is difficult to compare the observed activity levels across different plants as their mean activity values are inconsistent and don’t provide any meaningfull information. However, the activity drop at SIJ Acroni could potentially be linked to the overall decline in Southeast Europe steel production reported in “Southeast Europe’s July steel output falls on-year,” although a direct cause-and-effect relationship cannot be explicitly confirmed. The temporary shutdown of a blast furnace at ArcelorMittal Poland, as mentioned in “Poland reduced steel production by 14.7% m/m in July”, is not directly observable through the satellite data of the selected plants, highlighting a limitation of this dataset. No direct connections can be established between the satellite data and the increase in Austrian or Ukrainian steel output.

SIJ Acroni Jesenice, a ResponsibleSteel certified plant with a 726ktpa EAF capacity, experienced a notable activity drop to 35% in July and August. While no direct link can be proven from the news articles, if this decline is due to reduced demand in its key end-user sectors (building/infrastructure, tools/machinery), then European buyers should consider diversifying their flat-rolled steel sourcing from this plant. SN SEIXAL Siderurgia Nacional, also ResponsibleSteel certified with 1100ktpa EAF capacity, producing mesh, wire and hot-rolled coils, saw an increase to 46% activity in August. This indicates a potential increase in supply in those product categories. Acciaierie Venete Padua, a 600ktpa EAF producer, experienced a notable activity drop to 36% in August. Since its products are used in the automotive sector, the building sector, the energy sector, and the transport sectors, the slowdown could indicate potential weaknesses in those industries, which requires continuous monitoring of steel demand.

Given the increase in Ukrainian long rolled steel exports (“Ukraine increased its exports of long rolled products by 56.7% y/y in January-July”), steel buyers should explore Ukrainian suppliers to potentially leverage cost-competitive options, especially for carbon steel bars and rods, hot-rolled bars and rods in coils, and carbon steel wire. However, buyers must carefully consider logistical challenges and geopolitical risks associated with Ukrainian supply chains. Based on “Poland reduced steel production by 14.7% m/m in July” and the reported temporary shutdown at ArcelorMittal Poland, buyers reliant on Polish steel should proactively engage with their suppliers to understand potential delivery delays or explore alternative sources, particularly within the EU market, but considering that “July steel production in Southeastern Europe decreased compared to the same period last year“, the supply may be limited and costlier.