From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMixed Signals in European Steel: Austria & Spain Rise, Poland & France Fall Amidst EU Production Dip

European steel markets present a mixed picture, with increases in some nations offset by declines in others amidst a broader EU downturn. As per the article “Austria increased crude steel production in July,” Austrian output increased, contrasting with the EU trend. Similarly, “Spain increased steel production by 6.3% y/y in January-July” highlights a positive trend in Spain, although July saw a month-on-month decrease. However, the article “Poland reduced steel production by 14.7% m/m in July” reveals a significant monthly decrease in Polish production, and “France reduced steel production by 20.8% y/y in July” shows a sharp year-over-year decline. It’s difficult to establish direct, immediate relationships between these news pieces and the satellite data due to the limitations in geographical and temporal resolution of the plant-specific data.

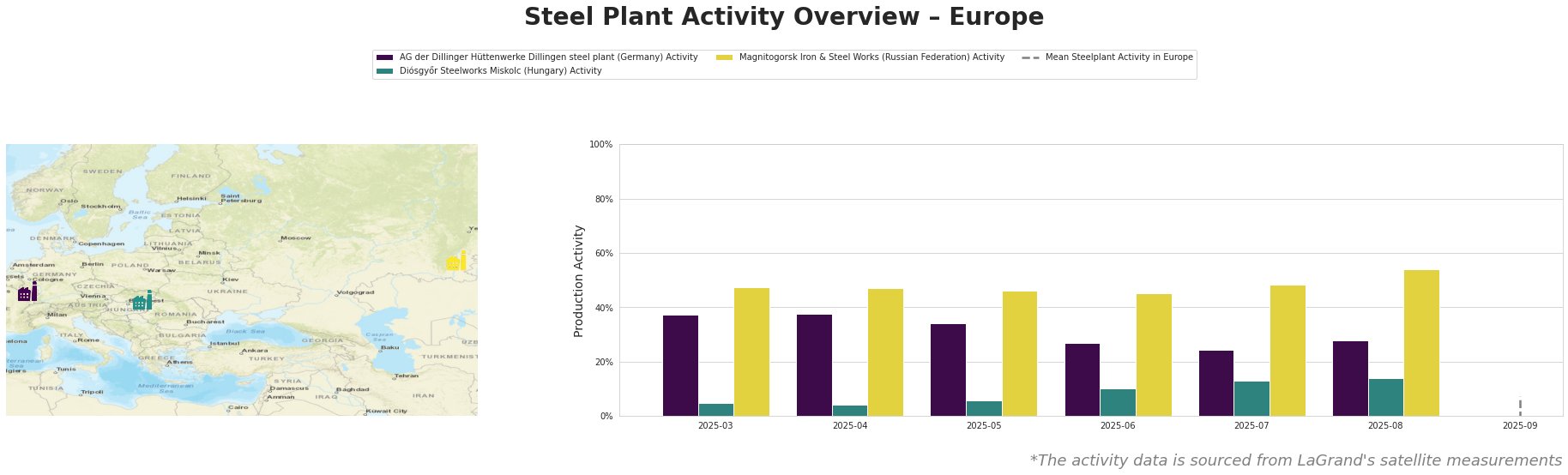

The “Mean Steelplant Activity in Europe” shows consistently negative and implausible values until a sharp jump to 7.0 in September, rendering it unusable for meaningful comparison. AG der Dillinger Hüttenwerke’s activity shows a decline from March (37.0%) to July (24.0%), followed by a slight increase in August (28.0%). Diósgyőr Steelworks exhibits a gradual increase in activity from March (5.0%) to August (14.0%). Magnitogorsk Iron & Steel Works shows relatively stable activity from March (48.0%) to June (45.0%), followed by increases in July (48.0%) and August (54.0%). It is important to note that Magnitogorsk Iron & Steel Works is located in the Russian Federation and therefore not reflective of EU steel dynamics.

AG der Dillinger Hüttenwerke Dillingen steel plant in Saarland, Germany, operates with a capacity of 2.76 million tonnes of crude steel using BOF technology and 4.79 million tonnes of iron using BF technology. The plant produces semi-finished and finished rolled products for various sectors, including automotive and energy. The satellite data indicates a decrease in activity from 37.0% in March to 24.0% in July, followed by a slight rebound to 28.0% in August. Considering voestalpine’s optimism about German infrastructure spending, as noted in “Austria increased crude steel production in July,” it’s unclear if Dillingen’s activity dip aligns with expected demand. No direct link can be established between the observed activity changes and the news articles at this time.

Diósgyőr Steelworks Miskolc in Hungary produces 550,000 tonnes of crude steel using EAF technology, specializing in semi-finished and finished rolled products for the building and infrastructure sectors. The satellite data shows a consistent increase in activity from 5.0% in March to 14.0% in August. Voestalpine’s plan to supply BYD’s new plant in Hungary, as mentioned in “Austria increased crude steel production in July,” could potentially contribute to increased demand for Diósgyőr’s products, supporting the observed activity increase. However, a direct connection remains speculative.

Magnitogorsk Iron & Steel Works (Russia) has a significant capacity of 14.5 million tons of crude steel. Activity increased from 48% in July to 54% in August. The news article do not mention this plant, or the Russian Federation, thus no connection can be made with the observed activity.

Given the mixed signals across Europe and the temporary shutdown at ArcelorMittal Poland, as highlighted in “Poland reduced steel production by 14.7% m/m in July,” coupled with the contrasting increases in Austria and Spain, steel buyers should:

1. Diversify Procurement: Actively seek supply options beyond Poland and France to mitigate potential disruptions. Consider increasing reliance on suppliers in Austria and Spain, provided their pricing remains competitive.

2. Monitor Regional Pricing: Closely track steel prices in Austria and Spain due to their increased production, as noted in “Austria increased crude steel production in July” and “Spain increased steel production by 6.3% y/y in January-July“, respectively. Negotiate contracts that reflect these regional variations.

3. Assess Supply Chain Risks: Conduct thorough risk assessments of their supply chains, focusing on potential disruptions from facilities experiencing production declines. Evaluate alternative suppliers and transportation routes.