From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMixed Signals: German Steel Production Declines While Italian Output Fluctuates, Impacting European Market

Steel production trends across Europe present a mixed picture, with Germany experiencing continued decline and Italy showing volatility. The “Germany reduced steel production by 10.5% y/y in August“ news article directly explains the observed downward trend in overall European steel plant activity. At the same time, as per the news articles “Italian crude steel production up 7.3 percent in August 2025“ and “Italy reduced steel production to an annual low in August“, August shows increase year-over-year, while the production was lowest in the year in Italy. The satellite-observed activity does reflect a decrease in overall European production, which is most likely tied to the German Steel production decline in the same period.

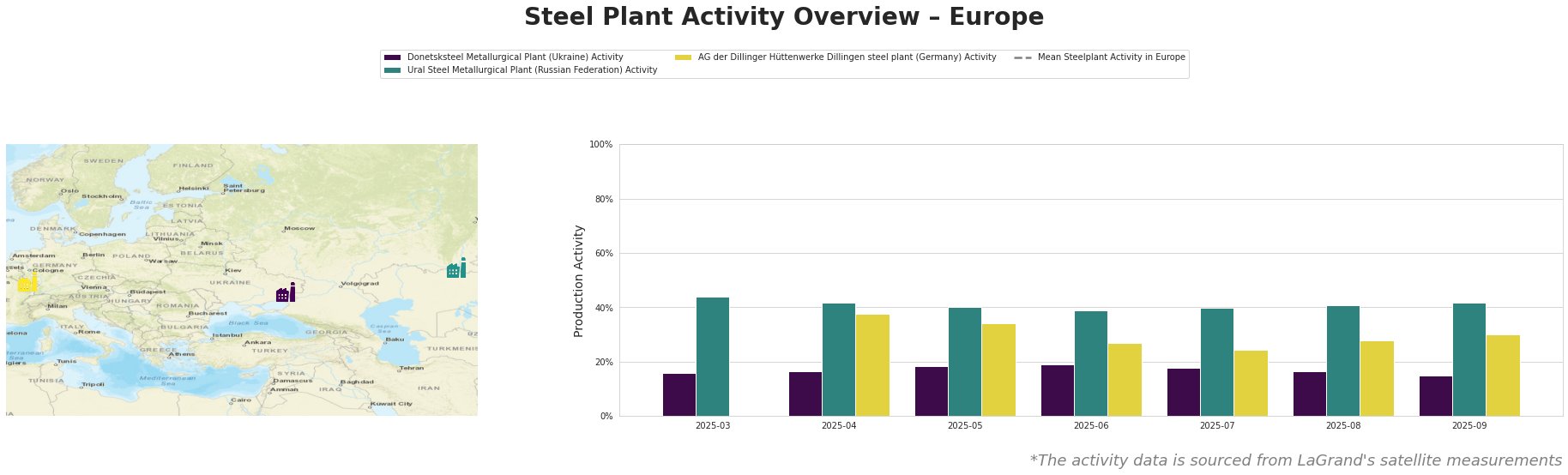

The mean steel plant activity in Europe shows fluctuations, with a notable dip in September 2025. Donetsksteel Metallurgical Plant activity has remained relatively stable, fluctuating slightly between 15% and 19% over the observed period. Ural Steel Metallurgical Plant activity also shows relative stability, ranging from 39% to 44%. AG der Dillinger Hüttenwerke Dillingen steel plant, a German plant, exhibited a decline from 38% in April to 24% in July, followed by a slight increase to 30% in September. This trend aligns with the “Germany reduced steel production by 10.5% y/y in August” news article, where German steel production has fallen.

Donetsksteel Metallurgical Plant, located in the Donetsk region (Ukraine), primarily produces pig iron using integrated (BF) processes, with a BF iron capacity of 1500 ttpa. Satellite data indicates a stable activity level, fluctuating between 15% and 19% over the observed months. Given its location in a conflict zone, this consistent activity is notable, though no direct link to specific news articles can be established from the provided information.

Ural Steel Metallurgical Plant, situated in the Orenburg region (Russian Federation), utilizes integrated (BF) processes alongside EAF, boasts a crude steel capacity of 1600 ttpa and an iron capacity of 2700 ttpa. Satellite observations indicate a relatively stable activity level, ranging between 39% and 44%. It produces crude, semi-finished, and finished rolled products. As a Responsible Steel certified plant, it has a diverse production line, and its consistent activity suggests a stable operational status. No direct connection between plant activity and provided news articles can be established.

AG der Dillinger Hüttenwerke Dillingen steel plant, located in Saarland (Germany), operates using integrated (BF) processes with a crude steel capacity of 2760 ttpa. The satellite-observed data shows a decline in activity from 38% in April to 24% in July, with a slight recovery to 30% in September. The observed activity decline aligns with the information in the news article “Germany reduced steel production by 10.5% y/y in August”, and may therefore be related. Dillinger produces heavy-plate products, including high-temperature, cryogenic, and offshore steels. The decrease in observed activity could affect the supply of specialized steel products.

Based on the information provided, the following market implications can be evaluated:

-

Potential Supply Disruptions: The decline in production at AG der Dillinger Hüttenwerke Dillingen, connected to the broader trend of reduced German steel production reported in “Germany reduced steel production by 10.5% y/y in August”, may create supply bottlenecks, specifically for heavy-plate products used in energy and infrastructure sectors.

-

Recommended Procurement Actions: Steel buyers relying on AG der Dillinger Hüttenwerke Dillingen for specialized steel products should:

- Diversify Suppliers: Explore alternative suppliers of heavy-plate products, particularly those specializing in high-temperature, cryogenic, and offshore steels.

- Increase Inventory: Consider increasing inventory levels of critical heavy-plate products to mitigate potential supply disruptions.

- Monitor alternative steel production statistics: Track production of long and flat steel in Italy, as a backup source and to track the effect on their local pricing.

These recommendations are driven by the correlation between the decreased activity observed via satellite and the reported production decline in Germany, which may lead to specific product shortages in the European market.