From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineJapan Steel Market: Nippon Steel’s US Acquisition Drives Optimistic Outlook Despite Recent Production Dips

The Japanese steel market shows a very positive sentiment, underpinned by Nippon Steel’s strategic acquisition of US Steel. According to “Trump approves $14.9 billion takeover of US Steel by Japan’s Nippon Steel,” this deal is crucial for Nippon Steel’s global expansion. Similarly, “Trump approves U.S. Steel’s takeover of Japan’s Nippon Steel for $15 billion” highlights the access to American infrastructure projects gained. Satellite data shows a recent decline in overall plant activity across Japan, but no direct link can be conclusively established between this decline and the news of the acquisition.

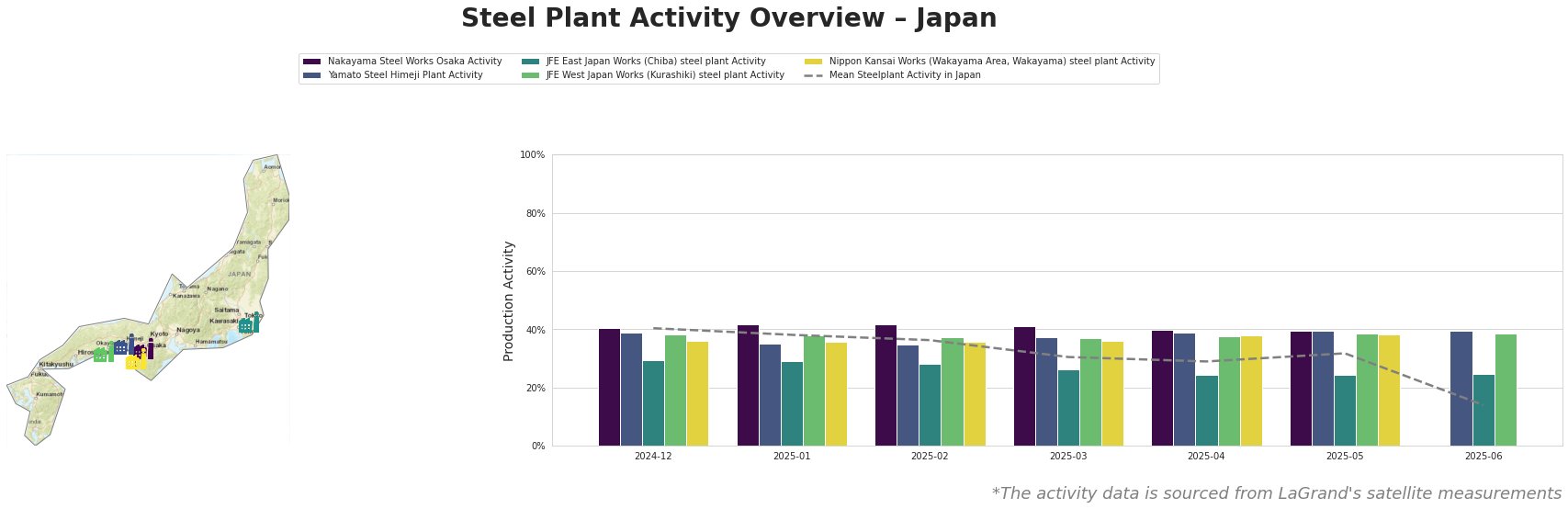

Here’s a breakdown of recent plant activity:

The mean steel plant activity in Japan has decreased significantly from 40% in December 2024 to 14% in June 2025. Nakayama Steel Works Osaka activity remained relatively stable around 41% until April 2025, then shows a slight decline. Yamato Steel Himeji Plant shows a peak of 39% in April and May 2025. JFE East Japan Works (Chiba) steel plant activity shows a continuous decline, reaching a low of 24% in April and May 2025. JFE West Japan Works (Kurashiki) steel plant shows a stable trend with activity around 38-39%. Nippon Kansai Works (Wakayama Area, Wakayama) steel plant activity also exhibits a stable trend around 36-38%.

Nakayama Steel Works Osaka: This Kansai-based plant operates solely with EAF technology and has a crude steel capacity of 660 ttpa. Activity held relatively constant at approximately 41% until recently, outperforming the national average. There is no immediately obvious link to the Nippon Steel/US Steel acquisition news.

Yamato Steel Himeji Plant: This plant in Kansai focuses on semi-finished and finished rolled products, including H-beams and channels, and utilizes EAF technology with a 1495 ttpa capacity. Activity has remained steady around 39% recently. No direct connection between plant activity and recent news can be established.

JFE East Japan Works (Chiba) steel plant: Located in the Kantō region, this integrated BF-BOF plant has a crude steel capacity of 4500 ttpa. The activity has shown a steady decline to a low of 24% in April-May 2025. There is no immediately obvious link to the Nippon Steel/US Steel acquisition news.

JFE West Japan Works (Kurashiki) steel plant: This integrated BF-BOF plant in the Chūgoku region boasts a large 10000 ttpa crude steel capacity. Its activity has held steady at around 38-39%. There is no immediately obvious link to the Nippon Steel/US Steel acquisition news.

Nippon Kansai Works (Wakayama Area, Wakayama) steel plant: Located in Kansai, this plant uses both BF-BOF and EAF processes, with a crude steel capacity of 5490 ttpa. The activity has held relatively constant at approximately 36-38%. There is no immediately obvious link to the Nippon Steel/US Steel acquisition news.

The news highlights future investment into US Steel, as per “Trump approves $14.9 billion takeover of US Steel by Japan’s Nippon Steel” which mentions “$11 billion in investments by 2028”.

Evaluated Market Implications:

The observed drop in mean steel plant activity, particularly at JFE East Japan Works (Chiba) combined with the planned investment into US Steel creates a complex situation for steel buyers. While Nippon Steel is expanding its global reach, domestic production appears to be reducing.

* Potential Supply Disruption: The significant drop in activity at JFE East Japan Works (Chiba) could indicate a potential near-term decrease in the availability of sheets and plates, particularly for the automotive and steel packaging sectors.

* Recommended Procurement Action: Given the positive outlook driven by the US Steel acquisition, but also the recent mean activity drop, steel buyers should consider securing medium-term contracts (6-12 months) to lock in current prices and mitigate potential supply shortages, especially for products sourced from JFE East Japan Works (Chiba). Buyers should also proactively diversify their supplier base to reduce dependence on single sources. Due to the acquisition, analysts should monitor financial reports from Nippon Steel, as mentioned in “Trump approves $14.9 billion takeover of US Steel by Japan’s Nippon Steel,” which highlights shareholder concerns around financing the deal and potential share dilution, which could impact investment and therefore long term production levels in Japan.