From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Steel Market Shows Mixed Signals: Plate Prices Wavering, Rebar Declines, Plant Activity Fluctuates Amid CBAM Uncertainty

Italy’s steel market presents a complex picture as Q3 2025 concludes. Price volatility, particularly in the plate and rebar sectors, contrasts with generally stable longs markets. These dynamics occur against the backdrop of CBAM implementation and sluggish post-holiday demand. The shifts described in “Italy steel heavy plate prices narrow upward ibn new deals; CBAM costs built into import offers“, “Thick-sheet steel prices in Italy are declining due to new deals; CBAM costs are embedded in import proposals“, and “Italian plate hikes fail amid sluggish post-holiday restart” may correlate with the activity at regional steel plants, though direct, immediate links are difficult to establish definitively. “European longs market mostly stable, Italian rebar prices decline” confirms weakening rebar pricing.

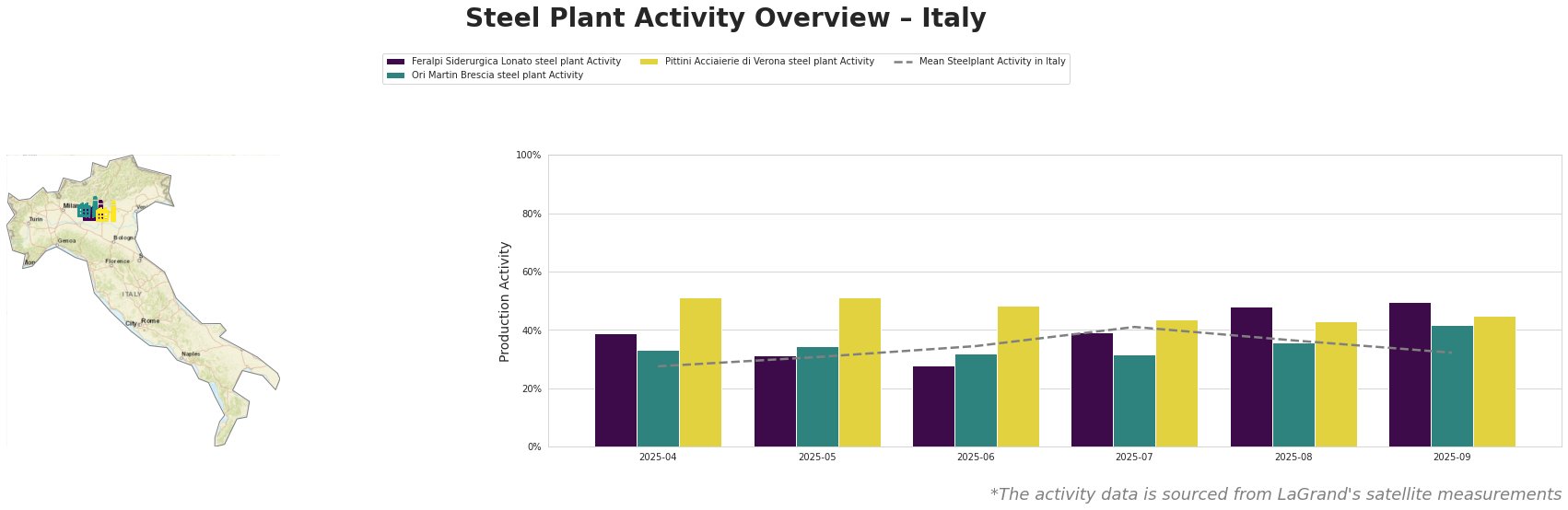

The mean steel plant activity in Italy shows a general upward trend from April (28%) to July (41%), followed by a decrease to 32% in September. Feralpi Siderurgica Lonato saw a significant increase in activity from 28% in June to 50% in September. Ori Martin Brescia experienced a relatively stable activity level, fluctuating between 32% and 42%. Pittini Acciaierie di Verona maintained the highest activity levels overall, but experienced a decline from 51% in April/May to 45% in September. It is important to note that the satellite data does not give insight into potential reasons for increased or decreased steel plant activities, and that direct connections between articles and observations are not possible.

Feralpi Siderurgica Lonato, located in the Province of Brescia, operates a 1.1 million tonne per year EAF-based steel plant, producing rebar, billets, mesh, and wire rod. Its activity has risen significantly over the last few months. From June to September, the plant increased production from 28% to 50%. This increase in activity may be related to the stable longs market mentioned in “European longs market mostly stable, Italian rebar prices decline“, as rebar is one of the plant’s primary products.

Ori Martin Brescia, also located in the Province of Brescia, has a 650,000 tonne per year EAF capacity, specializing in billet, rolled products, wire, and wire rod for the automotive, building & infrastructure, energy, and tooling sectors. The observed plant activity has been consistently below the national average and stable for several months, going from 33% in April to 42% in September. No direct connection between this stable trend and specific news articles can be established.

Pittini Acciaierie di Verona, an EAF-based steel plant with a 1.25 million tonne per year capacity located in the Province of Verona, produces wire rod, mesh, rebar, and jumbo coils. The plant has experienced the highest relative activity level compared to the other two plants in the observed time frame, though this activity level decreased in recent months. A drop from 51% in April and May, to 45% in September. No direct connection between this decline and specific news articles can be established.

The fluctuating plate prices, as highlighted in “Italy steel heavy plate prices narrow upward ibn new deals; CBAM costs built into import offers“, “Thick-sheet steel prices in Italy are declining due to new deals; CBAM costs are embedded in import proposals“, and “Italian plate hikes fail amid sluggish post-holiday restart“, combined with the rebar price declines reported in “European longs market mostly stable, Italian rebar prices decline” signal a potential oversupply situation, or at least weakening demand. While Feralpi Siderurgica Lonato’s increased activity could contribute to rebar oversupply, the lack of clear price recovery in plate markets, despite producers’ attempts, and the potential CBAM influence, require a cautious approach.

Recommendations:

-

Steel buyers focused on rebar: Given the declining rebar prices reported in “European longs market mostly stable, Italian rebar prices decline“, consider negotiating short-term contracts to capitalize on the current price weakness. Closely monitor activity at rebar producers like Feralpi Siderurgica Lonato to anticipate potential shifts in supply.

-

Steel buyers focused on heavy plate: Delay long-term commitments until CBAM details are clearer, as suggested in “Italy steel heavy plate prices narrow upward ibn new deals; CBAM costs built into import offers” and “Thick-sheet steel prices in Italy are declining due to new deals; CBAM costs are embedded in import proposals“. The market is sensitive to import pricing and CBAM cost absorption.

-

Market analysts: Closely monitor import volumes and pricing from Asia, specifically considering CBAM costs, to assess their impact on domestic Italian plate prices, as discussed in “Italy steel heavy plate prices narrow upward ibn new deals; CBAM costs built into import offers“. Further analysis of plant-level activity shifts is needed to draw definitive conclusions about their relationship to overall market dynamics.