From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Steel Market Poised for Growth: New Piombino Mill to Boost Supply Amidst Rising Plant Activity

Italy’s steel market shows positive momentum, fueled by the Metinvest-Danieli joint venture and increasing activity across key steel plants. The announcement of the new mill, as detailed in “Metinvest, Danieli complete €3bn flats mill JV closing,” “Metinvest and Danieli are completing the closure of a joint venture for the production of rolled products worth €3 billion,” and “Metinvest and Danieli complete establishment of Metinvest Adria JV,” signals a significant capacity increase. This coincides with observed increases in production activity, although a direct causal relationship between the JV announcements and immediate activity levels at existing plants cannot be explicitly established.

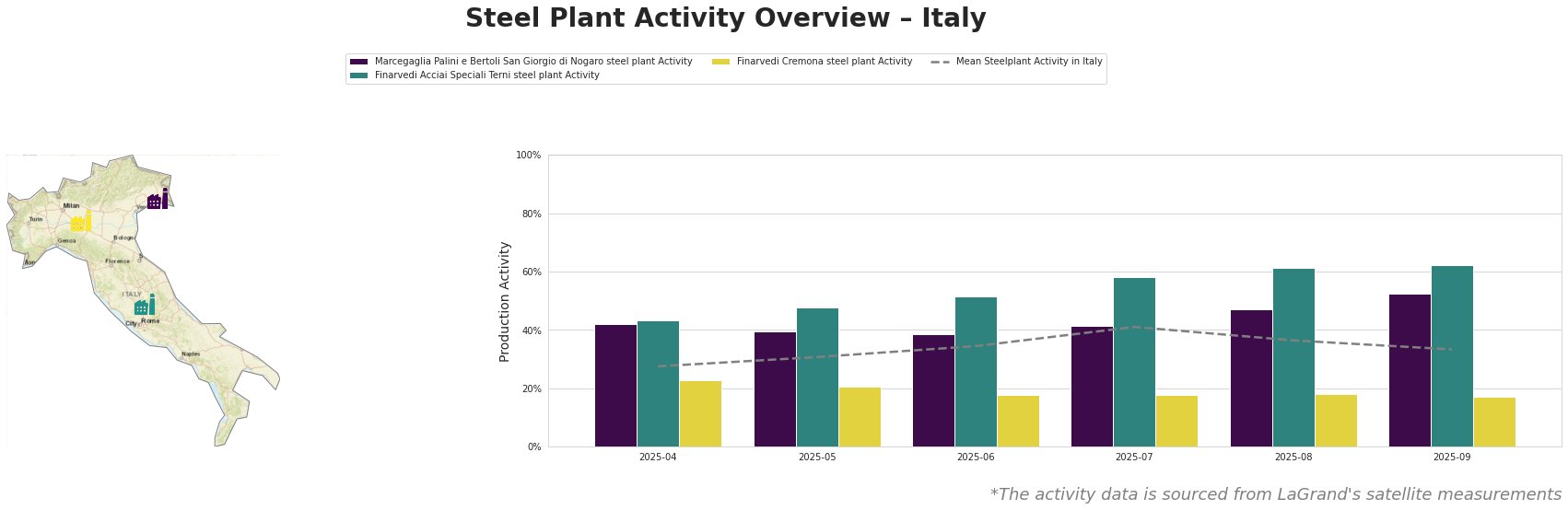

The mean steel plant activity in Italy has generally increased from 28% in April to 33% in September, with a peak of 41% in July, indicating a growing trend.

Marcegaglia Palini e Bertoli San Giorgio di Nogaro steel plant, an EAF-based plant producing 600ktpa of hot-rolled plate for various sectors, including building, energy, and transport, shows fluctuating activity. Starting at 42% in April, activity dipped to 39% in June before rising to 53% in September. This increase does not have a directly attributable link to the news regarding the Metinvest-Danieli JV.

Finarvedi Acciai Speciali Terni steel plant, with a capacity of 1450ktpa and employing EAF technology to produce both semi-finished and finished rolled products, including stainless steels, exhibited the most significant growth in activity. Activity consistently increased from 43% in April to 62% in September, significantly outpacing the national average. While the expansion of the new mill described in “Metinvest, Danieli complete €3bn flats mill JV closing” is a positive sign for the steel industry in Italy, no direct correlation to the production trends at this plant can be established from the provided information.

Finarvedi Cremona steel plant, producing 3850ktpa of semi-finished and finished rolled products using EAF technology, has maintained a consistently low activity level, ranging from 17% to 23% during the observed period. This stable but low production rate currently has no clear connection to the news about the Metinvest-Danieli JV.

The Metinvest-Danieli joint venture, according to “Metinvest and Danieli complete establishment of Metinvest Adria JV,” is expected to produce 2.7 million tons of low-carbon hot-rolled steel annually. This will significantly increase the supply of flat steel in Italy, potentially impacting pricing dynamics.

Evaluated Market Implications:

The upcoming production from the Metinvest-Danieli JV should increase overall steel supply in Italy. The Finarvedi Acciai Speciali Terni steel plant’s activity is also greatly increasing.

Recommended Procurement Actions:

* Steel Buyers: Closely monitor the pricing of hot-rolled steel as the Metinvest-Danieli mill comes online. Diversify your supply base to leverage the increased availability of low-carbon steel options.

* Market Analysts: Track the ramp-up of production at the Metinvest-Danieli plant in Piombino to assess its impact on existing producers, especially those focused on flat steel products. Pay close attention to activity at Finarvedi Acciai Speciali Terni steel plant.