From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIran Steel Market Faces Uncertainty Amidst Rising Geopolitical Tensions: Production Hit

Iran’s steel market is facing increased uncertainty due to escalating regional tensions and potential supply disruptions. Recent U.S. strikes on Iranian nuclear facilities, as reported in “Iran vows payback after US strike on nuclear facilities” and “Trump again brings up regime change in Iran“, have heightened concerns about potential retaliation and disruptions to vital shipping routes. While no direct link can be established between these news articles and observed plant activity data, the overall market sentiment is negative.

The threat of closure of the Strait of Hormuz, highlighted in “Potential closure of Hormuz strait by Iran to trigger higher oil prices, inflation and shipping route disruptions” and “Iran raises Hormuz closure threat after US strikes“, could severely impact global oil supplies and drive up inflation, potentially affecting steel production costs and demand. However, the satellite data has not been able to establish a direct relationship to plant activity.

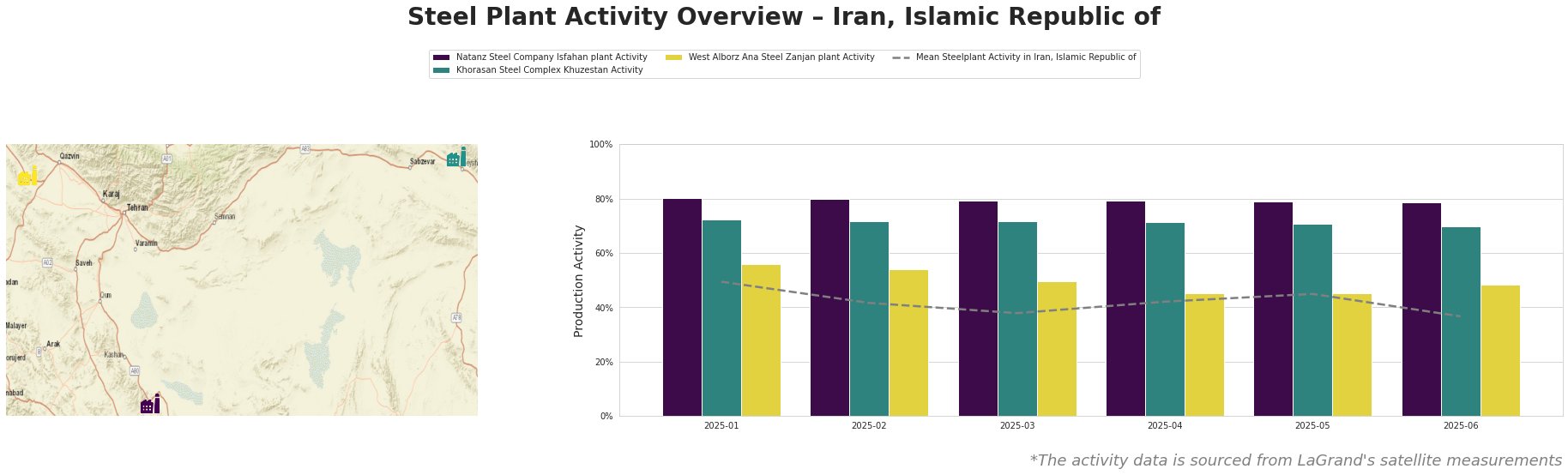

The mean steel plant activity in Iran, Islamic Republic of decreased significantly from 49% in January 2025 to 37% in June 2025.

Natanz Steel Company Isfahan plant, a DRI-based integrated steel plant with a 1 million tonne EAF-based crude steel capacity and 1.5 million tonne DRI capacity, primarily produces bars and rebar. The plant’s activity remained relatively stable at around 80% throughout the observed period, showing slight declines. The activity is significantly above the country’s mean, and no direct connection between its operational levels and current political tensions can be established based on the provided news articles.

Khorasan Steel Complex Khuzestan, with a 1.5 million tonne EAF-based crude steel capacity and 1.8 million tonne DRI capacity, produces rebar, billets, DRI, and HBI. The plant’s activity shows a slight decline from 72% in January to 70% in June. Its activity is above the country’s mean. No direct link can be established between these fluctuations and the provided news articles about geopolitical tensions.

West Alborz Ana Steel Zanjan plant, an integrated DRI-based steel plant with a 1.5 million tonne EAF-based crude steel capacity and 1.2 million tonne DRI capacity, mainly produces billets. The plant shows fluctuations, dropping to 45% in April and May before increasing to 48% in June, below the country’s mean. No direct correlation between these activity changes and the provided news articles can be established.

The combination of geopolitical instability and potential supply chain disruptions presents a challenging environment for steel buyers. Given the threat to the Strait of Hormuz, steel buyers should consider increasing their inventory levels of steel products, specifically rebar and billets, produced by Natanz Steel Company Isfahan plant and Khorasan Steel Complex Khuzestan, if possible. Since the satellite observations show these plants have been relatively stable, building up stock would shield them from immediate market shocks, if supply chains are impacted. It is further recommended to closely monitor geopolitical developments and assess the potential impact on shipping costs and lead times, as these could significantly affect the overall cost of steel procurement. Given the negative outlook and potential for increased volatility, hedging strategies may also be considered to mitigate price risks.