From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia’s Steel Market: Momentum Grows Amid Trade Shifts

Recent developments in India’s steel industry reflect a very positive sentiment, largely catalyzed by significant trade agreements such as As India, UK Clinch Landmark Trade Deal. This agreement is projected to bolster trade dynamics across multiple sectors, enhancing market access for Indian manufacturers and encouraging increased industrial activity.

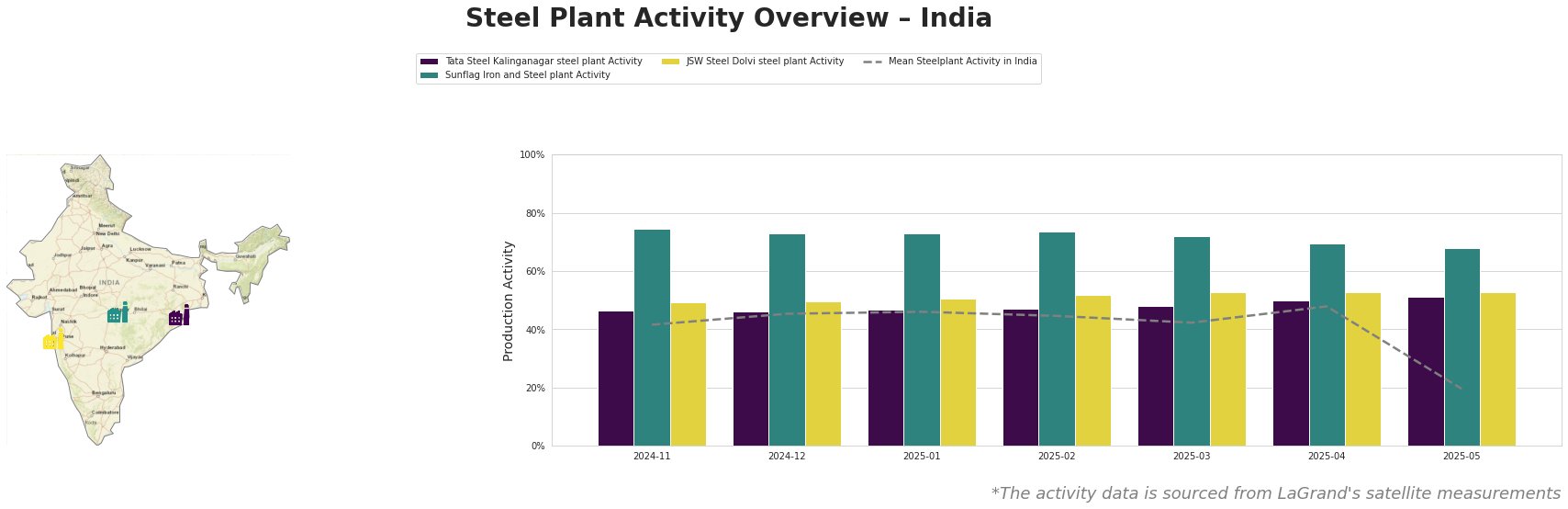

The finalized India-UK FTA cuts tariffs on Indian auto imports promises to substantially reduce trade barriers, directly impacting demand for automotive steel products. This shift correlates with satellite-observed increases in activity at key steel plants, particularly Tata Steel Kalinganagar, Sunflag Iron and Steel, and JSW Steel Dolvi, where activity levels reflect a trend of sustained or heightened production.

Activity at Tata Steel Kalinganagar showcases a modest climb, reaching 51.0% in May, up from 46.0% in November, signaling robust operational capacity amidst favorable trade conditions. This lines up with the India-UK Trade Deal Shows Globalisation Is Ticking Along, emphasizing an improved ability to cater to automotive sector demands.

The Sunflag Iron and Steel plant maintained a high operational efficiency, peaking at 75.0% in November and displaying resilience with 68.0% in May, supporting its strategic role in fulfilling both automotive and machinery sectors’ requirements despite fluctuating mean plant activity. The ongoing agreements spur demand that could enhance output at this facility.

Conversely, the JSW Steel Dolvi plant shows a stable activity level, reaching 53.0% by May, remaining consistent within a healthy range. Continued support for refining and infrastructure projects—bolstered by India-UK FTA cuts tariffs on Indian auto imports—positions this plant advantageously within the competitive landscape.

Evaluated Market Implications:

– Potential Supply Disruptions: The notable decrease in mean steel plant activity to 20.0% in May suggests critical sniff points for future supply reliability, potentially through insufficient inventory levels if operational adjustments aren’t aligned with increasing demand from trade agreements.

– Recommended Procurement Actions:

– Steel buyers should prioritize sourcing from Tata Steel Kalinganagar to leverage increasing production capabilities linked to renewed automotive growth opportunities informed by trade dynamics. The plant’s ability to ramp up production towards automotive needs is vital.

– Engage with Sunflag Iron and Steel for a steady supply of specialized steel products, particularly in light of the consistent operational output, which is crucial for various end-user sectors.

– Maintain strategic stock levels at JSW Steel Dolvi to hedge against any potential volatility arising from mean activity declines, ensuring the longevity of supply and reducing the risk of shortages.

This landscape positions steel procurement strategies to capitalize on the expansive trade opportunities while navigating shifts in production capabilities.