From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia’s Electrical Steel Surge: JSW/JFE Investment Drives Bullish Market, While Chinese Output Dips

Asia’s steel market displays a very positive outlook, particularly in India, driven by significant investments in electrical steel production. This is highlighted by news articles such as “JSW and JFE invest $669 million to expand electrical steel production in India” and “India’s JSW Steel and JFE of Japan commit additional $669 million investments to ramp up CRGO production capacities“, which detail capacity expansions set to impact the market by fiscal year 2028. In contrast, satellite data reveals fluctuations in activity levels at other major Asian steel plants, for which no direct connection to the provided news could be explicitly established.

The JSW/JFE investment in India directly relates to the country’s green transformation initiatives, as reported in the article “JSW and JFE to invest $669 million in expanding electrical steel production in India“, and will increase capacity for cold-rolled grain-oriented (CRGO) steel, crucial for energy-efficient transformers. This expansion, also mentioned in “Regarding the Expansion of Electrical Steel Manufacturing Capacity in India,” is intended to reduce reliance on imports and strengthen domestic manufacturing. However, the impact of these new capacities is still several years away.

Steel Plant Activity Analysis:

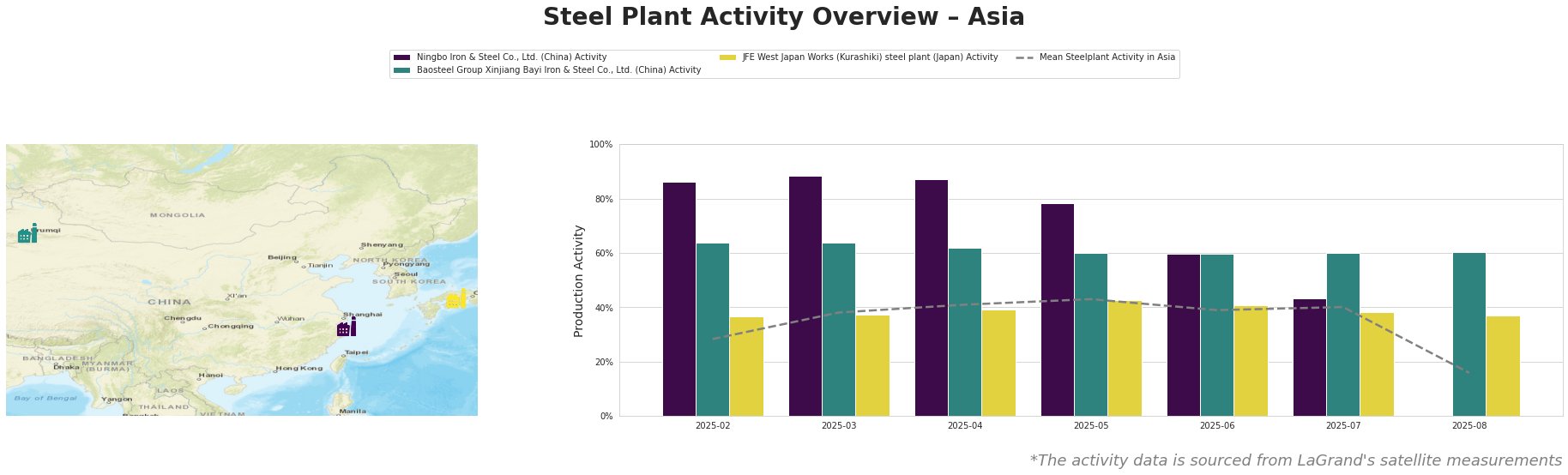

- Ningbo Iron & Steel Co., Ltd. (China): Starting at a high activity level of 86% in February, Ningbo experienced a consistent decline, reaching 43% by July. The most significant drop occurred between June (60%) and July (43%). August activity data is unavailable. No direct connection to the provided news articles could be explicitly established.

- Baosteel Group Xinjiang Bayi Iron & Steel Co., Ltd. (China): This plant showed a stable activity level, hovering around 60-64% throughout the observed period. No significant fluctuations were detected. No direct connection to the provided news articles could be explicitly established.

- JFE West Japan Works (Kurashiki) steel plant (Japan): Activity remained relatively stable, fluctuating between 37% and 43%. No significant trends were observed. No direct connection to the provided news articles could be explicitly established.

- Mean Steelplant Activity in Asia: The mean activity shows an initial increase from 28% in February to 43% in May, followed by a decline to 16% in August. This broad trend reflects overall market conditions but does not directly correlate with specific plant activities or news events apart from the overall bullish trend driven by the Indian investments.

Ningbo Iron & Steel Co., Ltd., an integrated BF-BOF steel plant in Zhejiang, China, produces 4 million tonnes of crude steel annually. Its product range includes electrical steel, relevant to the news about capacity expansion in India. The plant’s observed activity decline throughout the period, culminating in a 43% activity level in July, might indicate potential shifts in regional demand or production strategies. However, no explicit link to the provided news articles can be established.

Baosteel Group Xinjiang Bayi Iron & Steel Co., Ltd., located in Xinjiang, China, features a mix of BF, BOF, and EAF production, with a crude steel capacity of 7.3 million tonnes. Its stable activity level around 60% does not show a clear reaction to the electrical steel market developments highlighted in the news, though as a Responsible Steel certified producer, they may see shifts in long term demand. Again, no direct connection to the provided news articles can be explicitly established.

JFE West Japan Works (Kurashiki) steel plant, an integrated BF-BOF steel plant in the Chūgoku region of Japan, boasts a crude steel capacity of 10 million tonnes. Producing a wide range of products including electrical sheets, its stable activity, fluctuating between 37% and 43%, does not indicate an immediate impact from the Indian electrical steel market expansion. No direct connection to the provided news articles could be explicitly established.

Evaluated Market Implications:

The Indian electrical steel capacity expansion, driven by the JSW/JFE investment, will primarily impact the market in fiscal year 2028. While this promises increased domestic supply in India, it does not immediately alleviate current or near-term supply constraints. The observed activity decline at Ningbo Iron & Steel, though not directly linked to the news, could exacerbate regional supply tightness in the short term.

Procurement Recommendations:

- Steel Buyers focused on electrical steel in Asia (excl. India): Monitor the activity levels of plants like Ningbo Iron & Steel closely. The observed decline, combined with the future-dated impact of the Indian capacity expansion, suggests potential near-term price increases and supply challenges.

- Steel Buyers sourcing for the Indian Market: While the JSW/JFE expansion is a positive long-term development, reliance on imports will remain significant until fiscal year 2028. Diversify your supply base and secure long-term contracts to mitigate potential price volatility during the transition. Given JFE’s involvement, consider partnerships with Japanese suppliers.

- Market Analysts: Focus on monitoring the progress of the JSW/JFE projects in India. Track construction milestones and equipment installation to refine predictions about the actual on-stream date and capacity ramp-up. Simultaneously, analyze the competitive landscape and potential responses from other Asian electrical steel producers.