From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndian Steel Imports Dip Amid Domestic Growth, While JFE Activity Declines

In Asia, the steel market shows a complex interplay of import reduction, domestic production growth, and fluctuating plant activity. India’s steel landscape is shifting as evidenced by “India’s stainless steel imports drop over 20 percent in Jan-Oct’25 as Chinese shipments fall sharply“ and “India remains net steel importer despite shipments dropping 15% y-o-y in January-October 2025“. Although domestic production is on the rise and imports are falling, no direct relationship to the satellite-observed changes in activity can be established from the provided news articles.

Measured Activity Overview:

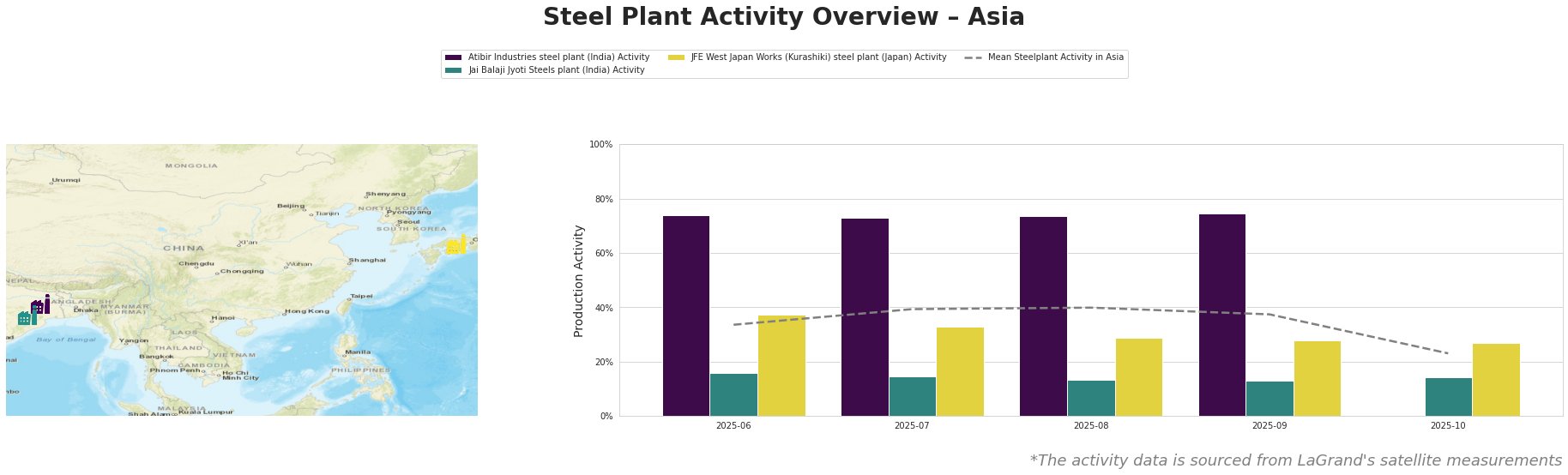

The mean steel plant activity in Asia decreased significantly to 23% in October, after hovering around 34-40% in the preceding months. Atibir Industries in India shows stable activity, ranging from 73% to 75% between June and September, significantly above the Asian average. Jai Balaji Jyoti Steels in India shows low activity, ranging from 13% to 16%. JFE West Japan Works in Japan showed a steady decline from 37% in June to 27% in October.

Atibir Industries, located in Jharkhand, India, operates as an integrated steel plant with a 600 ttpa BOF capacity. Satellite data reveals a consistently high activity level, fluctuating narrowly between 73% and 75% from June to September 2025. Given the backdrop of “India reduced its imports of rolled steel by 34% y/y in April-October“, the stable activity at Atibir could indicate that it is capitalizing on the reduced import competition, although a direct link cannot be definitively established.

Jai Balaji Jyoti Steels, situated in Odisha, India, primarily utilizes DRI and EAF technologies with a 92 ttpa EAF capacity. Activity levels at this plant are substantially lower than the Asian average, fluctuating only slightly between 13% and 16% from June to October. No explicit connection to the news articles can be established, but this may reflect struggles to compete with larger producers.

JFE West Japan Works (Kurashiki), a major integrated steel plant in Japan with a 10,000 ttpa BOF capacity, has shown a declining trend in activity, from 37% in June to 27% in October. This decline could potentially be related to the overall weaker global demand mentioned in “India remains net steel importer despite shipments dropping 15% y-o-y in January-October 2025”, although no direct link can be confirmed with the provided articles.

Evaluated Market Implications:

The observed decline in activity at JFE West Japan Works, coupled with the information about reduced imports from Japan to India in “India remains net steel importer despite shipments dropping 15% y-o-y in January-October 2025”, could indicate potential oversupply in the Japanese market. Steel buyers should monitor JFE’s output and pricing strategies for potential opportunities. Given the stable, high activity levels at Atibir Industries and the overall reduction in Indian steel imports as noted in “India’s stainless steel imports drop over 20 percent in Jan-Oct’25 as Chinese shipments fall sharply”, steel buyers should prioritize domestic sourcing from Indian producers to mitigate supply chain disruptions caused by import regulations and fluctuating global prices.