From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia-US Trade Talks & High Plant Activity: Steel Market Watch, May 2025

India’s steel market is navigating trade negotiations with the US, potentially impacting steel trade flows, as described in “India, US Make Progress On Mutually Beneficial Trade Agreement: Piyush Goyal“. This report analyzes the interplay between these trade discussions and observed steel plant activity.

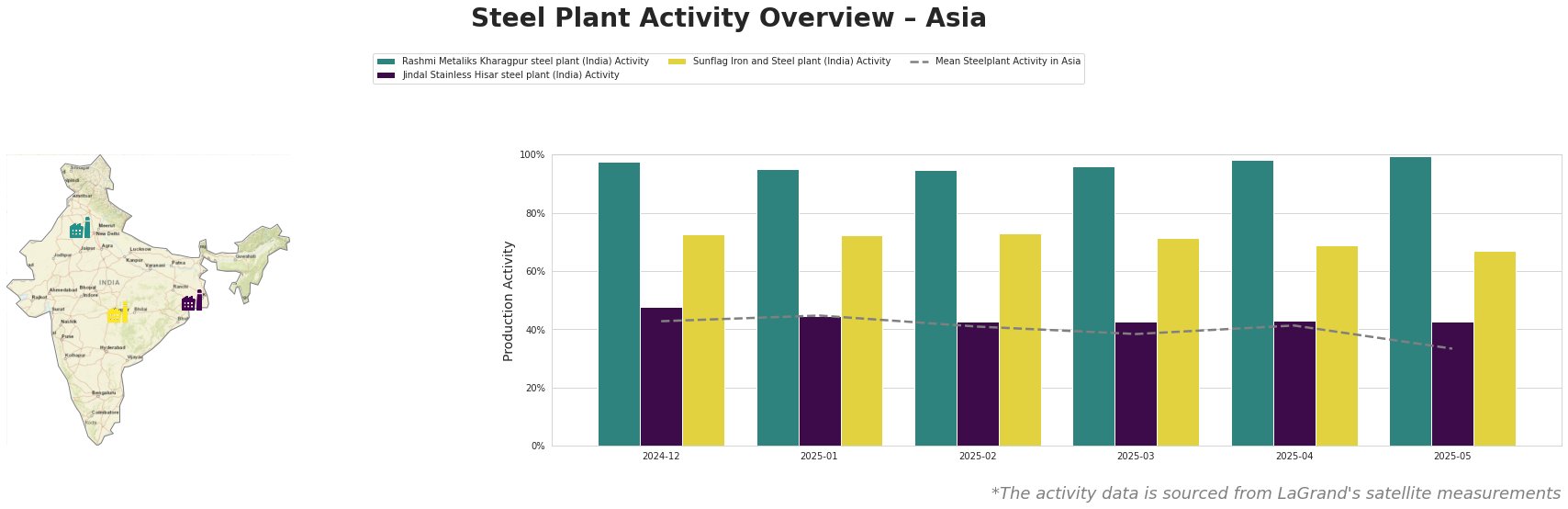

Observed activity data reveals the mean steel plant activity in Asia declined to 33% in May 2025. Rashmi Metaliks Kharagpur maintained very high activity close to 100% throughout the observed period, while the activity levels at Jindal Stainless Hisar remained almost unchanged, consistently below the mean Asian activity. Sunflag Iron and Steel witnessed a gradual decline from 73% in December 2024 to 67% in May 2025.

Rashmi Metaliks Kharagpur steel plant, an integrated BF and DRI based plant in West Bengal with a crude steel capacity of 1.5 million tonnes, has sustained very high activity levels, peaking at 99% in May 2025. No direct link can be established between its activity and the news articles on India-US trade talks.

Jindal Stainless Hisar steel plant, an EAF-based plant in Haryana producing stainless steel with a crude steel capacity of 800,000 tonnes, shows stable activity around 43% throughout the observed period, consistently below the mean activity in Asia. This consistent activity, given its stainless steel focus, might indicate stable demand in its end-user sectors such as automotive and building, even amidst trade negotiations. No direct link can be established between its activity and the news articles on India-US trade talks.

Sunflag Iron and Steel plant, an integrated BF and DRI plant located in Maharashtra with a crude steel capacity of 500,000 tonnes, exhibited a gradual decline in activity from 73% in December 2024 to 67% in May 2025. No direct connection to the news articles can be explicitly established.

The ongoing negotiations between India and the US, as detailed in “India Working On US Reciprocal Tariff Exemption, Interim Deal By July 8” and “India Seeks Full Exemption From 26% Additional Tariffs In Interim Deal With US,” introduce uncertainty in the market.

Evaluated Market Implications:

Given the high and stable activity at Rashmi Metaliks, buyers can be reasonably assured of supply from this source, at least in the short term. However, considering the ongoing trade negotiations, buyers should monitor developments closely.

* Procurement Action: Steel buyers sourcing flat products should diversify their supply base to mitigate potential disruptions linked to tariff changes on Indian steel imports to the US. Actively explore alternative suppliers within Asia or other regions less susceptible to the India-US trade outcomes.

* Procurement Action: Analysts should monitor the July 9th deadline closely. If no agreement is reached and tariffs are reinstated, expect downward pressure on Indian steel prices, creating a potential buying opportunity. Conversely, a favorable deal for India could strengthen prices.

* Supply Disruption Alert: If the U.S. imposes tariffs on Indian steel as described in “India Seeks Full Exemption From 26% Additional Tariffs In Interim Deal With US” a potential disruption in the supply of Indian steel to the U.S. could occur.