From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Sector Surges: Capacity Expansions Drive Positive Outlook – Satellite Data Confirms Activity

Asia’s steel market demonstrates a very positive sentiment, particularly in India, driven by capacity expansions and strategic initiatives. The activity is reflected in the news articles “India’s NINL achieves operational profit in Q4 FY 2024-25” and “Tata Steel increases steelmaking capacity in Kalinganagar to 8 million tons per year“, both of which indicate significant growth in production capabilities. These announcements are reflected in the observed activity at Indian steel plants.

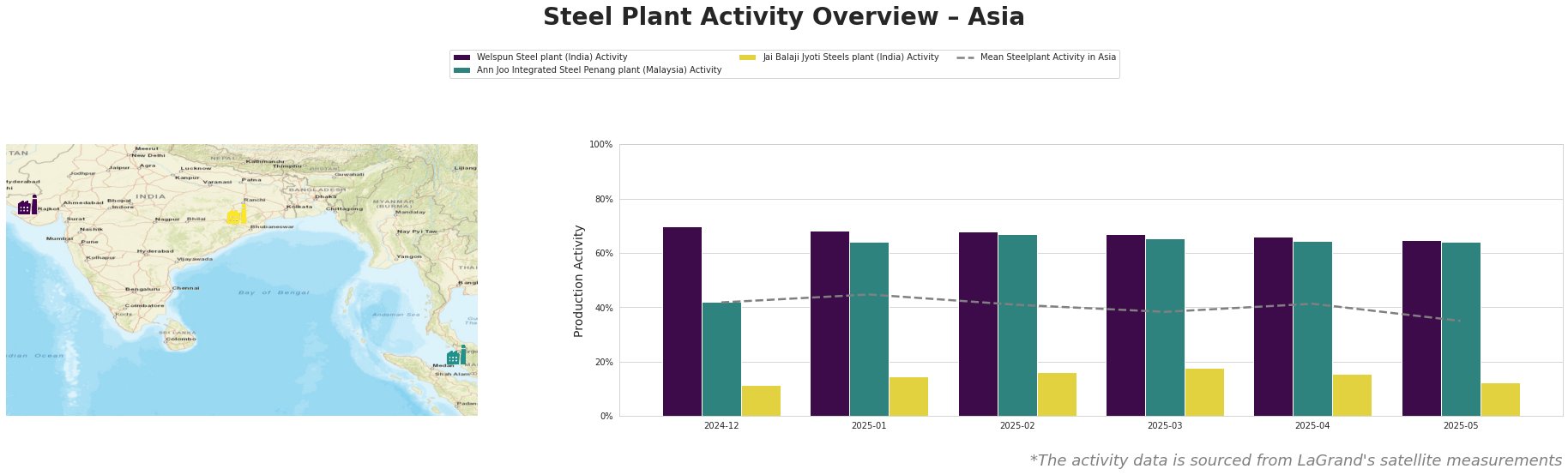

The mean steel plant activity in Asia has fluctuated, experiencing a general decrease from 45% in January 2025 to 35% in May 2025. Welspun Steel plant consistently operates well above the mean. Ann Joo Integrated Steel in Malaysia started low but quickly rose above the Asian mean activity and sustained at this level, while Jai Balaji Jyoti Steels plant showed a steady rise until March, followed by a decline back to initial levels.

Welspun Steel plant in Gujarat, India, primarily produces TMT rebars, ingots, billets, and DRI using integrated (DRI) processes. The plant’s activity level has been consistently high, ranging from 65% to 70% over the observed period, significantly exceeding the Asian mean. While the overall trend is slightly decreasing, it’s still high, indicating robust production. There is no direct connection to be established based on the current news articles.

Ann Joo Integrated Steel Penang plant in Malaysia, an integrated BF-EAF facility, produces pig iron, hot metal, and billets. Its activity shows a marked increase from 42% in December 2024 to around 64% for most of 2025. Although the news articles do not directly relate to this plant, the consistent activity above the Asian mean suggests stable production.

Jai Balaji Jyoti Steels plant in Odisha, India, utilizes integrated (DRI) processes to produce DRI, billets, bars, and wire rods. The plant’s activity started at a low of 11% in December 2024 but increased to 18% by March 2025, before falling back down to 12% in May 2025. There is no direct connection to be established based on the current news articles, but the location of the plant could mean that Tata Steel investments in the region could lead to future increases.

The article “India’s steel ministry planning separate mining vertical within SAIL to boost iron ore output” signals a strategic move to secure iron ore supply. The expansions undertaken by Tata Steel, as highlighted in “Tata Steel increases steelmaking capacity in Kalinganagar to 8 million tons per year” and the operational improvements at NINL per “India’s NINL achieves operational profit in Q4 FY 2024-25“, indicate a strengthening of India’s steel production capabilities. The high activity levels at Welspun align with these expansion efforts.

These developments collectively suggest no immediate threat of supply disruptions. Steel buyers and analysts should focus on India as a promising source, leveraging the increased capacity. The SAIL development should also make iron ore more easily accessible.