From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Market: Output Surges Amidst Safeguard Measures – Plant Activity Analysis

India’s steel market demonstrates a strong positive sentiment driven by rising domestic output and government protectionist policies. According to “India’s Crude Steel Output Rises in May Amid by safeguard,” crude steel production increased by 9.5% year-over-year in May. This rise appears to correlate with observed increases in activity at several steel plants, as detailed below. The article “India may halve steel imports in 2025 due to safeguard measures” highlights the potential impact of these policies, although a direct impact on plant activity is not explicitly observable in the provided data for the immediate past months. Despite this, the trade deficit remains a concern as stated in “India remains a net importer of rolled steel products despite slowdown in supplies“.

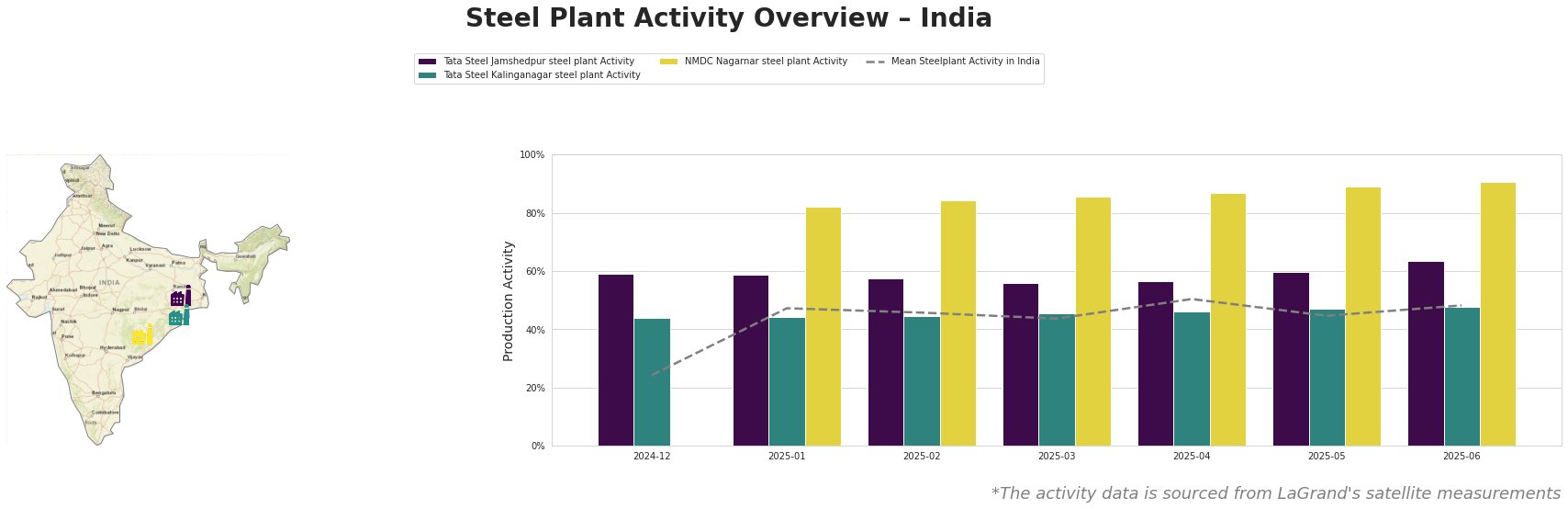

The mean steel plant activity in India shows an overall increasing trend from December 2024 (24.0%) to June 2025 (48.0%), albeit with some monthly fluctuations. Tata Steel Jamshedpur consistently operates above the average, reaching a peak activity level of 63.0% in June 2025. Tata Steel Kalinganagar also shows a steady, if less pronounced, increase in activity, reaching 48.0% in June 2025. NMDC Nagarnar steel plant exhibits significantly higher activity levels compared to the mean, starting at 82.0% in January 2025 and climbing to 91.0% by June 2025.

Tata Steel Jamshedpur, an integrated BF-BOF plant in Jharkhand with a crude steel capacity of 10,000 TTPA, demonstrates consistently high activity. The observed rise to 63% activity in June aligns with the general increase in domestic crude steel output reported in “India’s Crude Steel Output Rises in May Amid by safeguard,” suggesting effective capacity utilization.

Tata Steel Kalinganagar, located in Odisha, is another integrated BF-BOF plant with a 3,000 TTPA crude steel capacity. Its activity has gradually increased, mirroring the broader trend. However, no direct connection to the news articles can be explicitly established.

NMDC Nagarnar steel plant, situated in Chhattisgarh, also has a 3,000 TTPA crude steel capacity, producing finished rolled products like hot-rolled coils. This plant consistently shows the highest activity levels among those monitored, peaking at 91% in June 2025. This strong activity could be related to the increased domestic production mentioned in “India’s Crude Steel Output Rises in May Amid by safeguard,” potentially driven by demand from end-user sectors like automotive and infrastructure.

The safeguard duties, as mentioned in “India may halve steel imports in 2025 due to safeguard measures,” are seemingly stimulating domestic production, as evidenced by the plant activity data. However, as noted in “India remains a net importer of rolled steel products despite slowdown in supplies” the impact of these duties is still playing out, as India is still a net importer.

Evaluated Market Implications:

The increasing activity at NMDC Nagarnar steel plant, combined with the government’s safeguard measures, suggests a potential shift in the supply dynamics for hot-rolled coils, sheets, and plates, particularly for the automotive, building, and energy sectors.

Recommended Procurement Actions:

- Steel Buyers: Given the potential reduction in imports due to safeguard duties and increased domestic production, buyers should proactively secure contracts with domestic suppliers, especially for hot-rolled coils, sheets, and plates produced by plants like NMDC Nagarnar. Consider diversifying the supply base to mitigate risks associated with over-reliance on imports, despite the overall trade deficit.

- Market Analysts: Closely monitor the Directorate General of Trade Remedies (DGTR) investigation regarding safeguard duties. Any decision to increase the duty beyond 12% could further impact import volumes and domestic prices, requiring adjustments to forecasting models. Furthermore monitor the product portfolios of plants like NMDC Nagarnar.