From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Market: FTA Talks Drive Optimism Amid Stable Plant Activity

India’s steel sector shows a positive outlook driven by ongoing FTA negotiations, despite largely stable steel plant activity levels. The potential impact of trade agreements discussed in “India, Canada Discuss Ways To Promote Bilateral Trade, Investments,” “‘Winning Partnership’: Piyush Goyal Lauds New Zealand Trade Minister Amid India-NZ FTA Talks,” and “Goyal Leads 60-Member India Inc Delegation To Israel For Big FTA, Trade Push” is anticipated to further boost the sector. A direct relationship between these trade talks and observed changes in steel plant activity could not be established.

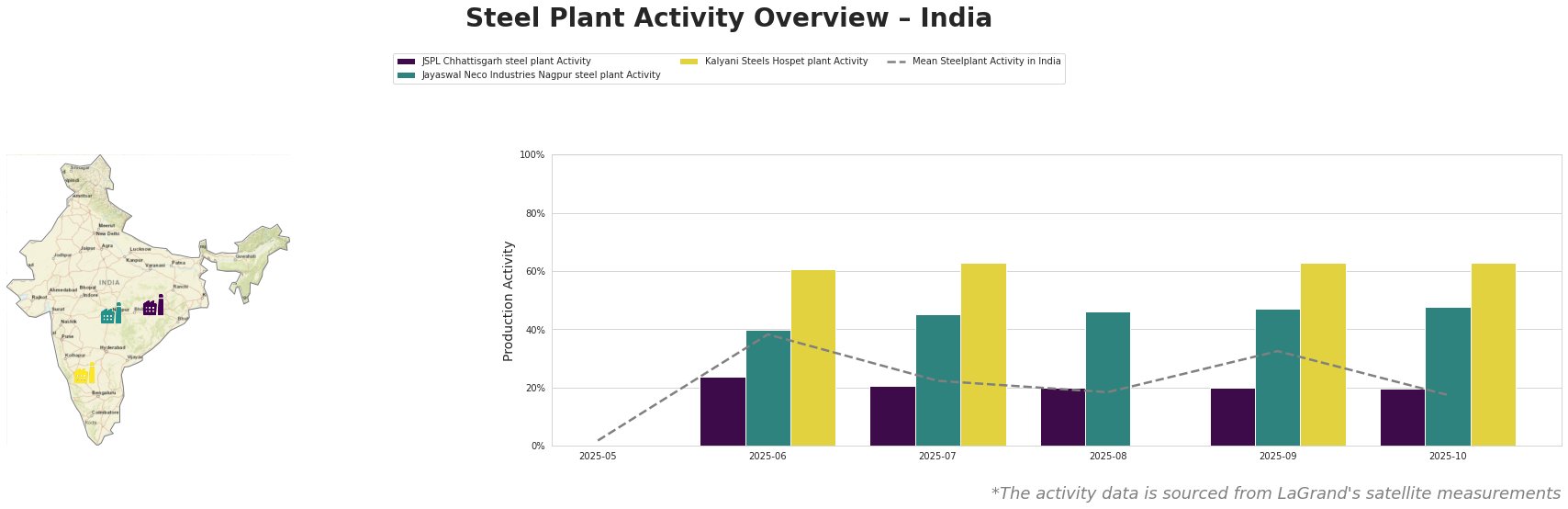

The mean steel plant activity in India fluctuated significantly, peaking at 38% in June 2025 and then dropping to 17% by October 2025. JSPL Chhattisgarh steel plant activity remained relatively stable at around 20-24% from June to October. Jayaswal Neco Industries Nagpur steel plant showed a gradual increase in activity, reaching 48% in October. Kalyani Steels Hospet plant maintained the highest activity levels, consistently around 61-63% from June to October, though no data is available for August.

JSPL’s Chhattisgarh plant, with a 3.6 million tonne EAF-based capacity and integrated BF and DRI processes, maintained a steady activity level around 20-24%. As one of the main producers of rails and beams for building and infrastructure, no direct correlation can be established between its stable activity levels and the aforementioned news articles on trade negotiations.

Jayaswal Neco Industries’ Nagpur plant, featuring a 1 million tonne capacity using both BF and DRI alongside BOF technology, showed a slight increase in activity to 48% by October. Given its product focus on pipes and specialty flats, it is plausible the increased activity may reflect anticipations of trade expansion, but no direct link can be established with the news on FTA talks.

Kalyani Steels’ Hospet plant, a 0.86 million tonne facility utilizing BF, DRI, EAF, and BOF processes, consistently operated at high activity levels around 61-63%. The plant focuses on rolled and machined bars for the automotive and engineering sectors, but no clear correlation can be established with the recent trade-related news.

Evaluated Market Implications:

Given the ongoing FTA negotiations reported in “Goyal Leads 60-Member India Inc Delegation To Israel For Big FTA, Trade Push” and the consistently high activity at Kalyani Steels, steel buyers focusing on automotive-grade steel bars should proactively engage with Kalyani Steels for potential volume discounts and secure future supply. The ‘Winning Partnership’: Piyush Goyal Lauds New Zealand Trade Minister Amid India-NZ FTA Talks” could also lead to automotive import adjustments and thus shifts in demand for automotive steel.

Despite the positive outlook from FTA negotiations, the fluctuating mean steel plant activity indicates a need for steel buyers to closely monitor overall market stability and plant-specific operations to mitigate potential supply chain disruptions.