From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Expansion & Modernization Drive Asia’s Positive Outlook

Asia’s steel market sentiment is very positive, driven by significant investments in modernization and capacity expansion in India. The upgrades are exemplified by “JSP Taps Primetals Technologies to Upgrade Plate Mill,” “JSP commissions Primetals Technologies,” and “India’s JSL commissions Primetals to modernize plate mill,” all highlighting efforts to enhance production stability and reduce downtime at Jindal Steel plants in Angul. While these specific modernization efforts at JSP plants cannot be directly correlated with satellite-observed activity levels, POSCO and JSW’s potential collaboration, detailed in “POSCO Group, JSW Steel Partner to Assess Indian Integrated Steel Plant“, signals a major capacity boost which points to further market strengthening.

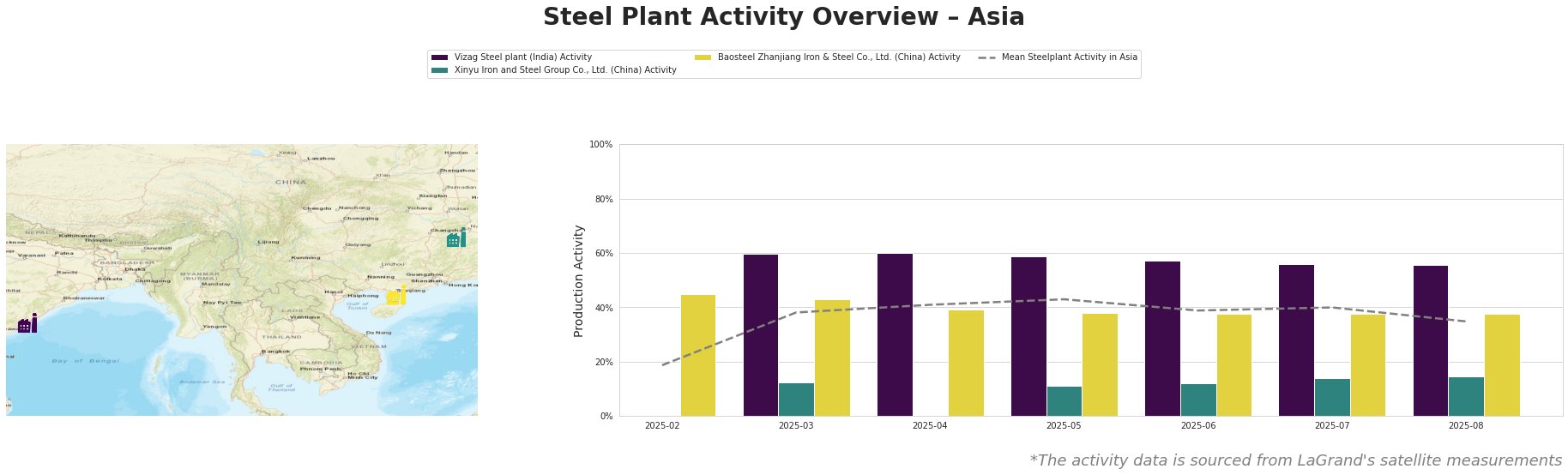

Measured activity levels across the monitored Asian steel plants, expressed as a percentage of all-time high activity, are shown below:

The data indicates Vizag Steel Plant in India consistently operates above the mean activity level, with activity remaining stable between 60% and 56% from March to August 2025. Xinyu Iron and Steel Group in China shows relatively low activity, fluctuating between 11% and 15% during March-August 2025. Baosteel Zhanjiang Iron & Steel in China has demonstrated stable activity at around 38%-45%. The mean activity across all observed plants in Asia peaked in May 2025 (43%) but declined to 35% by August 2025.

Vizag Steel plant, located in Andhra Pradesh, India, is an integrated steel plant with a 7.3 million tonne crude steel capacity, utilizing BF/BOF technology to produce primarily semi-finished and finished rolled products for the building and infrastructure sectors. Its activity remained relatively stable between March and August 2025 (60% to 56%). No direct connection can be established between Vizag’s activity and the provided news articles, as they primarily focus on modernization efforts at Jindal Steel, not Vizag.

Xinyu Iron and Steel Group Co., Ltd., situated in Jiangxi, China, operates as an integrated BF/BOF steel plant with a 10 million tonne crude steel capacity. The plant produces finished rolled products, including plates, for the energy, building, infrastructure, and transport sectors. The plant’s satellite-observed activity is substantially below the average, with observed activity between March and August 2025 staying between 11% and 15%. No direct connection can be established between Xinyu’s low activity and the provided news articles, suggesting factors beyond those mentioned may be influencing production.

Baosteel Zhanjiang Iron & Steel Co., Ltd., based in Guangdong, China, is an integrated BF/BOF steel plant with a 12.5 million tonne crude steel capacity. Its products include hot-rolled plates, cold-rolled sheets, and galvanized plates. The plant’s activity has remained relatively stable around 38% during the period of May-August, with a short peak of 45% in February and 43% in March. No direct connection can be established between Baosteel Zhanjiang’s activity and the provided news articles.

The news concerning Jindal Steel’s upgrades, combined with the potential JSW-POSCO joint venture, signal increased future capacity and efficiency in the Indian steel market, supporting the very positive sentiment.

Evaluated Market Implications:

While near-term supply from Jindal Steel is unlikely to be disrupted due to the nature of the automation upgrades, steel buyers should anticipate potential fluctuations in plate availability from JSP’s Angul plant during the first quarter of 2026 as the new system is implemented. Given this, buyers reliant on JSP for plate products should secure alternative supply agreements in advance or plan for potential delays. Furthermore, the potential establishment of a new 6 million tonne integrated steel plant by POSCO and JSW in Odisha could significantly alter the regional supply dynamics in the medium to long term, providing opportunities for diversified sourcing. Steel market analysts should closely monitor the progress of the feasibility study and subsequent investment decisions, particularly concerning the proposed plant’s product mix and target markets, as this will inform future price expectations and trade flows in the region.