From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIncreased Production Activity at Minyuan Iron and Steel Signals Demand Resurgence

Minyuan Iron and Steel Group Co., Ltd., based in Henan, China, boasts an annual production capacity of 3,000 metric tons of crude steel. As a key player owned by Minyuan Group, it specializes in finished rolled products like rebar and high-speed wire coils, catering to vital sectors such as building, infrastructure, and transport.

Activity Trend Analysis

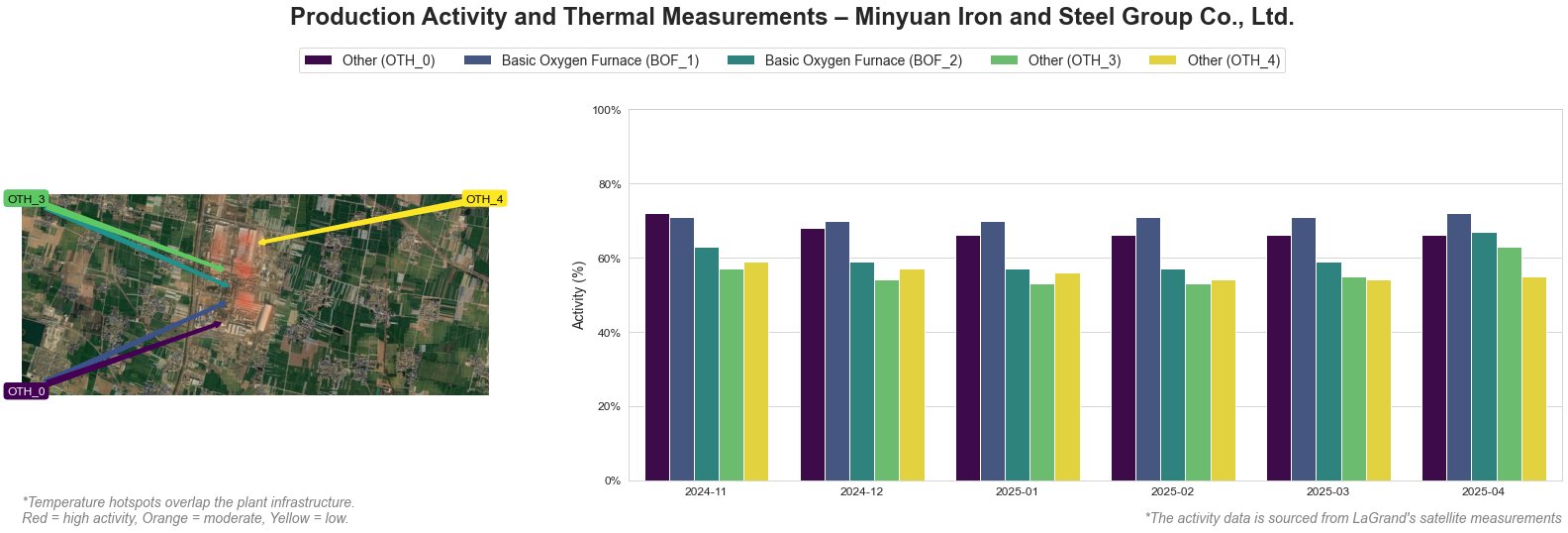

Recent satellite data indicates a +6.56 change in overall activity, reflecting a notable shift in operational levels over recent months. The increase mainly concerns the Basic Oxygen Furnaces (BOF), suggesting a strategic ramp-up in production to meet rising market demand.

Monthly Thermal Activity

Throughout the observed period, there was a steady improvement in BOF_1 and BOF_2 activities, indicating a proactive response to the growing output demands highlighted in China increases steel production to 10-month high in March. The operational uptick aligns with a broader industry narrative where external demand has stabilized amid rising emissions, as noted in Chinese metallurgy increases emissions, but improves environmental performance.

Market Implications

The observed trends illustrate a significant recovery path for Minyuan Iron and Steel, which could relieve supply pressures in the steel market. With global iron ore prices nearing a psychological barrier of $99/t, steel buyers should prepare for potential price fluctuations as higher production can alleviate some supply bottlenecks. However, operational risks remain tied to external factors, including the implications of Emissions in China’s steel industry increased by 9.7% y/y in March, which may affect future compliance costs and operational strategies.

As market dynamics evolve, constant monitoring of BOF activities and external policy impacts will be critical for buyers and analysts aiming to navigate the cyclical nature of the steel industry.