From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGreen Steel Investments Signal Strong European Rebar Market: Feralpi Expansion & Sustained Plant Activity

Europe’s steel market exhibits strong positive sentiment driven by investments in green steel technology and consistent production activity, particularly in the rebar sector. This is supported by the news of “Feralpi foresees Germany recovery, launches FERGreen brand“ and “Feralpi Stahl launches new steel rolling mill in Riesa for €220 million“. These developments coincide with observed high activity levels at several European steel plants, although a direct relationship between these specific investments and satellite-observed activity at all plants cannot be explicitly established.

Feralpi Group’s strategic initiatives, including the launch of the FERGreen brand and the inauguration of a new rolling mill focused on emissions reduction, as detailed in “Feralpi Stahl launches new steel rolling mill in Riesa for €220 million”, are indicative of a broader trend towards sustainable steel production within Europe. The reports “Germany’s Feralpi Stahl inaugurates new spooler rolling mill in Riesa“ and “Feralpi Germany starts up new rolling mill“ also corroborate this shift towards greener steelmaking processes. While these articles discuss investments aimed at reducing emissions and enhancing efficiency, they do not explicitly correlate with changes in the operational activity of all specific plants included in the provided satellite data.

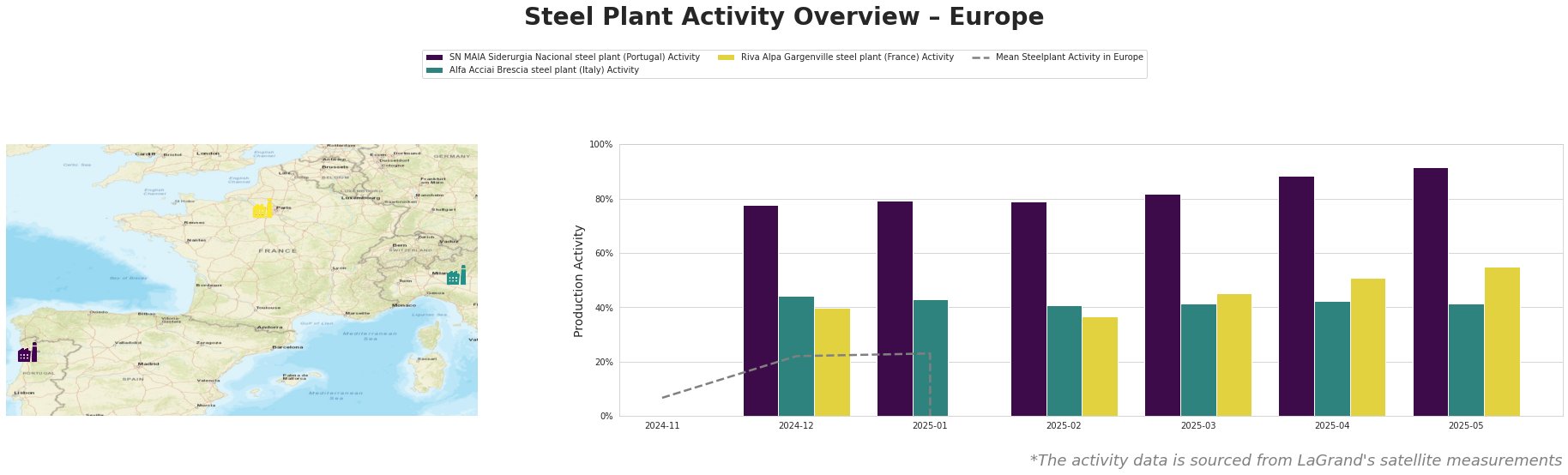

The satellite data reveals consistently high activity at SN MAIA Siderurgia Nacional steel plant in Portugal, reaching 92% in May 2025, significantly above the European mean. Alfa Acciai Brescia steel plant in Italy demonstrates stable activity, ranging from 41% to 44%. Riva Alpa Gargenville steel plant in France shows an upward trend, reaching 55% activity in May 2025. The negative values observed for the “Mean Steelplant Activity in Europe” raise questions about data consistency. No direct connection between the news articles and the specific activity levels at Alfa Acciai Brescia or Riva Alpa Gargenville can be established based on the provided information.

SN MAIA Siderurgia Nacional steel plant: This Portuguese plant, equipped with a 600,000-ton EAF and holding a ResponsibleSteel Certification, shows consistently high activity levels, reaching 92% in May 2025. This sustained high activity might reflect strong regional demand for rebar, its primary product. The provided news articles do not offer any direct insights into the causes of the high activity levels at this plant.

Alfa Acciai Brescia steel plant: This Italian plant, with a 1.7 million-ton EAF capacity, focuses on billet and rebar production. Activity levels are stable, fluctuating between 41% and 44%. While the news articles highlight Feralpi’s expansion and focus on the German market, they do not provide a clear explanation for the operational stability at Alfa Acciai Brescia.

Riva Alpa Gargenville steel plant: A French plant producing 700,000 tons of crude steel using EAF technology with Responsible Steel certification. This plant’s activity has shown a clear upward trend, reaching 55% in May 2025. No direct link can be established with the news articles.

The sustained high activity at SN MAIA, coupled with the rising activity at Riva Alpa Gargenville, suggests strong underlying demand for rebar in specific regions. The significant investments by Feralpi, highlighted in the news articles, focus primarily on green steel production in Germany. While the reports show investments aimed at reducing emissions and enhancing efficiency, they do not explicitly correlate with changes in the operational activity of specific plants.

Given the ongoing investments in green steel technology and the generally stable to increasing plant activity:

- Supply Disruptions: There are no explicitly indicated immediate supply disruptions in the provided data.

- Procurement Actions: Steel buyers should prioritize securing long-term contracts with suppliers committed to decarbonization, especially those offering products like Feralpi’s FERGreen brand. Buyers focused on rebar should closely monitor activity levels in Portugal and France to ensure consistent supply, as SN MAIA Siderurgia Nacional and Riva Alpa Gargenville both exhibit high and increasing activity. Given the emphasis on energy prices in the news articles, buyers should also factor energy cost fluctuations into their procurement strategies.