From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGreen Steel Investments Signal Positive Outlook for European Rebar Market

Europe’s steel market exhibits a very positive sentiment driven by investments in green steelmaking. “Germany’s Feralpi Stahl joins Juwi to develop regional wind farms for green steelmaking” and “Feralpi Stahl and Juwi explore joint initiatives in renewable energy” directly point to long-term shifts in energy sourcing for steel production. However, these long-term investments currently do not show an immediate impact on plant activity as observed by satellite data.

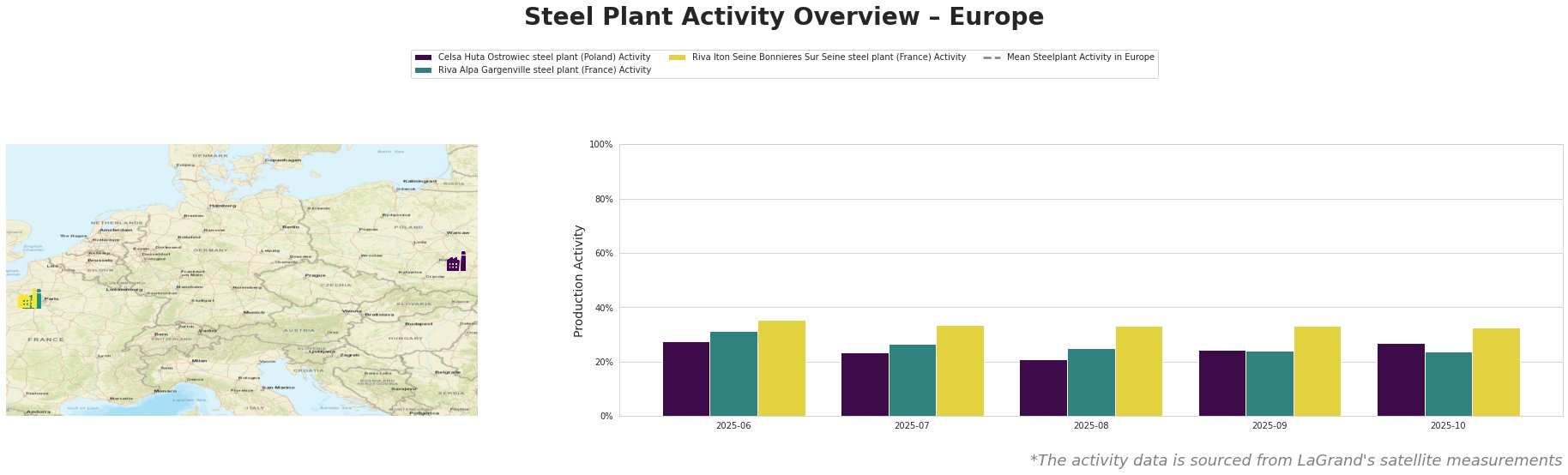

The mean steel plant activity in Europe fluctuated between approximately 271 million and 407 million over the observed period. Celsa Huta Ostrowiec experienced a decline from 28% in June to 21% in August, followed by a recovery to 27% in October. Riva Alpa Gargenville saw a gradual decrease from 31% in June to 24% in September and remained at 24% in October. Riva Iton Seine Bonnieres Sur Seine showed a stable trend, with activity consistently around 33-35%. It is important to note that Celsa Huta Ostrowiec exhibits activity levels below the mean European activity, while the two Riva plants show higher activity compared to Celsa. No direct connection could be established between the observed plant activity and the news about Feralpi Stahl.

Celsa Huta Ostrowiec, located in Świętokrzyskie, Poland, primarily produces finished rolled products, specifically bars and rebar, using an EAF with a capacity of 900ktpa. Its activity dropped from 28% in June to 21% in August before increasing to 27% in October. There is no apparent connection between this fluctuation and the “Germany’s Feralpi Stahl joins Juwi to develop regional wind farms for green steelmaking” or “Feralpi Stahl and Juwi explore joint initiatives in renewable energy” articles.

Riva Alpa Gargenville, situated in Île-de-France, France, operates a 700ktpa EAF-based steel plant that produces semi-finished and finished rolled products, including billets and rebar. The observed decrease in activity from 31% in June to 24% in September, remaining stable through October, cannot be directly linked to the Feralpi Stahl news.

Riva Iton Seine Bonnieres Sur Seine, also in Île-de-France, France, utilizes a 550ktpa EAF to produce semi-finished and finished rolled products, mainly billets and rebar. The consistent activity level around 33-35% does not show a discernible impact from the Feralpi Stahl announcements.

The news regarding Feralpi Stahl signals a long-term positive outlook and does not cause immediate supply disruptions. However, the observed activity decline at Celsa Huta Ostrowiec suggests a potential regional supply constraint in the rebar market.

Recommended Procurement Action: Steel buyers should closely monitor Celsa Huta Ostrowiec’s production and consider diversifying rebar sourcing options in Central/Eastern Europe to mitigate potential supply risks. Negotiate long-term contracts with Riva Alpa Gargenville and Riva Iton Seine Bonnieres Sur Seine to secure supply, considering their stable, above-average activity levels.