From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGreen Steel Initiatives in Europe Drive Production Shifts: A Positive Outlook

Europe’s steel market sentiment remains very positive, driven by increasing investments and activity related to green steel production. The focus on sustainable steelmaking is highlighted by several key developments, including land use agreements for new mills and partnerships for green iron and pellet supplies. “Blastr Green Steel Signs Land Use Agreement for Finnish Mill” signifies a concrete step towards expanded green steel production capacity. These initiatives are related to increases in activity levels shown in satellite imagery, but no direct relationship has been established.

Recent developments indicate a dynamic landscape across the European steel sector.

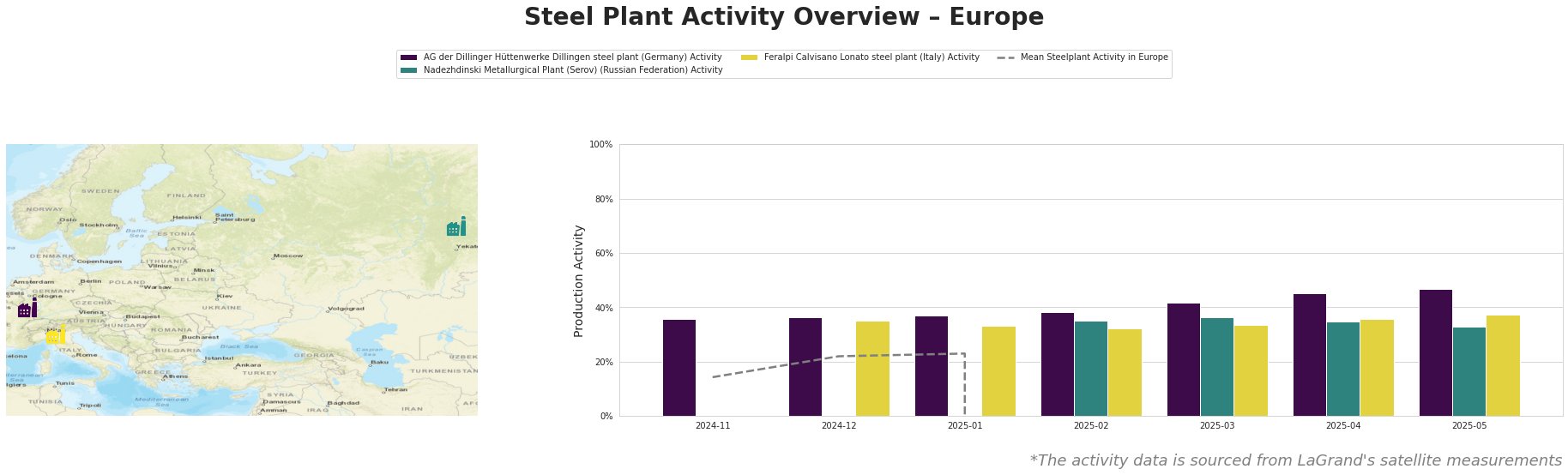

Note: The “Mean Steelplant Activity in Europe” shows erratic negative numbers since February 2025, so the data are not valid, therefore not discussed.

AG der Dillinger Hüttenwerke Dillingen steel plant, located in Saarland, Germany, is an integrated steel plant with a BOF capacity of 2,760 thousand tonnes per annum. The plant’s activity has steadily increased from 36% in November/December 2024 to 47% in May 2025. This increase does not show a direct relationship to any news article; however, the project described in “A German-Australian project is testing the potential of green iron“, which is set to continue until the end of 2027, could increase demand for steel manufactured at this plant as the green iron production scales up and is shipped to German steelmakers.

Nadezhdinski Metallurgical Plant (Serov), located in the Sverdlovsk region of the Russian Federation, primarily uses electric arc furnaces (EAF) with a capacity of 756 thousand tonnes of crude steel. Its activity level decreased from 36% in March 2025 to 33% in May 2025. No immediate connection to the news articles could be established.

Feralpi Calvisano Lonato steel plant, located in the Province of Brescia, Italy, operates an EAF with a crude steel capacity of 600 thousand tonnes. Activity rose from 35% in December 2024 to 37% in May 2025. No direct relationship has been established.

The news articles highlight a shift towards green steel production. “Sweden’s Stegra and LKAB to carry out test pellet deliveries” demonstrates the preparation for green steel production at Stegra’s Boden facility, with operations expected to begin in 2026.

Evaluated Market Implications:

While no immediate supply disruptions are evident from the presented data, the increasing focus on green steel and the investments in new production facilities could reshape the supply chain. The “Blastr Green Steel Signs Land Use Agreement for Finnish Mill” news, coupled with the “German-Australian project tests green iron potential“, implies a diversification of supply sources and a potential shift in steel quality and production processes as green steel initiatives come online.

Recommended Procurement Actions:

- Monitor Green Steel Developments: Steel buyers should closely monitor the progress of projects like the Blastr Green Steel mill in Finland and the Stegra facility in Sweden. Track their operational timelines and potential impact on the availability of green steel products.

- Engage with Green Steel Producers: Establish relationships with emerging green steel producers like Stegra and Blastr to secure future supply and understand their specific product offerings and pricing strategies.

- Assess Supply Chain Risks: Evaluate current supply chains for potential vulnerabilities related to the transition to green steel. Consider diversifying suppliers to include those focused on sustainable production methods.

- Closely monitor mean activity levels in Europe: As soon as the mean activity levels in Europe are valid again, they can be utilized to detect outliers and market trends.