From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGreen Steel Initiatives Drive Positive European Market Sentiment Amidst Rising Plant Activity

Europe’s steel market exhibits a very positive sentiment, propelled by green steel initiatives and demonstrably increased plant activity. Projects like the “German-Australian project tests green iron potential” and “Blastr Green Steel Signs Land Use Agreement for Finnish Mill” directly correlate with observed or projected shifts in steel production methodologies and location, supporting a bullish market outlook, especially for sustainably produced steel. The collaboration highlighted in “Sweden’s Stegra and LKAB to carry out test pellet deliveries” further solidifies this trend.

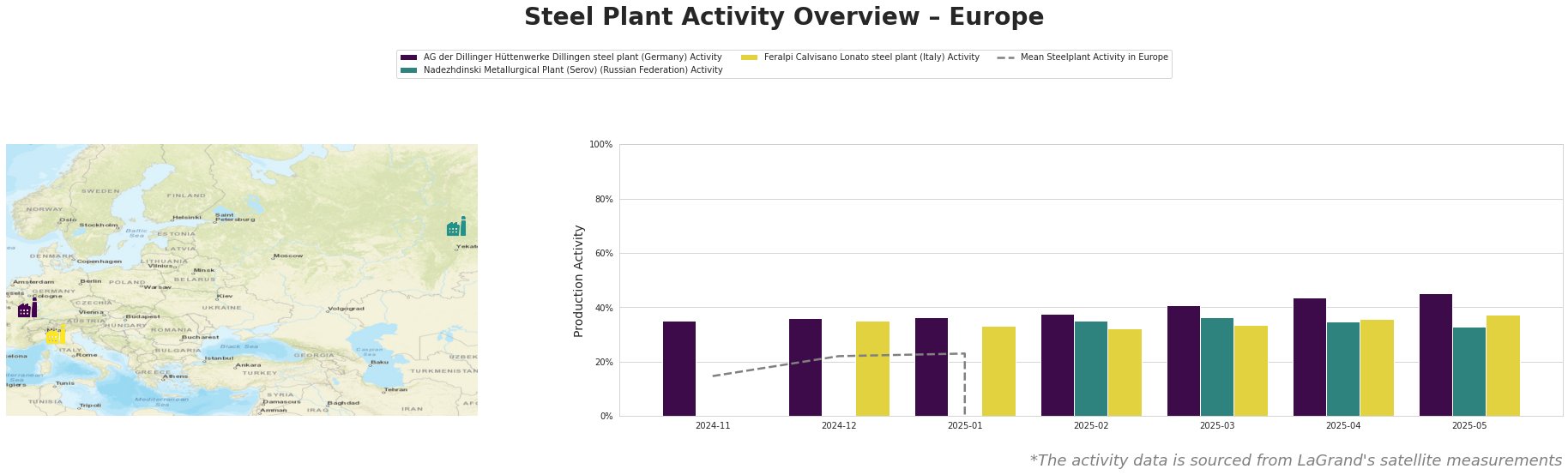

Monthly Steel Plant Activity:

While the “Mean Steelplant Activity in Europe” for the last four months exhibits anomalous numerical behavior, activity at individual plants shows a clearer upward trend. AG der Dillinger Hüttenwerke Dillingen steel plant (Germany) has consistently increased its activity from 35% in November 2024 to 45% in May 2025. Nadezhdinski Metallurgical Plant (Serov) (Russian Federation) shows stable activity around 35-36% before dropping to 33% in May 2025. Feralpi Calvisano Lonato steel plant (Italy) also presents a general increase in activity from 35% in December 2024 to 37% in May 2025.

AG der Dillinger Hüttenwerke Dillingen, a major integrated steel plant in Germany utilizing BF/BOF technology with a crude steel capacity of 2.76 million tonnes, has demonstrated a steady increase in activity, reaching 45% in May 2025. This increase may reflect preparation for integrating green iron produced via the “German-Australian project tests green iron potential,” which aims to supply German steelmakers with sustainably produced iron.

Nadezhdinski Metallurgical Plant (Serov) in Russia, an electric steelmaking facility with a capacity of 756,000 tonnes, experienced a slight activity decrease to 33% in May 2025. No direct connection between this activity drop and the provided news articles can be established.

Feralpi Calvisano Lonato, an Italian EAF steel plant with a 600,000-tonne capacity, displayed a gradual increase in activity, reaching 37% in May 2025. While aligning with the overall positive market sentiment, no direct link to the provided news articles can be established.

The collaborations exemplified by “Sweden’s Stegra and LKAB to carry out test pellet deliveries,” while not immediately impacting current activity levels, signals a longer-term shift towards green steel production, particularly impacting supply chains and potentially creating regional price differentiation for green versus conventionally produced steel.

Evaluated Market Implications:

- Potential Supply Chain Shifts: The “German-Australian project tests green iron potential” could reduce reliance on traditional iron ore sources for German steelmakers, potentially disrupting existing supply chains. “Sweden’s Stegra and LKAB agree on test deliveries of pellets” signals a shift toward green steel production in Northern Europe, potentially creating regional supply advantages.

- Recommended Procurement Actions:

- For steel buyers focused on sustainability: Prioritize engagement with suppliers like Stegra, leveraging the “Sweden’s Stegra and LKAB to carry out test pellet deliveries” to secure long-term contracts for green steel.

- For German steel buyers: Monitor the progress of the “German-Australian project tests green iron potential” and explore potential partnerships or supply agreements to access green iron resources, potentially mitigating future carbon taxes or regulations.

- For buyers sourcing from Nadezhdinski Metallurgical Plant (Serov): Closely monitor geopolitical and economic factors impacting Russian steel production and logistics, given the recent activity dip (33% in May 2025) and potential supply chain vulnerabilities. Consider diversifying supply sources to mitigate risks.