From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGreen Steel Initiatives Boost Spanish Steel Market: Gestamp-Hydnum Deal & ArcelorMittal’s Hydrogen Pilot Drive Optimism

Spain’s steel market exhibits very positive sentiment, driven by green steel initiatives. Recent developments, such as “Spain’s Gestamp and Hydnum Steel sign circular green steel supply deal“, which promotes closed-loop recycling and low-emission steel production, are significant. The “ArcelorMittal Olaberria launches a pilot project to use green hydrogen” at ArcelorMittal’s Olaberria plant, further solidifies this positive outlook. “Spain’s Sarralle completes green hydrogen steel project at ArcelorMittal Olaberria“, demonstrating the industrial viability of hydrogen-based combustion, with an efficient green energy transition.

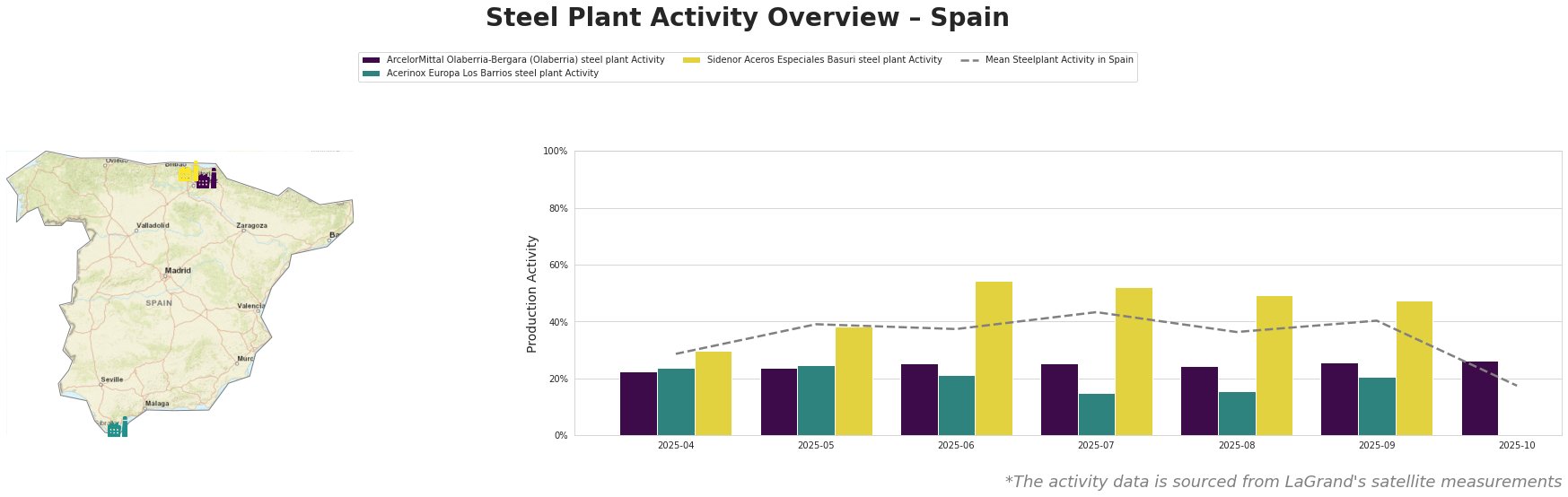

The mean steel plant activity in Spain saw a rise from April to July 2025, peaking at 43.0%, before experiencing a drop to 17.0% in October. ArcelorMittal Olaberria maintained a relatively stable activity level, ranging from 22.0% to 26.0%. Acerinox Europa Los Barrios experienced a drop in activity from 24.0% in April to 15.0% in July and August, with data missing for October. Sidenor Aceros Especiales Basuri showed the highest activity levels among the observed plants, peaking at 54.0% in June, but showing a significant reduction by October. The significant drop in the mean activity level during October does not appear to be directly linked to the named news articles.

ArcelorMittal Olaberria-Bergara (Olaberria) steel plant

ArcelorMittal Olaberria, an EAF-based plant with a crude steel capacity of 1450 ttpa, is at the forefront of green steel production. The plant’s stable activity, fluctuating between 22% and 26%, coincides with the implementation of the green hydrogen pilot project, as highlighted in “ArcelorMittal Olaberria launches a pilot project to use green hydrogen” and “Spain’s Sarralle completes green hydrogen steel project at ArcelorMittal Olaberria”. These initiatives suggest a strategic shift towards sustainable practices rather than immediate production increases.

Acerinox Europa Los Barrios steel plant

Acerinox Europa Los Barrios, with a 1200 ttpa crude steel capacity utilizing EAF technology, displayed fluctuating activity. A notable decline occurred from April (24.0%) to July-August (15.0%). No direct connection between this activity drop and the provided news articles can be established. The plant focuses on stainless steel production using electric arc furnaces and AOD converters.

Sidenor Aceros Especiales Basuri steel plant

Sidenor Aceros Especiales Basuri, a smaller EAF-based plant with a 740 ttpa crude steel capacity, experienced the most significant activity fluctuations, peaking at 54.0% in June before declining to 47% by September. The final recorded activity (September) is still higher than the overall Spanish mean. No clear connection can be established between these fluctuations and the provided news articles. The plant produces finished rolled products, including bars, for various sectors.

Evaluated Market Implications

The “Spain’s Gestamp and Hydnum Steel sign circular green steel supply deal” implies potential shifts in demand towards green steel, particularly within the automotive sector. The deal establishes a closed-loop system, where Gestamp supplies scrap to Hydnum for green steel production, potentially reducing reliance on traditionally produced steel. However, the observed drop in mean Spanish steel plant activity level in October of 2025 may indicate supply shortages across Spain.

Recommended Procurement Actions:

- Steel Buyers focused on Automotive Sector: Prioritize engagement with Gestamp and Hydnum Steel to secure access to their green steel supply chain, mitigating potential supply disruptions related to traditional steel sources.

- Market Analysts: Closely monitor Hydnum Steel’s production ramp-up and the impact of the Gestamp partnership on overall green steel availability. Track the evolution of monthly activity levels.

- Steel Buyers: Seek out alternative sourcing arrangements with steel plants that use green hydrogen, given the current market dynamics.