From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGermany’s Steel Market Stability Amidst Low Demand and Energy Pressure

In Germany, the steel market sentiment remains neutral as recent dynamics indicate a stable pricing environment alongside dipping activity levels at various steel plants. The articles “European steel prices hold flat as market awaits january shift“ and “European steel prices remain at the same level as the market expects January changes“ exemplify the current state, highlighting the flat pricing under low demand conditions. Despite this, the ongoing uncertainty related to the CBAM expectations presented in “CBAM expectations weaken purchasing decisions in the steel market“ has led to cautious purchasing behaviors, aligning with observed activity data showing fluctuations in plant operations.

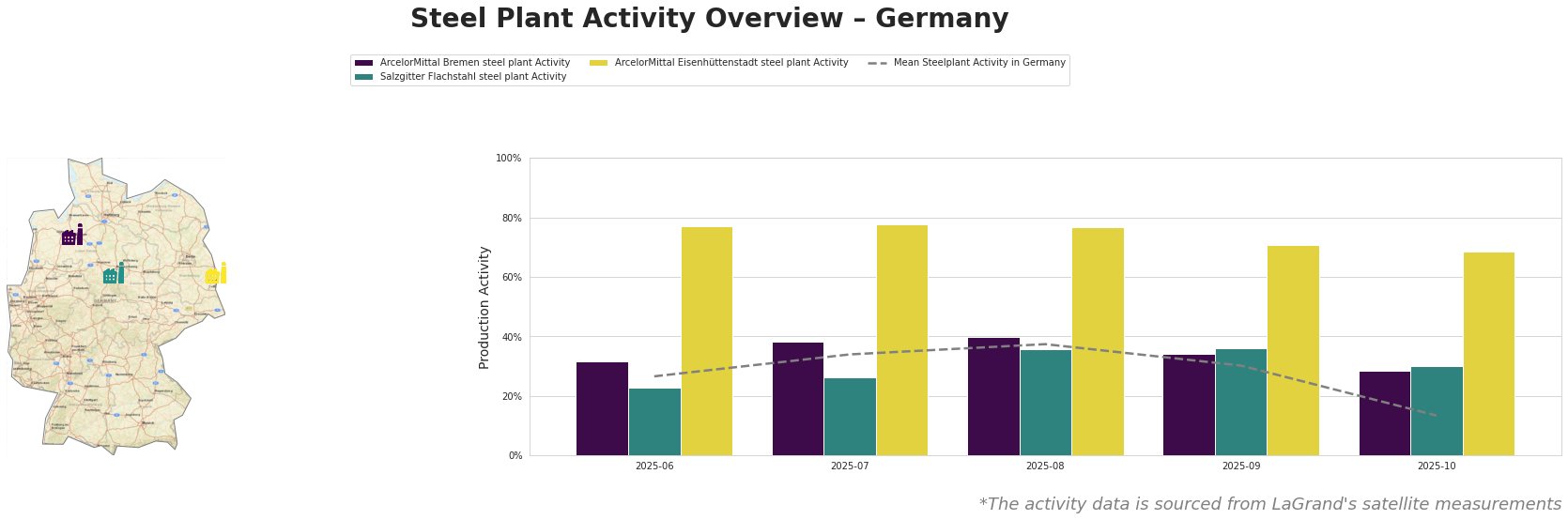

ArcelorMittal Bremen, which primarily operates through a blast furnace process and is engaged in producing finished rolled products, recorded a drop from 40% to 29% in activity between August and October 2025. This decline may correlate with the broader trend outlined in the article regarding price stability and energy cost pressures. Conversely, the Salzgitter Flachstahl plant, focusing on both semi-finished and finished rolled products, displayed a consistent but lower activity, notably 20% lower than the Bremen facility in October. Its transition towards hydrogen-based steel production underscores its strategic long-term planning amidst immediate market challenges tied to energy costs. Finally, ArcelorMittal Eisenhüttenstadt recorded a substantial drop between June and October, moving from 77% to 68%, indicating greater operational stability compared to the Bremen and Salzgitter plants amid the changing demand landscape addressed in the aforementioned news articles.

Potential supply disruptions may arise from the ongoing activity drops at these plants linked to the “CBAM expectations,” leading to a cautious purchasing stance within the market. For steel buyers, it is recommended to strategically time procurement decisions in light of potential upward movements in prices anticipated in January 2026 as suppliers adjust to the inflationary cost environment, particularly in CRC and HDG products which have shown signs of price pressure. Conducting market analyses on projected inventory levels and assessing individual plant outputs could offer further actionable insights into managing procurement risk effectively.