From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGermany’s Steel Market Sentiment Turns Negative Amid Weak Demand

Germany’s steel market is currently facing significant challenges, driven by weak demand and oversupply. The recent article titled “EU HRC prices inch down amid weak demand and holiday lull” highlights how domestic mills are lowering prices in a bid to stimulate orders, with reports indicating very low buyer interest, especially from service centers. Concurrently, satellite activity data reveals stark declines in output across major steel plants, aligning these trends with market sentiment and demand forecast.

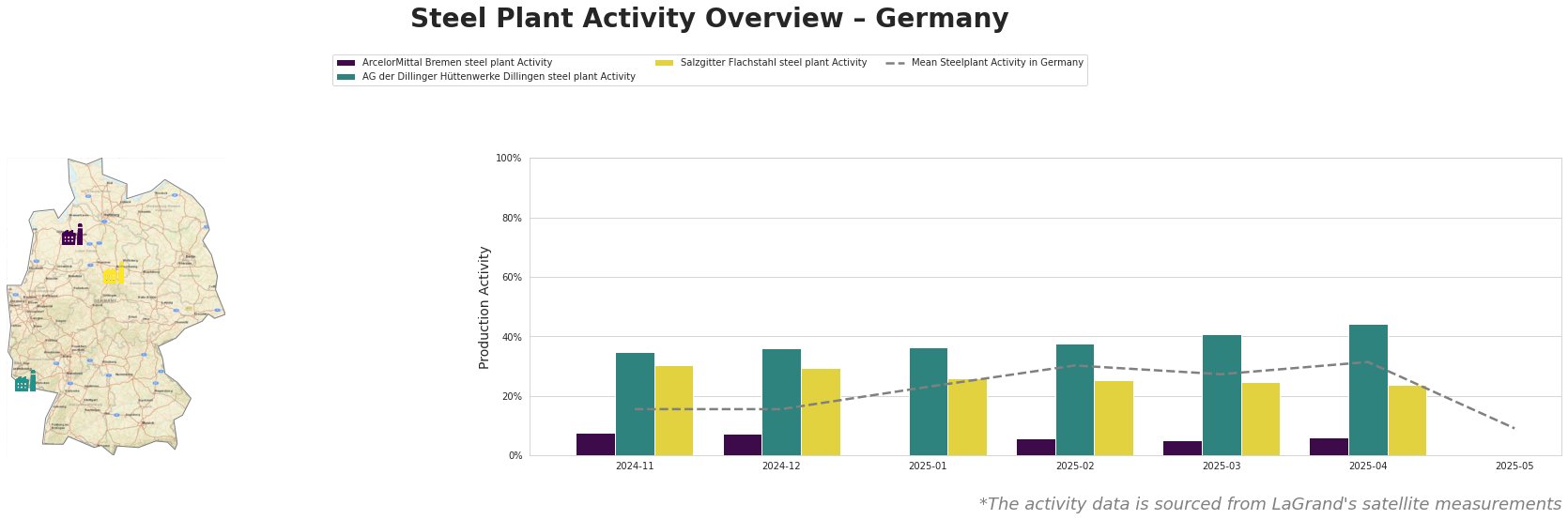

Measured Activity Overview

Activity levels across observed plants have sharply declined, with an overall mean falling to 9.0% by the end of May 2025. This downturn is especially pronounced at the ArcelorMittal Bremen plant, which reported only 6.0% activity in late April, notably decreased following the weak demand trends discussed in the news article “Steel prices in the EU are gradually decreasing amid weak demand and holiday lull”.

The AG der Dillinger Hüttenwerke experienced a peak at 44.0% in April, yet faced instability, confirming the overall narrative of declining demand underscored in recent publications. Salzgitter’s activity also dropped, reflecting the pervasive pessimism surrounding demand recovery, as emphasized in the referenced article.

Evaluated Market Implications

Given the current state of production and demand, combined with insights from the news articles, steel procurement professionals should brace for potential supply disruptions. Specifically, low activity at the ArcelorMittal Bremen plant poses a risk for those relying on its output, especially in finished rolled products for sectors like automotive and infrastructure.

In light of these developments, steel buyers are advised to prioritize immediate procurement to mitigate risks associated with further activity declines. Given the discouragement expressed by service centers regarding future demand recovery, securing reservations with AG der Dillinger Hüttenwerke—currently less affected than other plants—may provide a strategic buffer against price fluctuations and supply instability in the near future.

To summarize, the intersection of declining production and weak market demand in Germany’s steel sector calls for proactive, targeted procurement strategies, which are essential for navigating the challenging landscape ahead.