From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGermany’s Steel Market Faces Significant Downturn Amid Regulatory Changes and Plant Activity Dips

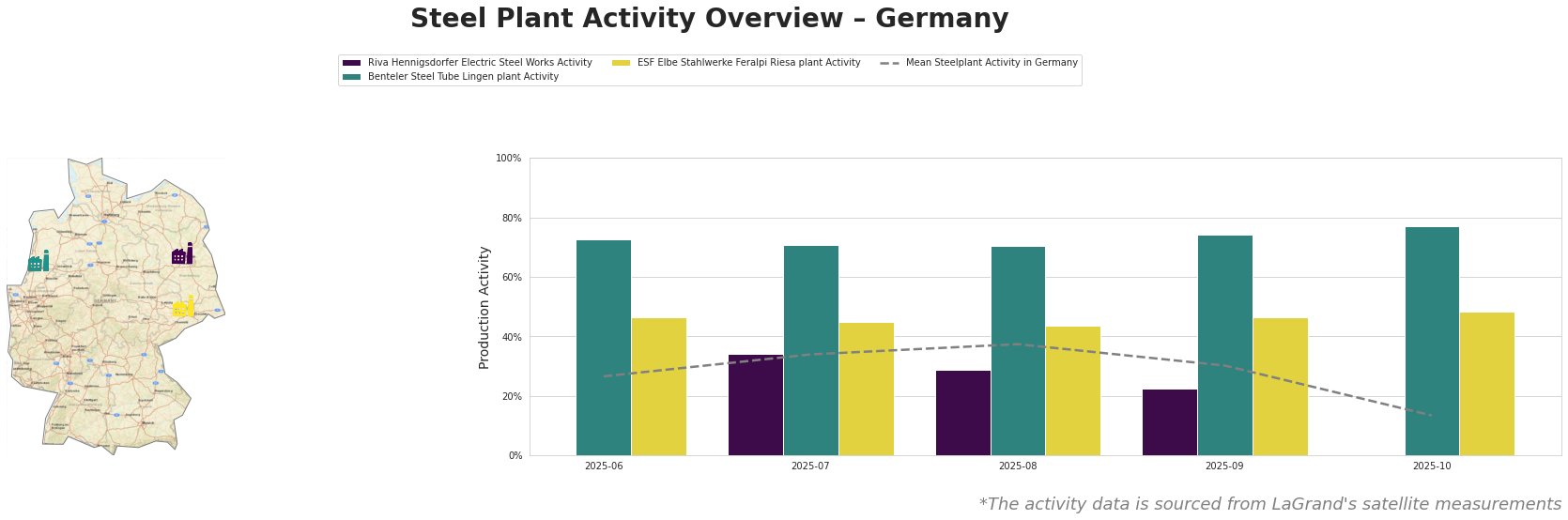

The German steel market is currently experiencing a very negative sentiment driven largely by significant regulatory shifts and reduced operational activity across key facilities. Notably, “The EU may ease the ban on ICE from 2035 under pressure from the automotive industry“ highlights contentious pressures from German stakeholders on EU regulations, potentially affecting the demand for steel as automotive manufacturing adapts. Concurrently, satellite data reveals declining activity levels at steel plants, indicating a contraction in production capabilities.

The observed trends reveal a notable decline in average steel activity, plummeting from 37.0% in August to 13.0% in October. Riva Hennigsdorfer Electric Steel Works reports intermittent activity, registering 34.0% in July, but trailing off entirely by October, aligning with market uncertainties stemming from EU policy revisions affecting emissions standards. The Benteler Steel Tube Lingen plant, while maintaining a relatively higher activity of 77.0% in October, has potential vulnerabilities due to its substantial role in the automotive sector, which is undergoing a pivotal transition influenced by the aforementioned articles.

The ESF Elbe Stahlwerke Feralpi Riesa witnessed varied activity, demonstrating a slight increase but remaining overshadowed by looming industry-wide adjustments prompted by the EU’s reconsideration of internal combustion engine regulations. Notably, the 45.0% activity recorded in July drops slightly to 48.0% in October, indicating a resilient output approach despite broad sector challenges. However, the overall situation suggests potential supply disruptions especially in regions heavily tied to automotive contracts.

For steel buyers and analysts, proactive measures are essential amidst this landscape:

- Prioritize suppliers with flexible production capabilities, particularly those in lower activity bands like Riva, to safeguard against broader disruptions.

- Monitor automotive sector demands closely as shifts in emissions regulations could redefine demand patterns for semi-finished and finished products.

- Secure long-term contracts with active suppliers like Benteler, whose performance remains robust, to mitigate risks associated with imminent regulatory changes and ensure stable inputs for manufacturing processes.

In conclusion, Germany’s steel industry faces significant pressures stemming from shifts in automotive regulation, evident in reduced plant activity and potential supply chain vulnerabilities. Buyers should act strategically to adapt to this changing landscape.