From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Slump Deepens: Production Cuts Signal Further European Weakness

Germany’s steel sector faces escalating challenges as evidenced by production declines and sales slumps, potentially impacting broader European steel supply. According to “Germany reduced steel production by 10.1% y/y in April” and “German crude steel output down 11.9 percent in Jan-Apr,” German steel output has contracted significantly, aligning with lower sales figures reported in “Steel sales in Germany decreased by 5% in April, inventories decreased“. While direct correlation with satellite data on other European plants requires more comprehensive analysis, the German downturn suggests broader regional vulnerabilities.

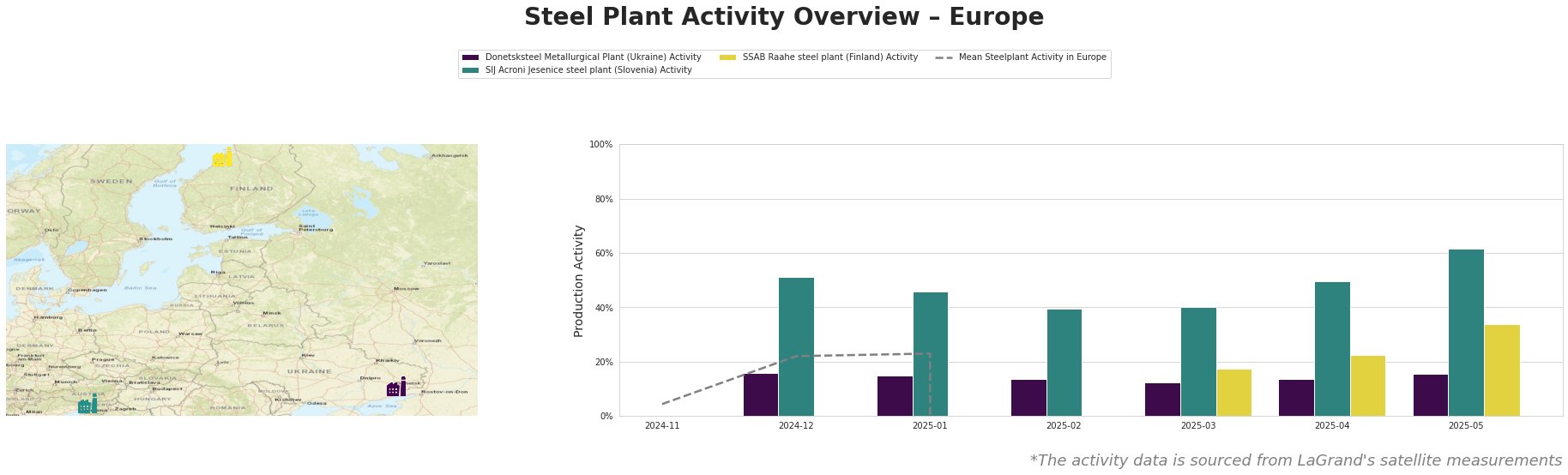

The mean activity level across observed European plants shows unrealistically high negative values starting in February 2025, making comparison with individual plants impossible. Activity at Donetsksteel Metallurgical Plant shows a gradual increase from 12% in March to 16% in May. SIJ Acroni Jesenice steel plant shows a strong increase in activity from 39% in February to 62% in May. Activity at SSAB Raahe steel plant increased from 17% in March to 34% in May. No direct connections could be established between these plant activity levels and the provided news articles concerning the German steel market.

Donetsksteel Metallurgical Plant, a BF-integrated plant in Donetsk with a pig iron capacity of 1.5 million tons and operating EAFs, shows slowly increasing activity in the observed period. Despite its Responsible Steel certification, the observed activity trend cannot be directly linked to the downturn reported in the German steel market.

SIJ Acroni Jesenice steel plant, located in Slovenia, relies on EAF technology for its 726,000-ton crude steel production, specializing in flat rolled products. The plant’s satellite-observed activity increased significantly from February to May. However, there’s no discernible connection between this increase and the reported German steel market contraction.

SSAB Raahe steel plant in Finland, an integrated BF-BOF producer with a 2.6 million-ton crude steel capacity, also exhibited increasing activity levels between March and May. The plant is slated to transition to EAF production by 2030. As with the other plants, no explicit link to German steel market news can be established based on the provided information.

The reported decline in German steel production and sales, particularly the 5.6% year-on-year drop in flat rolled steel sales linked to automotive sector weakness (“Steel sales in Germany decreased by 5% in April, inventories decreased“), warrants immediate risk assessment for steel buyers dependent on German suppliers. Given the reported stability in hot-rolled steel prices, buyers should explore diversifying their supplier base to mitigate potential price increases or supply disruptions stemming from the German downturn. Actively monitor inventory levels and lead times from German suppliers, preparing for potential order delays.