From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Production Slump Deepens: Activity Decline Signals Procurement Challenges

Germany’s steel sector faces growing headwinds, reflected in declining production and sales. As reported in “Germany reduced steel production by 10.1% y/y in April” and “German crude steel output down 11.9 percent in Jan-Apr,” production has fallen sharply, signaling potential supply chain vulnerabilities. While a direct relationship between the news articles and specific plants can’t be fully established, the overall negative trend in the market is evident.

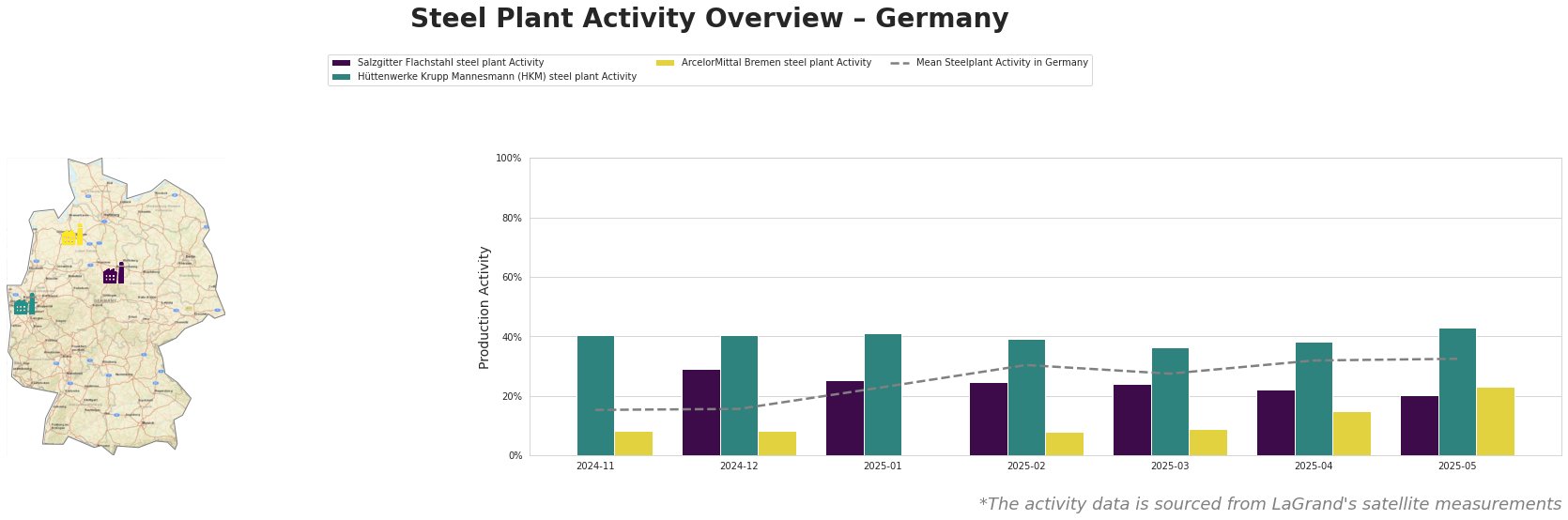

The mean steel plant activity in Germany shows a fluctuating trend, rising from 15.0 in November 2024 to a peak of 32.0 in April and May 2025. However, individual plant activities varied significantly. Salzgitter Flachstahl showed a declining trend from 29.0 in December 2024 to 20.0 in May 2025. Hüttenwerke Krupp Mannesmann (HKM) plant showed comparatively high activity levels, ranging from 36.0 to 43.0. ArcelorMittal Bremen started low, with activity around 8.0, but increased steadily to 23.0 in May 2025. The decline at Salzgitter Flachstahl may be related to the overall production decreases reported in “Germany reduced steel production by 10.1% y/y in April” and “German crude steel output down 11.9 percent in Jan-Apr“, but a direct causal link cannot be definitively established based on the provided information.

Salzgitter Flachstahl, located in Lower Saxony, is an integrated BF steel plant with a crude steel capacity of 5.2 million tonnes, primarily serving the automotive, building, and machinery sectors with hot and cold-rolled products. The observed activity drop from 29.0 in December 2024 to 20.0 in May 2025 does not have a directly attributable cause from the news articles, but could be contributing to the reduced flat rolled steel sales as noted in “Steel sales in Germany decreased by 5% in April, inventories decreased“. The company’s transition towards hydrogen-based steel production by 2050 might contribute to short-term production adjustments.

Hüttenwerke Krupp Mannesmann (HKM), situated in North Rhine-Westphalia, is another integrated BF steel plant with a 6 million tonne crude steel capacity. The plant consistently showed higher activity levels compared to the German average, maintaining activity between 36.0 and 43.0. This stable activity, in contrast to the national trend reported in “Germany reduced steel production by 10.1% y/y in April“, potentially indicates a more resilient product mix or regional demand.

ArcelorMittal Bremen, based in Bremen, has a crude steel capacity of 3.8 million tonnes and focuses on finished rolled products for the automotive and construction industries. Its activity increased significantly from 8.0 to 23.0 between November 2024 and May 2025. This rise in activity stands in contrast to the overall negative sentiment, but aligns with increased long product sales, even though the company is not primarily focused on long steel product.

Given the reported production declines and sales decreases, particularly in flat rolled steel, as well as the activity decline at Salzgitter Flachstahl steel plant, steel buyers should prioritize securing supply contracts with HKM to mitigate potential disruptions. Furthermore, steel buyers should carefully monitor inventories and consider increasing their stock of long steel products in anticipation of increased construction demand.