From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Production Dips, Global Output Softens: A European Steel Market Overview

In Europe, the steel market faces headwinds as German steel production declines. The report “Germany reduced steel production by 10.1% y/y in April” and “German crude steel output down 11.9 percent in Jan-Apr” directly reflect this downturn, though no direct link to specific plant activity levels is explicitly available. These reports are partially echoed in the broader context of “Global steel production fell by 6.3% m/m in April“, suggesting a wider softening of demand.

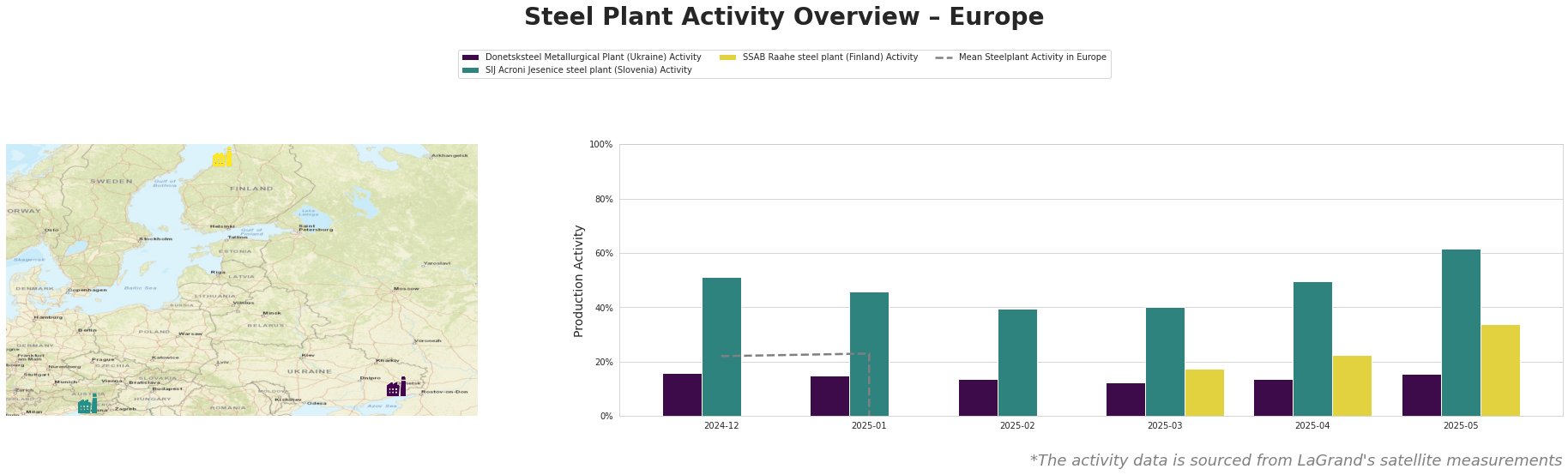

The Mean Steelplant Activity in Europe column has negative values that cannot be explained based on the provided information.

Donetsksteel Metallurgical Plant: This integrated plant in Donetsk, Ukraine, primarily produces pig iron using BF-EAF processes, and previously operated BOF furnaces. The Donetsksteel Metallurgical Plant demonstrates a gradual increase in activity, with levels ranging from 16% in December 2024 to 16% in May 2025. Given its location in Ukraine, its production is indirectly affected by the global output trends detailed in “Global steel production fell by 6.3% m/m in April”, where Ukraine’s overall steel production is mentioned, though no direct production data from the plant is available in this article. There is no explicit information to establish a correlation between the observed activity levels and news regarding german steel.

SIJ Acroni Jesenice steel plant: Located in Jesenice, Slovenia, this plant utilizes EAF technology to produce semi-finished and finished rolled products, focusing on flat rolled steel, plates, and hot/cold rolled products. The activity at SIJ Acroni Jesenice steel plant shows a clear upward trend, increasing from 51% in December 2024 to 62% in May 2025. This rise in activity contrasts with the German production declines reported in “Germany reduced steel production by 10.1% y/y in April” and “German crude steel output down 11.9 percent in Jan-Apr”, suggesting potential regional divergence within the European steel market. No other correlation can be drawn from the provided articles.

SSAB Raahe steel plant: Based in North Ostrobothnia, Finland, this integrated BF-BOF plant produces semi-finished and finished rolled products, including hot rolled coils and billets. Satellite data show activity rising from 17% in March 2025 to 34% in May 2025. There is no explicit information to establish a correlation between the observed activity levels and news regarding german steel, but its activity can be contrasted to the overall decreasing global activity.

The news article “Steel sales in Germany decreased by 5% in April, inventories decreased” highlights a decline in sales driven by reduced automotive demand, which could potentially impact plants producing flat rolled steel.

Given the German steel production declines and the global output softening reported in “Germany reduced steel production by 10.1% y/y in April”, “German crude steel output down 11.9 percent in Jan-Apr”, and “Global steel production fell by 6.3% m/m in April”, while observed activity levels at SIJ Acroni Jesenice show growth.

Procurement Actions:

- Steel Buyers Focused on Flat Rolled Products: Given the downturn in the automotive sector, according to “Steel sales in Germany decreased by 5% in April, inventories decreased”, and the decline in flat rolled steel sales in Germany, procurement professionals should negotiate for more competitive pricing on flat rolled steel products.

- Diversify Supply Sources: The decline in German steel production (“Germany reduced steel production by 10.1% y/y in April” and “German crude steel output down 11.9 percent in Jan-Apr”) coupled with rising activity at plants like SIJ Acroni Jesenice suggests buyers should diversify their sourcing to mitigate potential supply disruptions stemming from over-reliance on German steel producers.