From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Market: ThyssenKrupp Activity Surge Amidst EU Budget Concerns and Energy Transition Debates

Germany’s steel sector faces a complex landscape influenced by evolving EU policies and energy transition challenges. This report analyzes recent satellite-observed steel plant activity in light of key news developments.

The German steel market is showing mixed signals amidst concerns about EU budget increases and the energy transition. Observed activity changes at key plants are potentially linked to discussions highlighted in “Mega-EU-Haushalt: Bis zu 450 Milliarden Euro – Deutschland droht laut Bericht drastische Beitragserhöhung,” which discusses potential budgetary strains, and “Umweltbundesamt: Präsident warnt vor steigenden Energiekosten durch zu viele Gas-Kapazitäten,” emphasizing energy transition challenges. While the connection between these articles and specific plant activities cannot be definitively proven, the news underscores an environment of uncertainty that could impact steel production and procurement. The article “Nur noch E-Autos ab 2035?: Wie sich in der Union offener Widerstand gegen das Verbrenner-Aus formiert” is related to the steel industry’s future, but has no direct link to the plants’ activity.

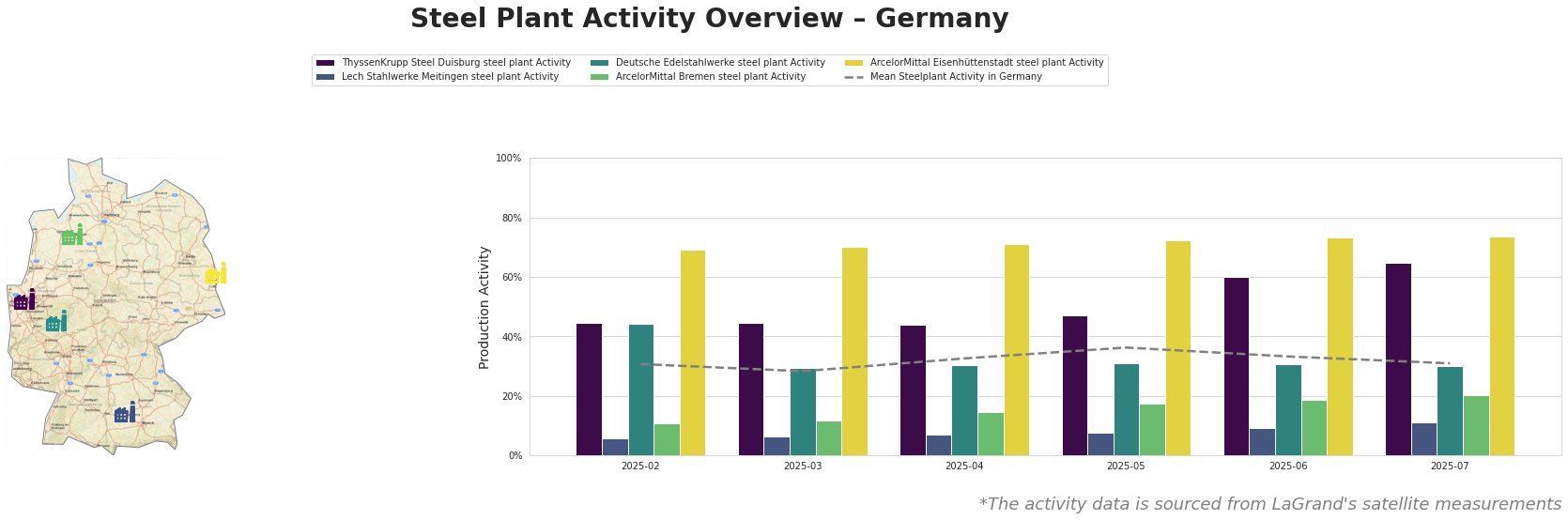

The mean steel plant activity in Germany fluctuated between 28.0% and 36.0% over the observed period, ending at 31.0% in July. ThyssenKrupp Steel Duisburg saw a significant rise, reaching 65.0% in July, significantly above the German average. Lech Stahlwerke Meitingen experienced a slow but steady increase, reaching 11.0% in July, but remains significantly below the national mean. Deutsche Edelstahlwerke showed relatively stable activity near the average levels. ArcelorMittal Bremen showed a consistent upward trend, albeit remaining below the average. ArcelorMittal Eisenhüttenstadt consistently showed the highest activity levels, reaching 74.0% in July, far exceeding the mean activity.

ThyssenKrupp Steel Duisburg steel plant: This integrated BF/BOF plant, with a crude steel capacity of 13,000 ttpa, showed a notable increase in activity from 45.0% in March to 65.0% in July. This rise, although not directly linkable to any specific news article, could indicate increased production to offset potential financial burdens highlighted in “Mega-EU-Haushalt: Bis zu 450 Milliarden Euro – Deutschland droht laut Bericht drastische Beitragserhöhung” or to leverage current market conditions before potential energy cost increases, as discussed in “Umweltbundesamt: Präsident warnt vor steigenden Energiekosten durch zu viele Gas-Kapazitäten.”

Lech Stahlwerke Meitingen steel plant: A smaller EAF-based plant with 1,400 ttpa crude steel capacity, demonstrated a gradual increase in activity, reaching 11.0% in July. This might reflect a cautious ramp-up in response to general market demand, but no direct connection can be established with the provided news articles.

Deutsche Edelstahlwerke steel plant: This EAF-based plant, producing 600 ttpa of crude steel, exhibited relatively stable activity, fluctuating around the 30% level. Its stability doesn’t correlate directly to any specific news event, suggesting a more consistent operational strategy.

ArcelorMittal Bremen steel plant: This integrated BF/BOF plant, with a crude steel capacity of 3,800 ttpa, showed a gradual increase in activity. No direct connection to any news article can be made.

ArcelorMittal Eisenhüttenstadt steel plant: This integrated BF/BOF plant, with a crude steel capacity of 2,400 ttpa, has consistently operated at high activity levels. No direct connection to any news article can be made.

Given the rising activity at ThyssenKrupp Steel Duisburg, potentially influenced by financial concerns and energy transition debates, steel buyers should:

- Monitor ThyssenKrupp’s pricing and lead times closely. The increased activity may impact pricing strategies and delivery schedules. Procurement professionals should proactively engage with ThyssenKrupp to clarify their production outlook and any potential changes to contractual agreements.

- Assess alternative supply options. While the increase in ThyssenKrupp’s activity is a positive sign, the broader economic uncertainty and energy cost concerns warrant exploring alternative steel suppliers to mitigate potential disruptions or price increases.

- Factor energy costs into steel procurement strategies: Due to the concerns raised in “Umweltbundesamt: Präsident warnt vor steigenden Energiekosten durch zu viele Gas-Kapazitäten,” it is crucial to incorporate potential energy cost fluctuations into your steel procurement budgets. Discuss energy surcharges and hedging strategies with suppliers.

This analysis provides a snapshot of the German steel market based on available data. Continuous monitoring of plant activity and policy developments is essential for informed decision-making.