From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Market Stagnates Amidst Weak Demand: Activity Analysis and Procurement Insights

Germany’s steel market faces headwinds due to weak demand and quota concerns, impacting plant activity. As reported in “European long steel market steady amid weak demand, quota caution” and “The European long products market is stable against the background of weak demand and caution with quotas,” long steel prices remain stagnant, reflecting the overall subdued market sentiment. The article “European HRC mills reduce offers, but buyers hold back” indicates that HRC prices also remain stagnant, as buyers are hesitant due to a weak market and upcoming summer holidays. The recent satellite-observed activity changes at key steel plants corroborate this negative outlook, though direct causal links cannot be definitively established.

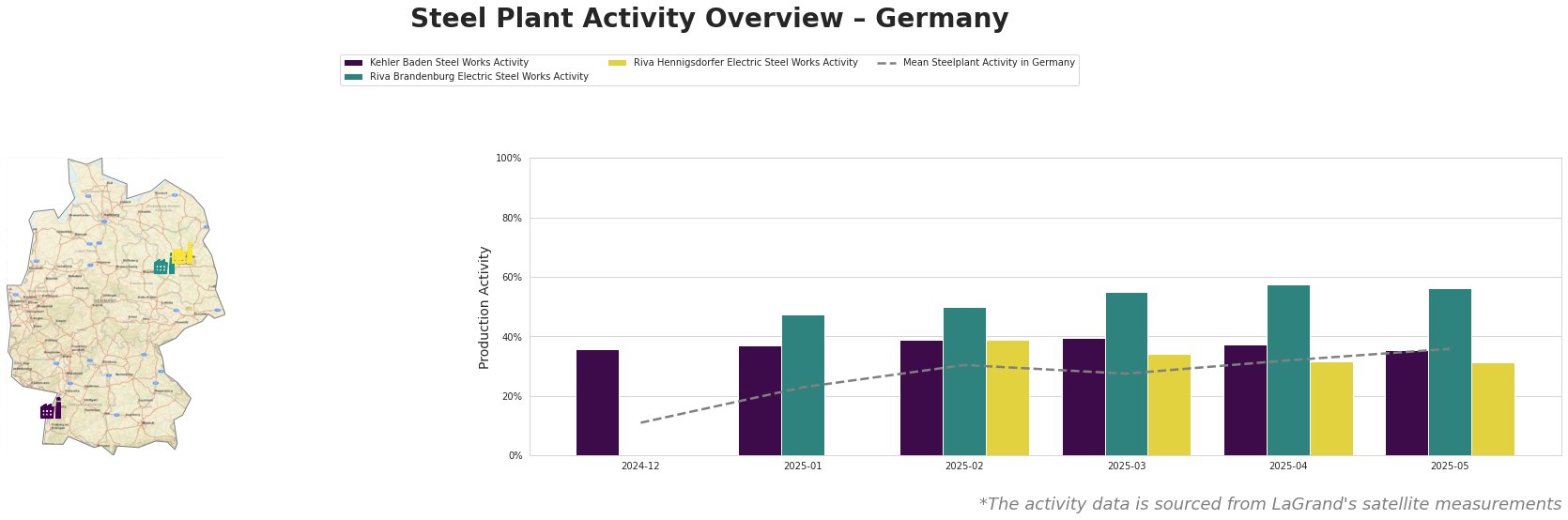

Across Germany, the mean steel plant activity has shown a gradual increase since the end of 2024, reaching 36% in May 2025. However, individual plant trends vary.

Kehler Baden Steel Works, a plant specializing in wire rod, bar, and rebar production using EAF technology, shows fluctuating activity. Activity increased from 36% in December 2024 to a peak of 40% in March 2025 before decreasing to 35% in May 2025. While the decline in May aligns with the weak demand reported in “European long steel market steady amid weak demand, quota caution,” a direct causal link cannot be definitively established.

Riva Brandenburg Electric Steel Works, an EAF-based plant with a 1.8 million tonne crude steel capacity, producing rebar and wire rod, has consistently operated above the German average. Its activity rose steadily from January to April, reaching 57% before slightly decreasing to 56% in May. While the high activity suggests resilience, the slight decrease in May could reflect the market’s overall stagnation detailed in “European long steel market steady amid weak demand, quota caution,” although a direct causal relationship cannot be confirmed.

Riva Hennigsdorfer Electric Steel Works, focused on rebar and bright steel production, has shown fluctuating activity significantly below the national mean. After a peak in February (39%), activity has declined to 31% in May. This reduction could be related to the overall market slowdown discussed in “European long steel market steady amid weak demand, quota caution,” but a direct and explicit connection is not verifiable based on the provided information.

Given the weak market sentiment and potential for continued price stagnation highlighted in “European long steel market steady amid weak demand, quota caution” and “European HRC mills reduce offers, but buyers hold back,” steel buyers should:

- Prioritize Short-Term Contracts: Avoid long-term commitments, particularly for HRC, given the current price volatility and reduced offers from mills as mentioned in “European HRC mills reduce offers, but buyers hold back“.

- Carefully Monitor Import Quotas: Remain vigilant regarding import quota allocations for long steel and HRC, as supply disruptions could arise, impacting price negotiations. The articles referencing quotas indirectly influence domestic market dynamics.

- Assess Plant-Specific Risks: Buyers sourcing from Riva Hennigsdorfer Electric Steel Works should closely monitor its activity levels and assess potential supply risks based on its recent decline. The provided activity data is key, but a direct link to specific risks cannot be established based on news alone. Consider diversifying suppliers if possible.