From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Market Poised for Growth: Feralpi Investment Drives Optimism Amid Energy Concerns

Germany’s steel market shows signs of recovery, driven by investment in green steel production and anticipated improvements in consumer confidence. Feralpi’s optimism, as highlighted in “Feralpi foresees Germany recovery, launches FERGreen brand“, is now materializing through the commissioning of sustainable manufacturing capacity. This is further supported by the launch of a new rolling mill, detailed in “Feralpi Germany starts up new rolling mill“, “Feralpi company launches new rolling mill in Germany” and “Germany’s Feralpi Stahl inaugurates new spooler rolling mill in Riesa” demonstrating a commitment to reducing CO2 emissions and increasing production efficiency. However, the news underscores concerns about high energy costs potentially impacting profitability. Satellite data does not provide immediate corroboration of production changes, but the investment itself points to future capacity increases.

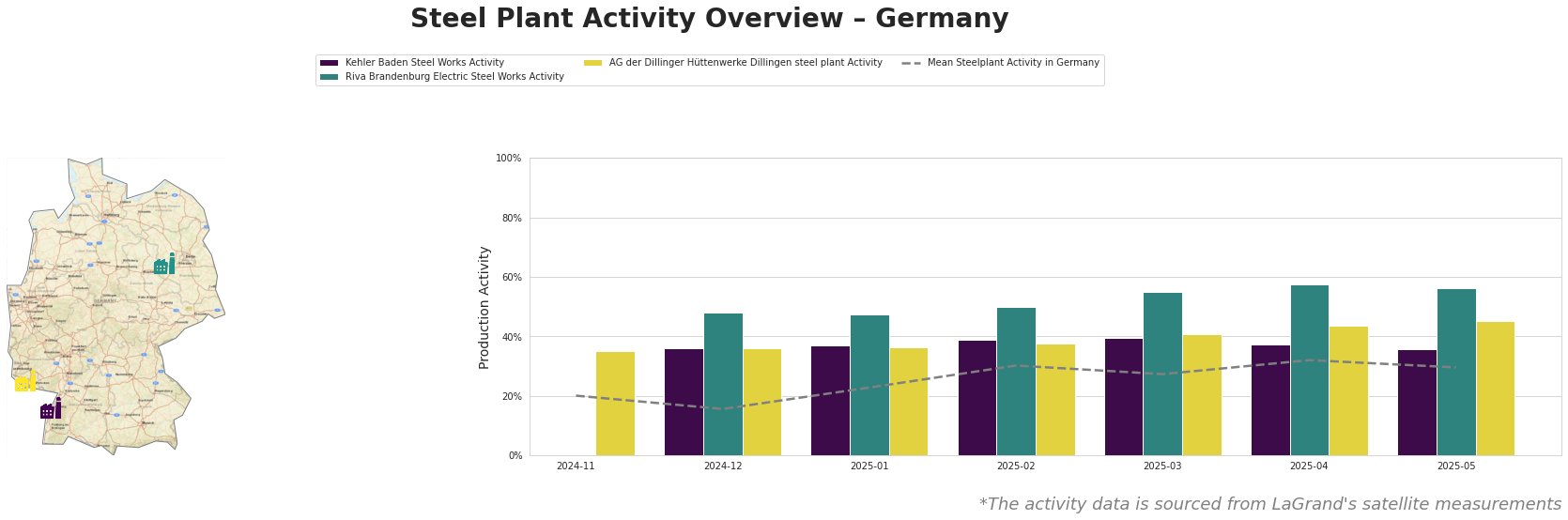

The mean steel plant activity in Germany has shown a general upward trend from November 2024 (20%) to April 2025 (32%), before a slight decrease in May 2025 (30%). Riva Brandenburg Electric Steel Works consistently shows the highest activity level compared to the other plants and the mean value, peaking at 57% in April 2025. Kehler Baden Steel Works displays the lowest activity levels, with a peak of 40% in March 2025, followed by declines. AG der Dillinger Hüttenwerke shows consistent increases in activity with a peak of 45% in May 2025.

Kehler Baden Steel Works, located in Baden-Württemberg, operates two electric arc furnaces (EAF) with a crude steel capacity of 2.5 million tonnes per annum. Its product range focuses on semi-finished and finished rolled products, including wire rod, bar, rebar, and billets for the building and infrastructure sector. The satellite data indicates a stable, but relatively low activity, fluctuating between 36% and 40% from December 2024 to May 2025. There is no direct connection between the news articles and the observed activity levels at this plant.

Riva Brandenburg Electric Steel Works in Brandenburg has a crude steel capacity of 1.8 million tonnes per annum, also relying on EAF technology. It produces wire rod, rebar, and steel billets for diverse sectors, including automotive, building, energy, and transport. Satellite data reveals a consistently high activity level, ranging from 47% in January 2025 to 57% in April 2025, indicating strong production. There is no direct connection between the news articles and the observed high activity levels at this plant, but this may be due to Feralpi’s announcement impacting production in the following months.

AG der Dillinger Hüttenwerke Dillingen, situated in Saarland, is an integrated steel plant with a blast furnace (BF) and basic oxygen furnace (BOF) process and a crude steel capacity of 2.76 million tonnes per annum. Its products include a wide range of heavy-plate products for various end-user sectors. The plant shows steady activity increases from 35% in November 2024 to 45% in May 2025. No direct relationship can be established between this activity increase and the provided news articles.

Given Feralpi’s investment in Riesa, as highlighted in “Feralpi company launches new rolling mill in Germany“, buyers should anticipate increased availability of green rebar from this specific location in the coming months. Due to concerns regarding energy prices stated in “Feralpi foresees Germany recovery, launches FERGreen brand“, steel buyers should prioritize securing long-term contracts with fixed-price agreements where possible, especially for material sourced from Feralpi’s German facilities, to mitigate potential price volatility. Monitor energy market developments in Germany closely, as these will directly impact production costs and potentially the competitiveness of German steel producers. Procurement managers should consider diversifying their supply base to mitigate potential disruptions from plants that have high activity, which have a higher probability of disruptions.