From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Market Faces Production Slowdown Amidst Political Uncertainty

Germany’s steel market faces increasing headwinds as political criticism and fluctuating plant activity signal potential disruptions. Observed changes in steel plant activity coincide with a period of political instability, as highlighted in the news articles „Maischberger“: „Seine Bilanz sind drei verlorene Jahre für Deutschland“, wirft die CDU-Politikerin Habeck vor, „Maischberger“: „Seine Bilanz waren drei verlorene Jahre für Deutschland“, wirft die CDU-Politikerin Habeck vor and „Maischberger“: „Seine Bilanz war drei verlorene Jahre für Deutschland“, wirft die CDU-Politikerin Habeck vor. Although the news article content does not directly address the steel market, the political uncertainty is linked to potential long-term impacts on industrial policy, which could indirectly impact business confidence and investment in the sector.

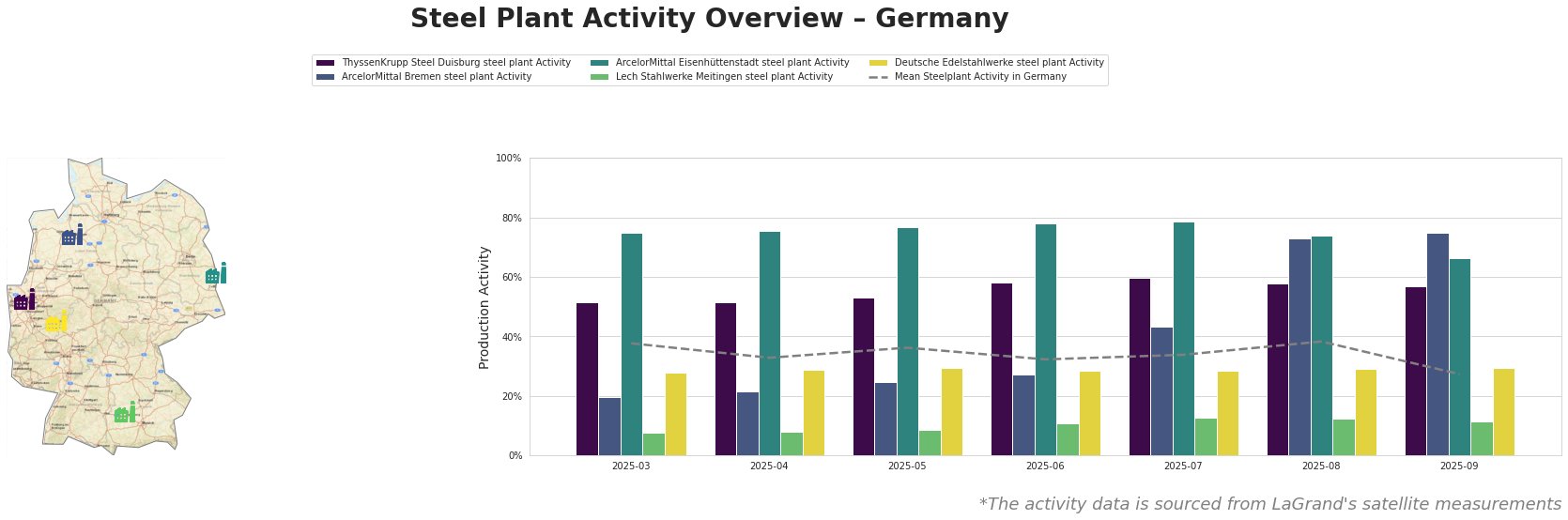

Overall, the mean steel plant activity in Germany has declined significantly in September, falling to 27% after hovering around 32-38% in the previous months. ThyssenKrupp Steel Duisburg saw relatively stable activity, while ArcelorMittal Bremen experienced a sharp increase, reaching its peak activity at 75% in September. ArcelorMittal Eisenhüttenstadt recorded a noticeable decline in September to 66%. Lech Stahlwerke Meitingen maintained consistently low activity levels. Deutsche Edelstahlwerke showed fairly stable activity throughout the period.

ThyssenKrupp Steel Duisburg steel plant

ThyssenKrupp Steel in Duisburg, a major integrated steel producer with a crude steel capacity of 13,000ktpa using BF/BOF technology, has demonstrated relatively stable activity levels. Starting at 52% in March 2025, activity peaked at 60% in July before settling at 57% in September. This stability, while above the national average, does not directly correlate with the political uncertainties discussed in „Maischberger“: „Seine Bilanz sind drei verlorene Jahre für Deutschland“, wirft die CDU-Politikerin Habeck vor, indicating other market factors might be at play.

ArcelorMittal Bremen steel plant

ArcelorMittal Bremen, another integrated BF/BOF steel plant with a 3,800ktpa crude steel capacity, produces finished rolled products. Its activity significantly increased from 20% in March to 75% in September. This notable rise does not appear to be directly influenced by the political discussions in „Maischberger“: „Seine Bilanz sind drei verlorene Jahre für Deutschland“, wirft die CDU-Politikerin Habeck vor, suggesting operational or market-specific drivers.

ArcelorMittal Eisenhüttenstadt steel plant

ArcelorMittal Eisenhüttenstadt, an integrated BF/BOF plant with a 2,400ktpa crude steel capacity, focuses on semi-finished and finished rolled products. The plant’s activity decreased from a high of 79% in July to 66% in September. As with other plants, there’s no explicit link between this decline and the political criticisms in the provided news articles.

Lech Stahlwerke Meitingen steel plant

Lech Stahlwerke Meitingen, an EAF-based plant with a 1,400ktpa crude steel capacity specializing in pipes, tubes, and billets, consistently operated at very low activity levels (8-13%) throughout the period. The persistently low activity, if not influenced by the news articles, points towards internal operational challenges or market positioning.

Deutsche Edelstahlwerke steel plant

Deutsche Edelstahlwerke, an EAF-based plant with a 600ktpa crude steel capacity focused on specialty steel products, showed relatively stable activity, hovering around 28-30%. No direct connection can be established between its stable operation and the political landscape covered in the provided news articles.

Evaluated Market Implications:

The observed decline in mean steel plant activity in Germany, coupled with the political uncertainties raised in „Maischberger“: „Seine Bilanz sind drei verlorene Jahre für Deutschland“, wirft die CDU-Politikerin Habeck vor, suggests potential supply disruptions, particularly if political instability impacts industrial policy and investment. The drop in activity at ArcelorMittal Eisenhüttenstadt and persistently low activity at Lech Stahlwerke Meitingen warrants caution.

Recommended Procurement Actions:

Given the observed trends and political climate, steel buyers and analysts should:

- Monitor ArcelorMittal Eisenhüttenstadt’s output closely: The recent drop from 79% to 66% requires careful observation. Secure alternative suppliers for hot rolled and cold rolled products if this trend continues.

- Diversify supply sources: Given the political uncertainty, buyers should reduce reliance on single suppliers and establish relationships with alternative sources outside of Germany.

- Negotiate flexible contracts: Incorporate clauses that allow for adjustments based on production volatility and political developments. This is especially relevant for contracts involving ArcelorMittal Eisenhüttenstadt.

These recommendations are grounded in the observed activity data and the potential impact of political uncertainty, providing actionable steps for informed procurement decisions.