From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Market Faces Headwinds: Economic Slowdown Impacts Plant Activity

Germany’s steel market faces headwinds as economic struggles impact production. The trend of meeting climate goals due to a “schlecht laufender Wirtschaft” (poorly performing economy), as noted in the article Deutschland hält Klimaziele ein – dank schlecht laufender Wirtschaft, appears to be reflected in fluctuating steel plant activity. Satellite observations show changes in steel plant activity, and these changes cannot all be directly linked to the article Deutschland hält Klimaziele ein – dank schlecht laufender Wirtschaft.

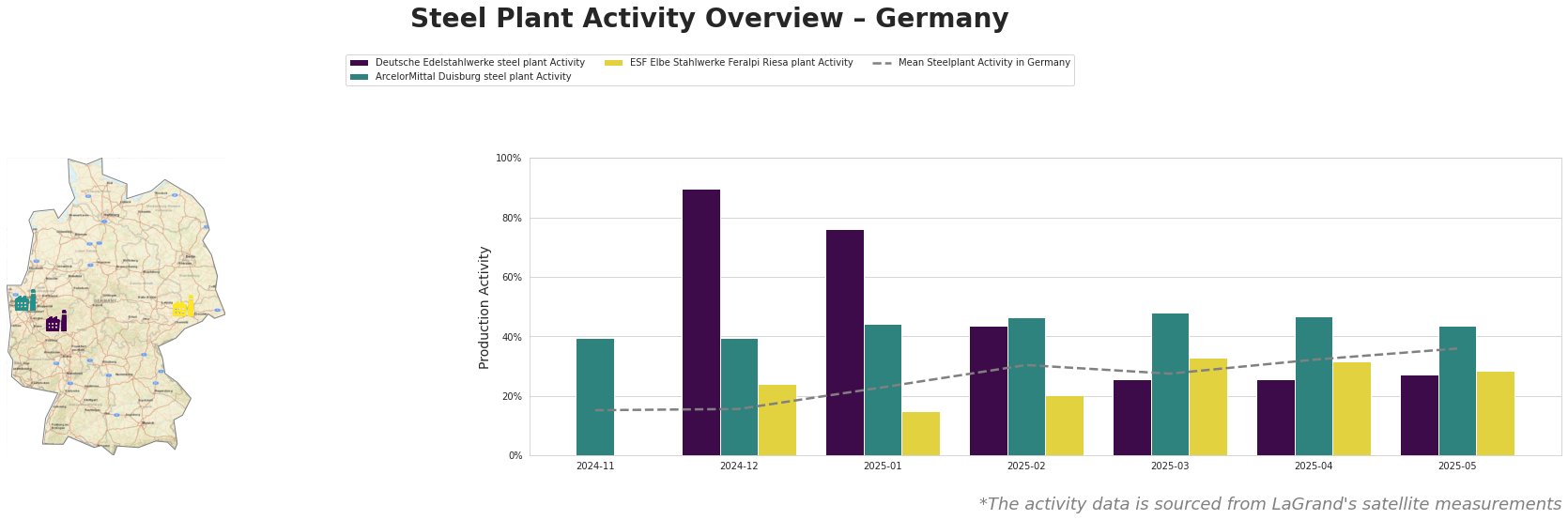

The mean steel plant activity in Germany has seen a general upward trend from 15% in November 2024 to 36% in May 2025, indicating a gradual recovery. However, this trend is not uniform across all plants.

Deutsche Edelstahlwerke, a steel plant located in North Rhine-Westphalia with a crude steel capacity of 600ktpa focusing on semi-finished and finished rolled products such as billets and forged products using EAF technology, experienced a sharp decline in activity from 90% in December 2024 to 27% in May 2025. This substantial drop, despite the overall market trend, does not directly correlate with the broader economic concerns highlighted in the articles Deutschland hält Klimaziele ein – dank schlecht laufender Wirtschaft or Zwischen Hoffen und Bangen – wie viel Aufschwung ist möglich?, as the general trend indicates a recovery. The observed decline may be due to plant-specific issues not covered in the provided news articles.

ArcelorMittal Duisburg, a significant steel producer in North Rhine-Westphalia with a capacity of 1300ktpa focusing on semi-finished and finished rolled products such as wire rod and reinforcing bars using BOF technology, showed relatively stable activity between 40% and 48% throughout the observed period. Its activity level remains consistently above the average for Germany. While the article Zwischen Hoffen und Bangen – wie viel Aufschwung ist möglich? mentions challenges faced by German companies, including steel forging companies, the stable activity at ArcelorMittal Duisburg suggests that this plant is either weathering these challenges effectively or is not directly affected by the issues highlighted in the article.

ESF Elbe Stahlwerke Feralpi Riesa, an EAF based steel plant in Saxony with a crude steel capacity of 1400ktpa and focusing on semi-finished and finished rolled products such as billets, rods, and wire rods, shows fluctuations in activity, reaching a peak of 33% in March 2025 and declining to 28% in May 2025. Its activity is consistently below the German average. Considering the article Deutschland hält Klimaziele ein – dank schlecht laufender Wirtschaft, it is possible that the plant’s fluctuating activity is influenced by broader economic factors. However, a definite link cannot be conclusively established based solely on the provided information.

Given the economic uncertainty highlighted in Deutschland hält Klimaziele ein – dank schlecht laufender Wirtschaft and Zwischen Hoffen und Bangen – wie viel Aufschwung ist möglich? and the observed decline at Deutsche Edelstahlwerke from a high of 90% to 27%, steel buyers should:

- Diversify sourcing: Reduce reliance on Deutsche Edelstahlwerke, given the significant activity drop, to mitigate potential supply disruptions.

- Monitor ArcelorMittal Duisburg: Closely track the activity of ArcelorMittal Duisburg as a more stable supplier to assess its capacity to absorb potential demand shifts.

- Negotiate contract terms: Seek flexible contract terms with suppliers to account for potential fluctuations in production due to economic headwinds and energy costs, as mentioned in Zwischen Hoffen und Bangen – wie viel Aufschwung ist möglich?.

- Evaluate alternative materials: Explore alternative materials where feasible, to hedge against potential price volatility driven by economic uncertainty and plant-specific production issues.