From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Industry Faces Decade-Low Production Amidst Economic Recession

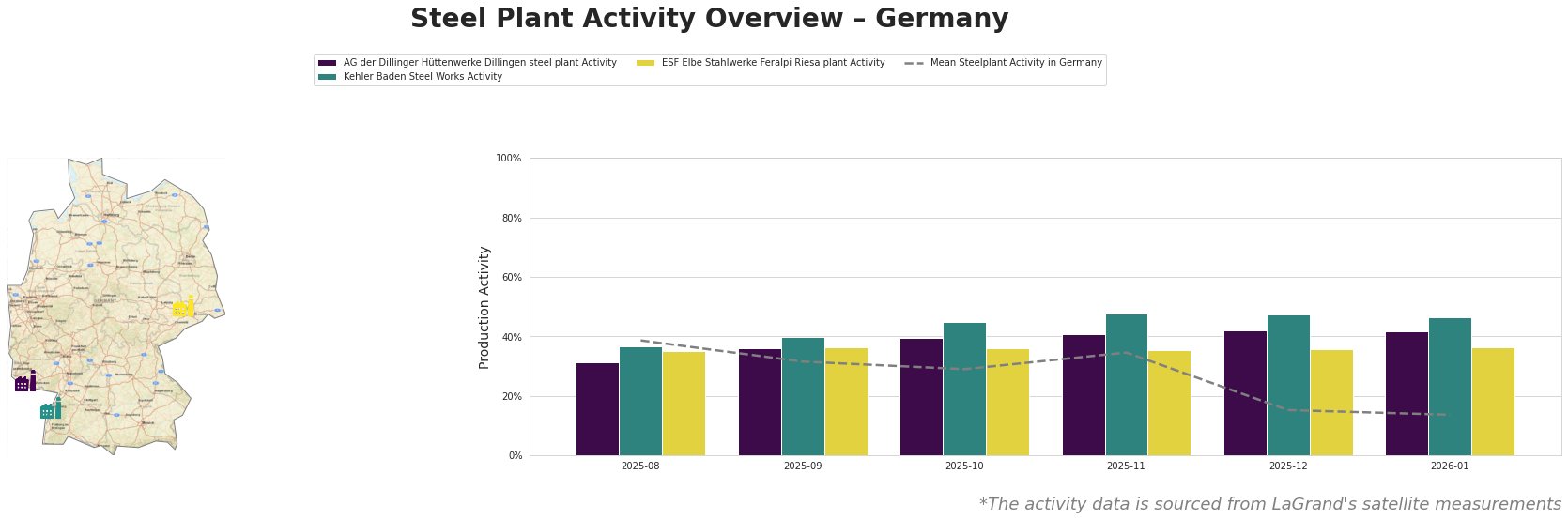

Germany’s steel sector is in crisis, with production dropping to the lowest levels since 2009, as outlined in the news articles titled “German steel production falls to its lowest level since 2009“ and “Germany sees another year of declining steel production“. Latest satellite-observed activity data corroborates these findings, with significant drops in plant activity reflecting ongoing challenges in capacity utilization and demand.

The observed data reveals a troubling downward trend, with the mean activity of steel plants declining to an alarming 14% in January 2026, indicating significant operational challenges across the sector. Notably, the AG der Dillinger Hüttenwerke Dillingen experienced a decline from 39% in August 2025 to 14% by January 2026, which reflects the severe repercussions outlined in “Germany reduced steel production by 8.6% y/y in 2025“. The Kehler Baden Steel Works showed greater volatility but also dropped to 47%, while the activity at ESF Elbe Stahlwerke Riesa remains similarly concerning, with no substantial recovery signals present.

In light of these circumstances, targeted actions for procurement professionals are crucial. There is a significant risk of supply disruptions, particularly from the AG der Dillinger Hüttenwerke Dillingen and Kehler Baden Steel Works, where operational effectiveness has severely waned. Steel buyers are advised to secure contracts while prices remain relatively low, potentially collaborating with suppliers to lock in advantageous terms before anticipated further declines, especially acknowledging the critical capacity utilization below 70% reported in the news.

In conclusion, the direct linkages between the low production levels, the diminished activity in key steel plants, and the reported conditions will likely lead to tighter supply and increased prices if the current trends continue. Proactive procurement actions based on these insights are essential for mitigating potential supply challenges in the coming year.