From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Faces Production Cuts Amidst Climate Policy Concerns and Automotive Transition

Germany’s steel industry faces a potential downturn as climate policy and automotive industry shifts impact production. Observed drops in activity at key plants coincide with growing concerns about the future of German industry. The news article, “Wegen Klimapolitik: Gewerkschaft warnt vor Verlust vieler Industriebetriebe,” highlights union warnings about the closure of industrial businesses due to climate policies. While a direct causal link to specific plant activity is difficult to establish, the overall sentiment expressed in the article aligns with recent production decreases, particularly at Salzgitter Flachstahl. The article “Nur noch E-Autos ab 2035?: Wie sich in der Union offener Widerstand gegen das Verbrenner-Aus formiert” highlights uncertainty in the automotive sector, potentially impacting demand for steel.

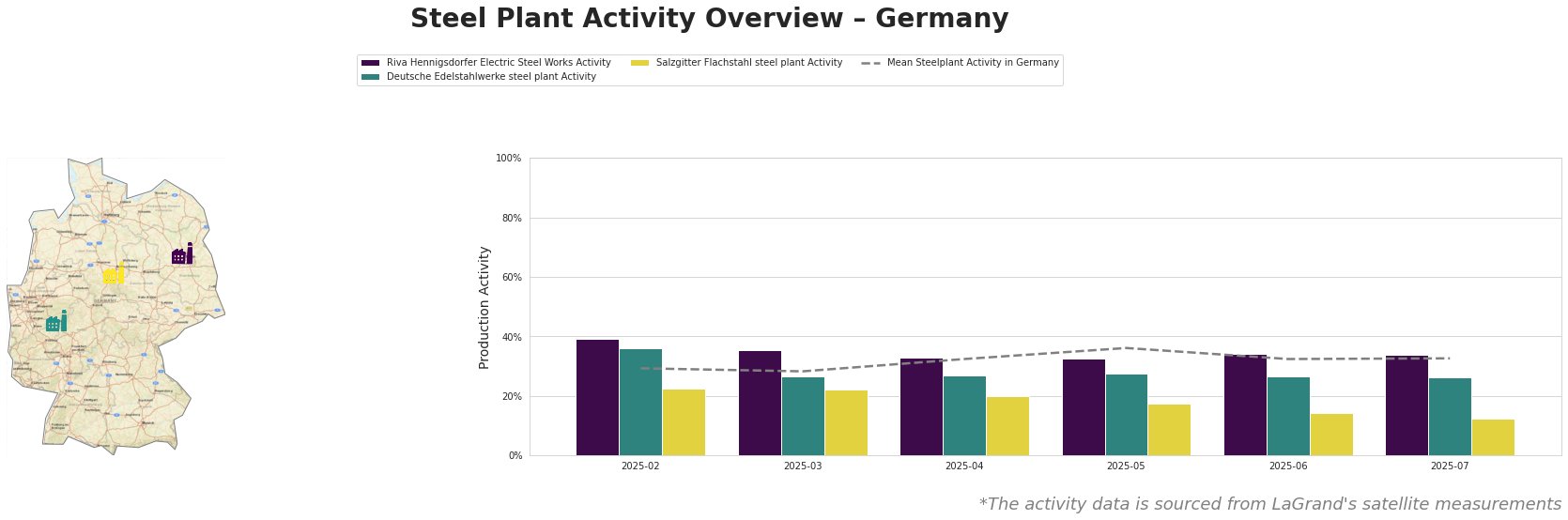

Overall, the mean steel plant activity in Germany shows volatility between February and July 2025, peaking at 36% in May before falling back to 33% in July. Riva Hennigsdorfer Electric Steel Works activity shows a slight decrease over time from 39% in February to 34% in July, remaining consistently above the national mean. Deutsche Edelstahlwerke steel plant activity decreased steadily from 36% in February to 26% in July. Salzgitter Flachstahl experienced the most significant decline, plummeting from 23% in February to 12% in July.

Riva Hennigsdorfer Electric Steel Works, located in Brandenburg, operates exclusively with electric arc furnaces (EAF) boasting a crude steel capacity of 1 million tonnes. They produce semi-finished and finished rolled products, including rebar and bright steel, with the automotive sector as a key end-user. Activity at Riva Hennigsdorfer decreased slightly from 39% in February to 34% in July. There is no clear connection between this decline and the provided news articles.

Deutsche Edelstahlwerke, situated in North Rhine-Westphalia, also relies on EAF technology with a 600,000-tonne crude steel capacity. Their product range includes billets and forged products, serving diverse sectors, including automotive, building, and energy. The plant’s activity dropped significantly from 36% in February to 26% in July, closely tracking the overall negative trend. The article “Wegen Klimapolitik: Gewerkschaft warnt vor Verlust vieler Industriebetriebe,” could potentially impact the plant, even if a clear link is hard to establish.

Salzgitter Flachstahl, located in Lower Saxony, is an integrated steel plant using blast furnace (BF) and BOF processes with a 5.2 million tonne crude steel capacity. They produce hot and cold-rolled products, primarily for the automotive and construction sectors. Salzgitter’s activity decreased from 23% in February to a low of 12% in July. Salzgitter’s declining activity, coupled with the Union’s warning in “Wegen Klimapolitik: Gewerkschaft warnt vor Verlust vieler Industriebetriebe,” suggests potential production adjustments or shutdowns due to climate policy pressures and potential shifts in steel demand from the automotive sector as highlighted in “Nur noch E-Autos ab 2035?: Wie sich in der Union offener Widerstand gegen das Verbrenner-Aus formiert.”

Given the sharp decline in activity at Salzgitter Flachstahl and the broader concerns about climate policy impacts, steel buyers should anticipate potential supply disruptions, especially for hot and cold-rolled products. Procurement professionals should diversify their supply base to mitigate risks associated with potential production cuts at Salzgitter Flachstahl. Moreover, given the concerns raised in “Wegen Klimapolitik: Gewerkschaft warnt vor Verlust vieler Industriebetriebe,” and the potential impact of the shift to electric vehicles described in “Nur noch E-Autos ab 2035?: Wie sich in der Union offener Widerstand gegen das Verbrenner-Aus formiert,” steel buyers should consider increasing their short-term inventory levels to hedge against potential future disruptions. It is also advisable to closely monitor the political discourse highlighted in “Katherina Reiche (CDU) im F.A.Z.-Gespräch: „Wir können nicht ein Drittel des Erwachsenenlebens in Rente verbringen“,” for indicators of policy shifts that might further impact the steel industry.