From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Downturn Deepens: Sales Plunge Amid Production Cuts – Satellite Data Confirms Negative Trend

Europe’s steel sector faces mounting challenges, particularly in Germany, evidenced by falling production and sales. The situation is reflected in recent reports, specifically the news articles titled “Germany reduced steel production by 10.5% y/y in August” and “Steel sales in Germany fell by 13% m/m in August – BDS“, detailing significant declines in both production and sales volumes. Satellite-observed activity at the Hüttenwerke Krupp Mannesmann (HKM) steel plant in Germany appears relatively stable, despite these reported declines, implying that other German steel plants may be experiencing even more significant reductions.

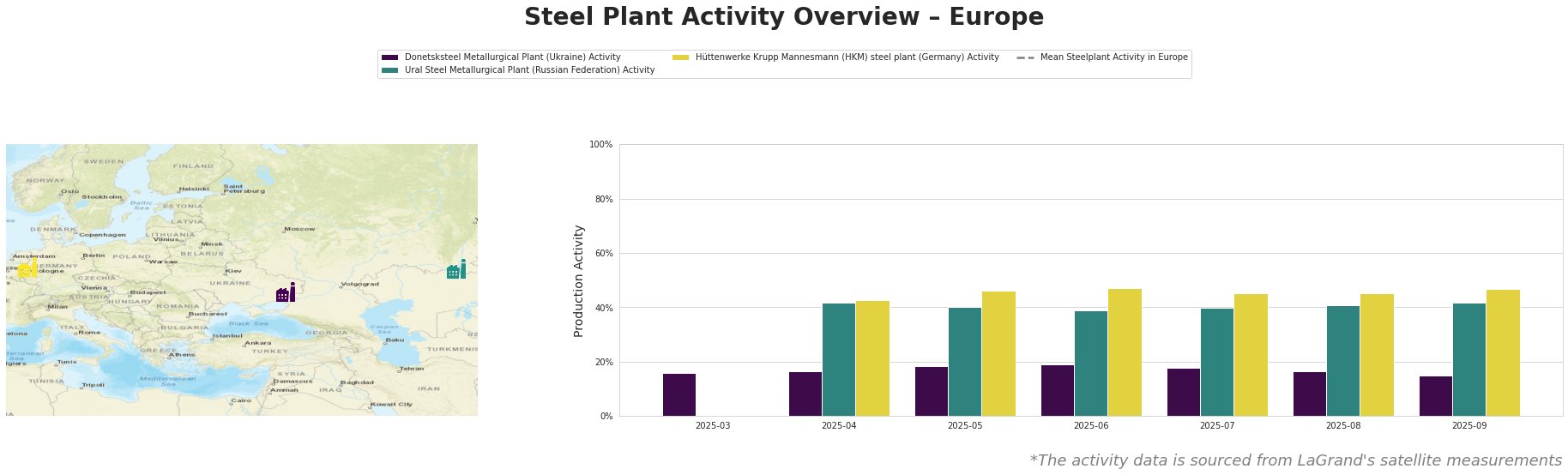

Activity levels at Donetsksteel Metallurgical Plant have fluctuated slightly, ranging from 15% to 19%, but overall show a minor downward trend towards the end of the observation period. Ural Steel Metallurgical Plant demonstrates relatively stable activity, hovering between 39% and 42%. The Hüttenwerke Krupp Mannesmann (HKM) steel plant in Germany shows a similar pattern of relative stability, with activity fluctuating between 43% and 47%. When comparing individual steel plant activity levels with the mean activity level across all observed plants in Europe, a significant volatility can be observed. The satellite observed activity levels for Ural Steel Metallurgical Plant and Hüttenwerke Krupp Mannesmann (HKM) steel plant appear relatively disconnected from the negative trends reported in Germany. No direct relationship between satellite-observed activity and the news articles about German steel production can be established based on this data alone.

Donetsksteel Metallurgical Plant, located in Donetsk, Ukraine, operates with integrated (BF) processes, primarily producing pig iron using BF and EAF technologies, with a BF iron capacity of 1500 ttpa. Satellite data indicates a modest decrease in activity from 19% in June to 15% in September. No direct connection can be established between this observation and recent news articles, as the provided news focuses on Germany.

Ural Steel Metallurgical Plant, situated in the Orenburg region of Russia, is an integrated (BF) plant with a crude steel capacity of 1600 ttpa, utilizing both BF and EAF technologies. Its main products include pig iron, cast billets, and flat products, serving the building, infrastructure, and transport sectors. The satellite data shows a relatively stable activity level, fluctuating between 39% and 42% throughout the observed period. This stability occurs despite the overall negative sentiment in the European steel market. No direct connection can be established between this stability and recent news articles focused on Germany.

Hüttenwerke Krupp Mannesmann (HKM) steel plant, located in North Rhine-Westphalia, Germany, is an integrated (BF) plant with a crude steel capacity of 6000 ttpa, relying on BF and BOF technologies. Its product range includes slabs, round bars, billets, coke, sinter, pig iron, and rolled products. Satellite observations indicate a stable activity level, fluctuating between 43% and 47%. While the German steel market faces significant challenges as reported in “Germany reduced steel production by 10.5% y/y in August“, “German crude steel output down 11.9 percent in January-August 2025” and “Steel sales in Germany fell by 13% m/m in August – BDS“, the stability in activity at HKM contrasts with the broader downturn, suggesting varied performance among German steel producers.

The news articles “Germany reduced steel production by 10.5% y/y in August” and “Steel sales in Germany fell by 13% m/m in August – BDS” highlight potential supply disruptions within the German market. While HKM’s stable activity offers some reassurance, the overall decline in German steel production indicates reduced availability.

Given the reported downturn in German steel production and sales, coupled with the relative stability observed at HKM, steel buyers should:

- Prioritize securing supply contracts with HKM, leveraging their consistent activity to mitigate potential shortages.

- Monitor smaller German steel producers closely for signs of further production cuts, as the aggregate data suggests that some plants are experiencing greater declines than others.

- Consider diversifying steel sourcing beyond Germany, particularly given the consistent activity observed at Ural Steel, although geopolitical considerations may influence this decision.